Active Indian equity funds and energy market trackers have been the clear winners of the past three years, according to a study by Trustnet.

It has been a tumultuous time in markets in recent years, starting with the optimism of a post-Covid bounce that was quickly overshadowed by rampant inflation, leading to one of the most aggressive interest rate hiking cycles in history.

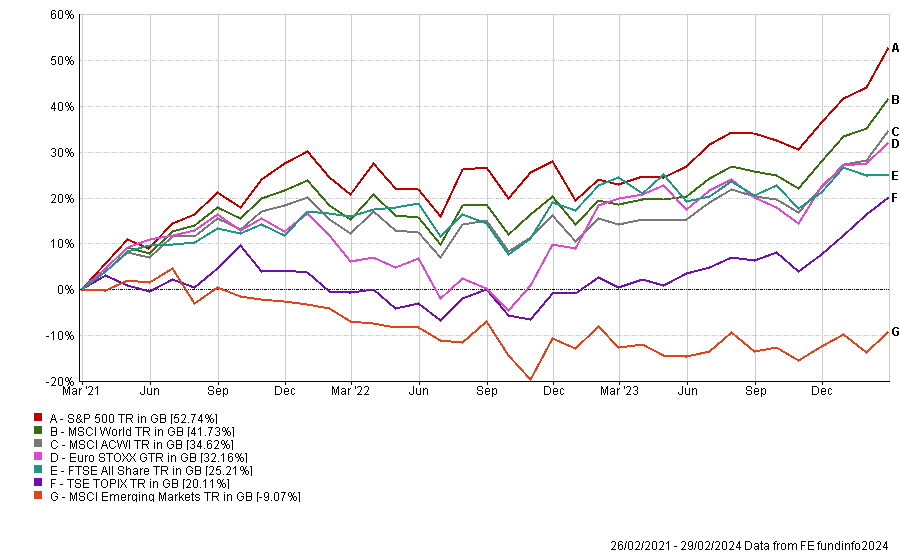

This has been a challenging time to invest. At an index level, among the major stock market indices, the US S&P 500 has made the highest return (52.7%) on the back of the rise in artificial intelligence (AI).

Yet outside of this it has been slower going. Japanese and UK stocks have made less than half this return, while the MSCI Emerging Markets index has disappointed the most, down 9% as the below chart shows.

Performance of indices over 3yrs

Source: FE Analytics. Data to last month end.

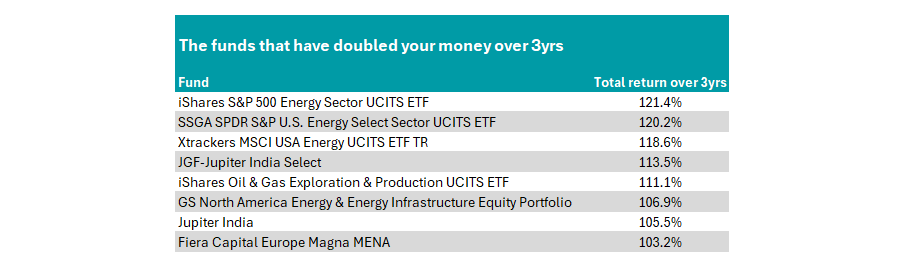

Yet some strategies have significantly outperformed. Eight funds have made more than twice as much as the US market, effectively doubling a cash pot invested three years ago.

The highest returns have come from the energy sector, where passives have reigned supreme. iShares S&P 500 Energy Sector UCITS ETF has been the best performing fund of any in the Investment Association universe, up 121.4%, closely followed by SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF and Xtrackers MSCI USA Energy UCITS ETF (120.2% and 118.6% respectively).

Source: FE Analytics. Data to last month end.

Much of this performance has come from a surging oil price, with a barrel of Brent crude up 111.6% over the past three years. These US trackers, which all follow slightly different benchmarks, have gained significantly from this.

Supply has been reduced by the sanctions placed on Russian exports following its invasion of Ukraine, which has boosted US shale producers.

iShares Oil & Gas Exploration & Production UCITS ETF and the actively managed GS North America Energy & Energy Infrastructure Equity Portfolio also made the list.

Yet now may not be the best time to dive into the energy market, according to Joost van Leenders, senior investment strategist at Van Lanschot Kempen.

“From a cyclical perspective we don’t view this as a good time to build up a position in commodities. Some improvement is visible in global industry but not enough to push up commodity prices,” he said.

On oil specifically, he noted: “The OPEC countries and Russia are limiting supplies, but this is partly being offset by higher production in non-OPEC countries, especially the US. As a result, the oil market has plentiful supplies.” This suggests the oil price may be limited from here.

Another main theme has been the rise of India, with both the JGF-Jupiter India Select and Jupiter India funds making the list, up 113.5% and 105.5% respectively.

Both are managed by Avinash Vazirani, although the former is the larger of the two, with £1.3bn in assets under management. They are similarly invested and follow the same process, although the weightings of portfolio holdings differ slightly. The former is the European SICAV version, while the latter is the UK unit trust version of the strategy.

Analysts at Hargreaves Lansdown recommend the UK version, noting that it “could work well alongside other emerging market funds with a focus on larger companies or as part of a broader globally diversified portfolio focused on long-term growth”.

“The fund’s focus on a single emerging country makes it a higher-risk option so it should only make up a small portion of an investment portfolio,” they added.

However, for those looking to buy now, Kristy Fong, investment director at abrdn New India Investment Trust, warned that valuations may have become overstretched.

She said: “We are concerned and wouldn't be surprised if there's a pullback in India. Given where valuations are, a lot of the earnings growth and returns expectations are already in the price. It's hard to see what will drive a further rerating from here.”

The final fund on the list is Fiera Capital Europe's Magna MENA, which has made investors 103.2% over three years to the end of March.

Managed by Stefan Bottcher and FE fundinfo Alpha Manager Dominic Bokor-Ingram, the portfolio is invested in quality-growth companies across the Middle East and North Africa region – predominantly Saudi Arabia.