Global investors increased their allocations to bond funds last year and took money out of equities, despite strong (albeit volatile) performance from stock markets, Calastone’s latest global fund flows report shows.

The value of mutual funds’ assets under management did a round trip in 2022 and 2023. Funds’ assets increased by $10.7trn to hit a high of $70.9trn by the end of last year – meaning they recovered everything they lost in 2022’s bear market and equalled their previous record at the end of 2021.

But not all asset classes were equally in favour.

As Calastone head of global markets Edward Glyn put it: “Fund flows for 2023 showed that it was a good year for fixed income, a bad year for equities (though better than 2022) and a subdued year for mixed-asset funds.”

The year of the bond

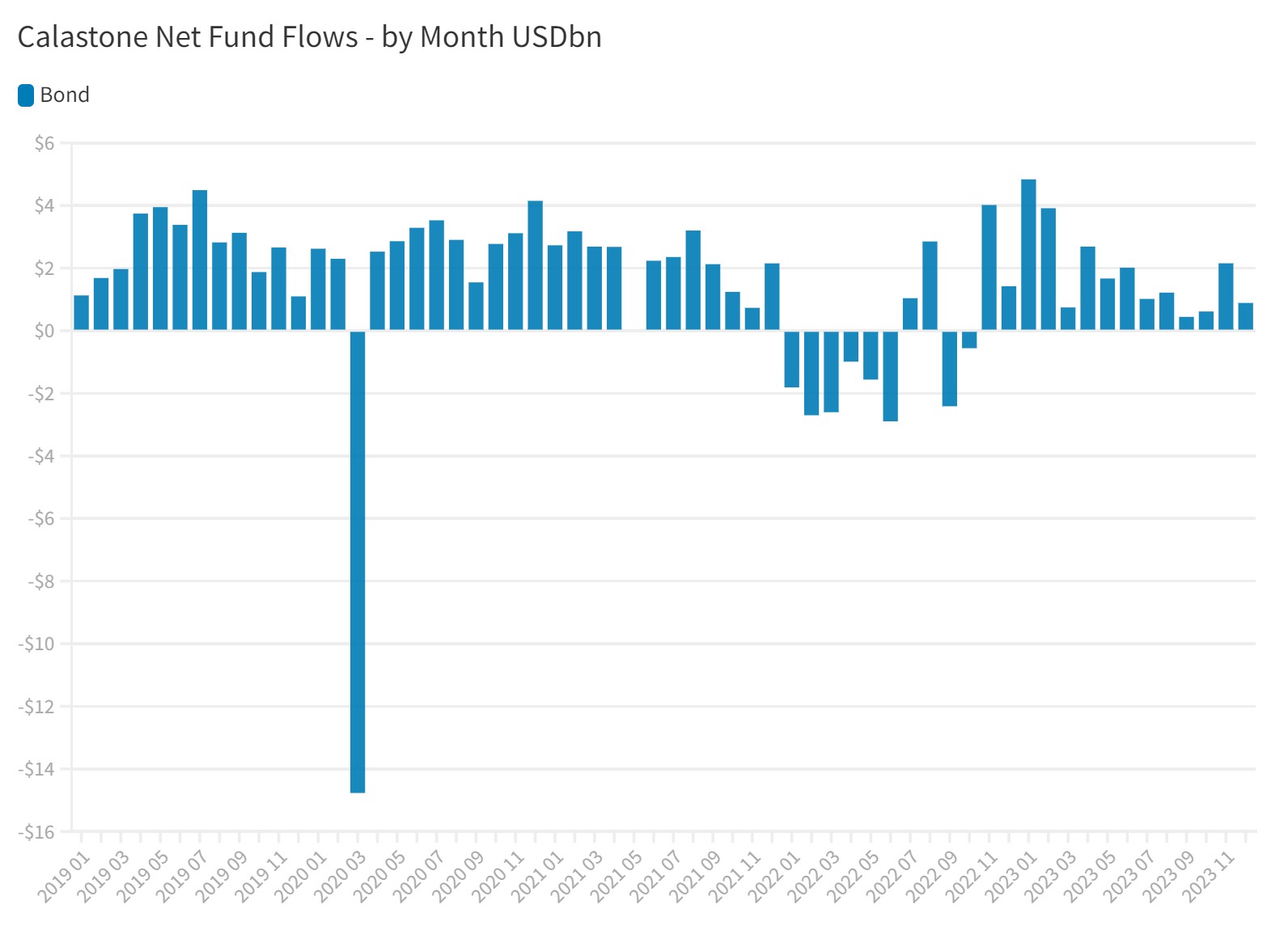

After a difficult year in 2022 when central banks hiked rates rapidly, fixed income funds were back in favour for most of 2023.

Last year, $22.2bn flowed into bond funds from global investors, with demand driven by a sharp one-quarter increase in the value of buy orders, the report explained. Selling activity was mostly flat in both years.

Glyn said: “Bond markets have recovered strongly from their lows of the third quarter of 2022, as investors increasingly judge that disinflation is now well entrenched in most major economies.”

Source: Calastone

Negative equity sentiment

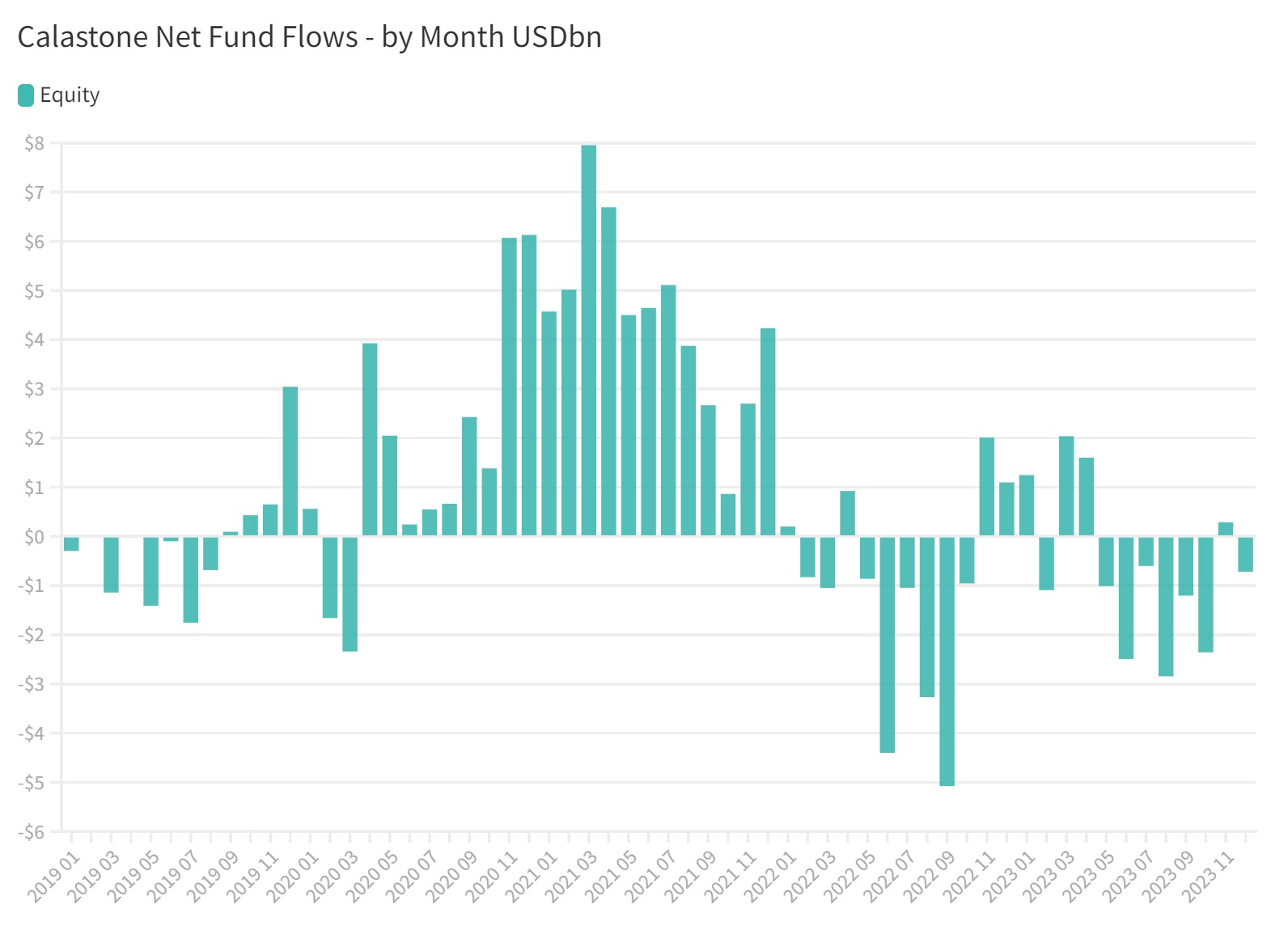

Global investors as a whole were risk averse last year, taking equity exposure off the table.

Equity funds saw $7.1bn of outflows, although that was significantly less than the $13.3bn of redemptions in 2022.

“Two years of net selling is certainly unusual. In the UK, where we have a longer history of data, we have never seen two negative consecutive years since we began compiling figures in 2015,” Glyn said.

“Despite global equity markets doing well in the first seven months of 2023, investors only added funds cautiously between January and April and then in November, but they were net sellers for the rest of the year,” he continued.

“Even strong markets in December were not able to tempt inflows. UK and European investors were the most negative.”

Source: Calastone

A mixed bag for mixed asset funds

Multi-asset funds attracted most attention from Taiwanese and European investors (who committed a record net $13bn to the sector) but suffered outflows everywhere else.

“The objective with mixed asset funds is to exploit the traditional inverse correlation between equities and bonds, but they have moved largely in tandem in the last eighteen months,” Calastone’s report explained.

“This is leading investors in many parts of the world to question whether they can do better elsewhere for a similar risk profile, clearly driving investors out the doors.”