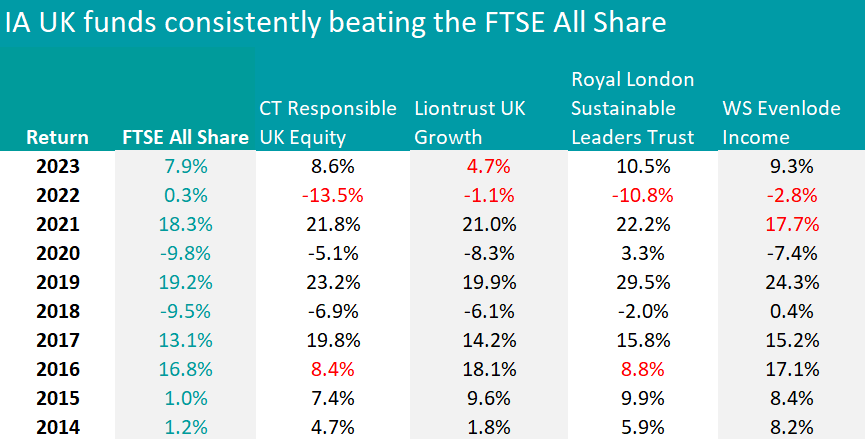

Columbia Threadneedle Investments, Liontrust Asset Management, Royal London Asset Management and Evenlode Investment Management offer the most consistent funds of the decade within the IA UK All Companies sector.

The FTSE All Share index proved a tough hurdle for this sector. Only four funds in the 236-strong peer group managed to beat the most commonly followed index in eight of the past 10 years. No funds could outpace the FTSE All Share every year.

Among the four there were no passive strategies – a significant difference that sets this UK sector apart from the European and global equity sectors previously covered in this series.

Below, we take a closer look at these four highly consistent portfolios.

Source: Trustnet

First up is the CT Responsible UK Equity fund, managed by Catherine Stanley. The vehicle is going through a large integration project with the Columbia Threadneedle UK Equity team following the merger with BMO, but there were no changes to the fund’s process, which continues to invest in attractively-priced, high-quality businesses.

Analysts from FE Investment praised the fund’s track record, saying it “has managed risk well versus peers, despite a relatively limited investment universe”.

“The strategy is well-supported by the responsible investment team, which conducts ESG [environmental, social and governance] screenings and some company engagement, giving the investment team more time to focus on stock analysis.

“This separation creates good structure and a thorough due diligence process, and helps ensure the fund remains loyal to its responsible mandate.”

Its most challenging year of the past decade was 2022, which is true for all four funds in this list. CT Responsible UK Equity, however, fell the most, with a 13.5% loss against a 0.3% increase for its benchmark, the FTSE All Share. It also fell short in 2016, just like the next fund, Royal London Sustainable Leaders Trust.

FE fundinfo Alpha Manager Mike Fox brings something different to the sector by seeking out companies that are making a positive contribution to the environment or society for his Sustainable Leaders strategy, FE analysts explained.

“The fund is distinguishable from its ethical peers, which focus predominantly on negative screening, as it goes a step further and screens companies to isolate those that are contributing to the transition to a sustainable world,” the analysts said.

“Fox is very experienced and his track record highlights the benefits of his style – despite several periods of outperformance of cyclical sectors, the fund continues to beat its peers and the wider market over the long term.”

Two Alpha Managers are in charge of the next fund, WS Evenlode Income. Hugh Yarrow and Ben Peters invest in large UK dividend-paying companies and managed to beat the fund’s benchmark, the FTSE All Share index, most years since inception in 2009.

When cyclical or asset-heavy companies such as banks, energy or miners lead the market, investors can expect more muted returns from the fund and it did underperform in 2021 and 2022.

On the other hand, the preference for global consumer products firms and tech companies means the fund will outperform when the market is led by these sectors and when sterling weakens.

“As we move further into a post-Covid world, the fund should be able to grow its dividends faster than it did previously thanks to the focus on profit resilience,” said FE analysts.

“Their processes and systems have become increasingly robust and efficient over the years, which sets Evenlode apart from other smaller management houses."

The fund is soft-closed, meaning that new direct investors are charged an extra 5% (but this doesn't apply when investing through platforms).

Finally, another Alpha Manager duo – Anthony Cross and Julian Fosh – is in charge of the last fund on the list, Liontrust UK Growth.

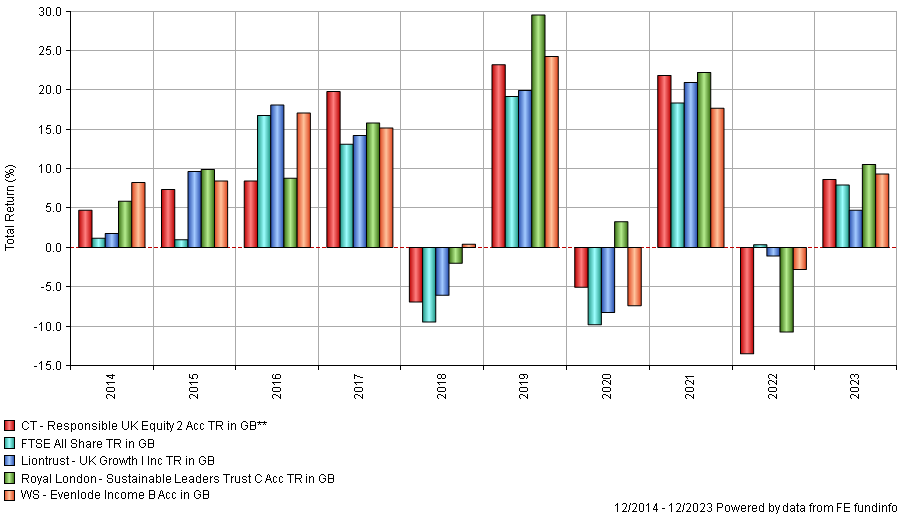

Performance of funds vs index over 10yrs Source: FE Analytics

Source: FE Analytics

The managers focus on companies with competitive advantages and intangible assets, which results in relatively low exposure to banks and miners. Similarly to the Evenlode fund, Liontrust’s strategy might therefore underperform when banks and miners do well, and vice versa.

Additionally, its mid-cap exposure makes it sensitive to changes in the UK economy – performing well when sentiment to the UK economy is positive and vice versa; however, occasional underperformance from relative sector exposures is offset by “good stock selection”, according to FE analysts.

“The fund provides good core UK equity exposure because of its large-cap exposure and focus on industry-leading companies that should perform well through the market cycle. However, the managers are willing to have large sector discrepancies versus the broader UK market,” they said.

“The team has proven the robustness of its process through its other small-cap funds, which can however be less liquid. This fund has a large-cap focus, meaning that its liquidity risk is lower.”