The iShares Core MSCI Europe UCITS ETF is the most consistent European fund of the decade, FE Analytics data has revealed.

Of all the Investment Association (IA) funds that invest in Europe, this was the only strategy to consistently outperform the most common benchmark in its sector, which for the IA Europe Including UK is the MSCI Europe index.

Every year since 2014, the tracker did slightly better than the index whose returns it tries to replicate – something not uncommon, which also happened in the IA Global sector, as Trustnet wrote last week.

The iShares Core MSCI Europe UCITS ETF allocates 22.4% of its total assets (£5.6bn) to the UK, while it main investment sectors are financial services (17.9%), industrials (15.9%) and healthcare (15.7%).

The fund’s top holding is Novo Nordisk (3.17%), the Danish healthcare company that produced the best-selling diabetes drug Wegovy, which made not only the headlines but also the fortune for many funds in 2023 – including Fundsmith Equity, as veteran Terry Smith recently told Trustnet.

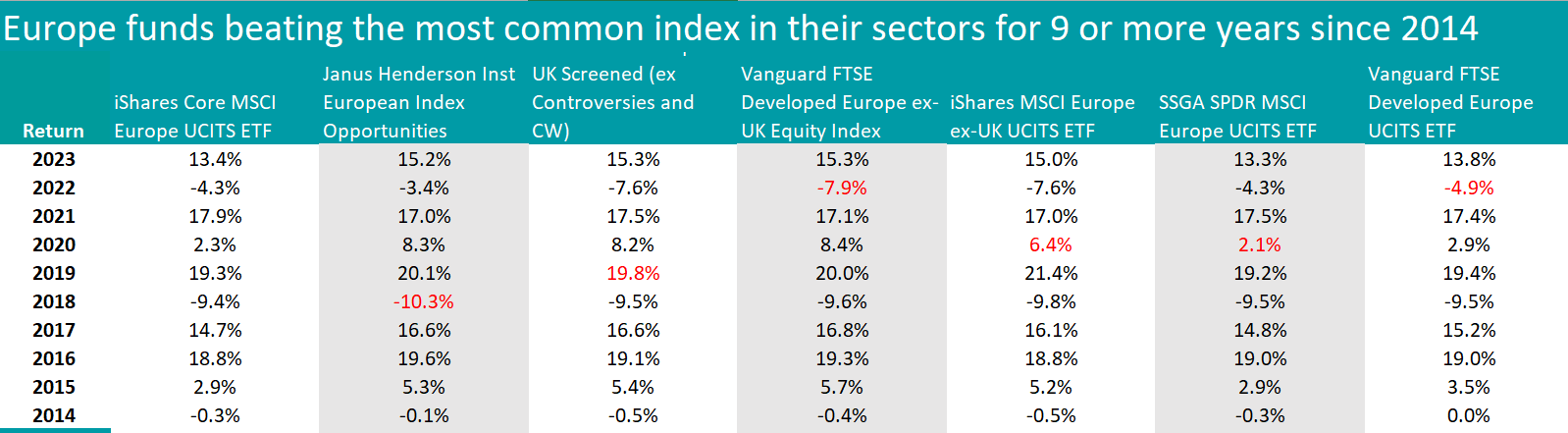

It was the only strategy that managed to outperform 10 years out of 10 – an achievement that is close to impossible for most funds. A handful came close, however, falling short of beating the most common benchmark of the sector in only one year of the past decade.

Remaining in the same Investment Association sector, the only standout was SSGA SPDR MSCI Europe UCITS ETF, whose annus horribilis was 2020.

If we turn to the IA Europe Excluding UK sector, the numbers of funds that made the list start to go up – although all are passive.

Source: Trustnet

Source: Trustnet

In the IA Europe Excluding UK sector, where the most common benchmark is the MSCI Europe Excluding UK index, the funds that made the list were Janus Henderson Inst European Index Opportunities, State Street Europe ex UK Screened (ex Controversies and CW), Vanguard FTSE Developed Europe ex-UK Equity Index and iShares MSCI Europe ex-UK UCITS ETF.

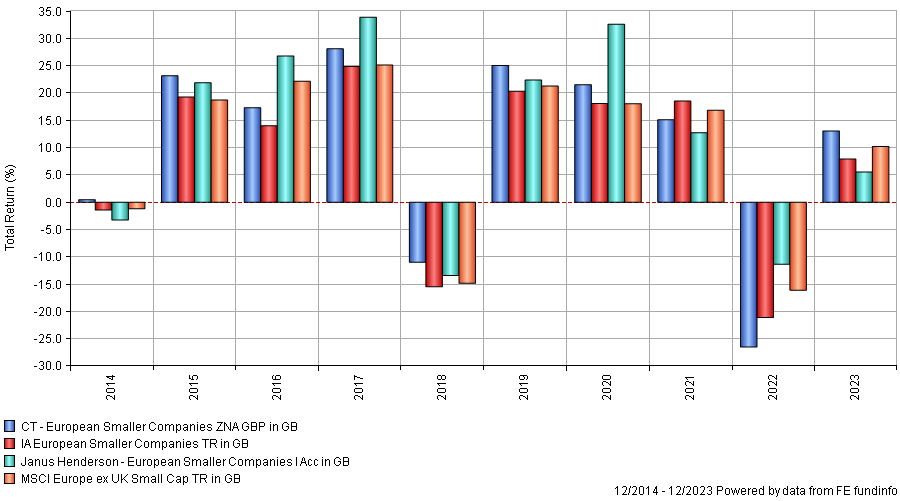

Smaller companies break the pattern in two different ways.

Firstly, in the IA European Smaller Companies peer group, no funds outperformed the MSCI Europe ex UK Small Cap index for more than 7 years in the past decade, proving less consistent compared to the large-cap space.

Secondly, it’s been a more fertile ground for active managers, with the two funds at the top of the list being the actively managed CT European Smaller Companies and Janus Henderson European Smaller Companies.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

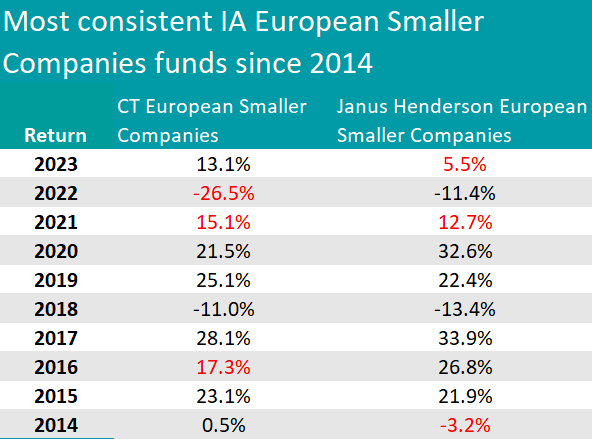

The two funds are of similar size (approximately £200m) and have similar ongoing charges, but a somewhat different asset allocation. The Janus Henderson fund allocates 12.9% of its portfolio to international stocks, while the team at Columbia Threadneedle is exclusively focused on Europe.

Additionally, the former has a small position in real estate (4.4%), which is absent in the CT fund. This in turn holds 2.3% in cash, which the Janus Henderson fund doesn’t. This differences result in a 86% correlation between the solutions.

Source: Trustnet

Of the two, FE Investment analysts highlight Janus Henderson European Smaller Companies for its “business cycle approach and strict valuation discipline”, setting it apart from the rest of the sector, which is mostly focused on quality growth businesses.

“Owing to its balanced approach, the fund managed to hold up well in every market environment, delivering consistent performance across time,” they said.

“Because manager Rory Stokes screens just for companies exhibiting a market cap lower than €1.5bn, the final portfolio is quite tilted towards the lower end of the small-cap spectrum.”