Only four funds in the IA Flexible Investment sector have consistently outperformed their peers, beating the sector average in nine of the past 10 years. That’s fewer than 5% of the 85 funds with a decade-long track record

The ‘fantastic four’ are Barclays Wealth Global Markets 5, Courtiers Total Return Growth, Liontrust Sustainable Future Managed Growth and WS IM Global Strategy, but only one of them has gathered more than £200m in assets and has attracted attention from third-party analysts.

That is the £994m Liontrust Sustainable Future Managed Growth fund co-managed by Peter Michaelis, Simon Clements and Chris Foster.

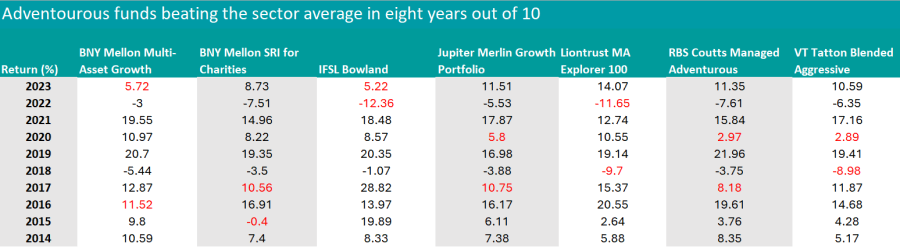

Source: FinXL. The red highlight represents underperformance against the sector.

Square Mile analysts backed the Liontrust team, whose experience investing in companies that are making a positive contribution to the environment or society gives them “an edge over competitors who have only recently grasped the responsible investment nettle”.

“The managers are clear and transparent in their approach as they ensure the equities and bonds of companies held in the portfolio are aligned with at least one of the team's sustainable investment themes and report on this regularly,” the analysts said.

“They also disclose a proprietary sustainability matrix score, which helps to provide investors with a clear understanding of why each investment is held, and seeks external council via an independent advisory committee, which is an important part of the process in what can be a highly subjective area.”

The equity allocation of the fund is expected to be in the range of 60% to 100% and was at 98.3% as of the fourth quarter of 2023, with the remainder in cash.

The second by size, Courtiers Total Return Growth isn’t widely available to retail investors, but can be found on the Aegon Retirement Choices, Aviva Wrap, Fidelity Adviser Solutions and Quilter platforms.

The other two vehicles don’t reach £100m of assets under management (AUM).

Moving down the consistency spectrum, a handful of funds made the list, with

The fund’s co-managers, FE fundinfo Alpha Manager Bhavin Shah, Simon Nichols and Paul Flood, believe that markets are often efficient at pricing in (or even overreacting to) short-term news, but they can be inefficient in reflecting longer-term developments.

They follow an approach that is both top-down (thematic) and bottom-up (based on fundamental research), and the strategy was recommended by RSMR analysts (alongside the whole BNY Mellon multi-asset range) for its flexibility and “potential to continue performing competitively”.

Source: FinXL. The red highlight represents underperformance against the sector.

The £1.8bn Jupiter Merlin Growth Portfolio is helmed by FE fundinfo Alpha Manager John Chatfeild-Roberts and co-managers Amanda Sillars, David Lewis and George Fox.

Square Mile analysts said: “Overall, we hold this team in high regard and consider this a strong offering run by experienced and proven investors, with a good longterm record of managing multiasset fund of funds and who have successfully delivered on the fund's expected outcome since launch.”

The conviction-led strategy comprises 17 holdings, including the Morant Wright Japan fund, Findlay Park American, Man GLG UK Income, Fundsmith Equity and Evenlode Income. Its equity portfolio comprises funds investing in global stocks (50%), the UK (22.7%), the US (12.7%) and Japanese companies (12.1%), paired up with a gold exchange-traded fund (1.9%) and 0.6% in cash.

Finally, two funds have only managed to outperform their sector once in the past decade – the WS Bentley Sterling Balanced and WS Cautela (but they only have £163.3m and £11m in them, respectively).

Pyrford Global Total Return and Artemis Strategic Assets have reached considerable sizes (£844.5m and £202m, respectively) despite their poor track record, outperforming the IA Flexible Investment sector in only two years since 2014.

This article is part of an ongoing series on consistency. Find the previous instalments here: Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds, cautious funds, balanced funds.