Investors who like steady strategies with predictable results should stick to exchange-traded funds (ETFs) when investing in US equities, data from FE Analytics shows.

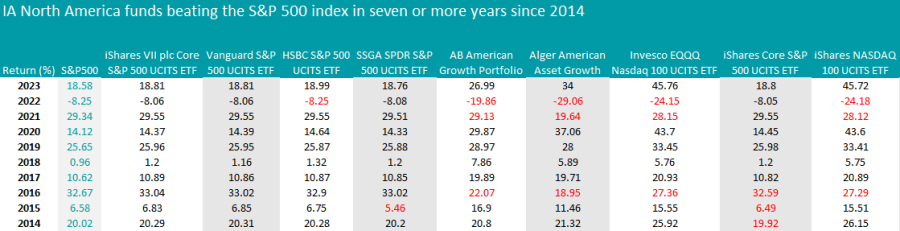

Two trackers in particular – the iShares VII plc Core S&P 500 UCITS ETF and the Vanguard S&P 500 UCITS ETF – have outperformed the S&P 500 every year since 2014, something no other fund in the IA North America sector achieved

Being passive in nature, these ETFs are designed to replicate the S&P 500 so their tracking error is very small. However, their returns have been slightly better than the index every year and their fees are much lower than actively-managed funds.

This has been a decade in which the highly-concentrated S&P 500 – the most common benchmark in the IA North America sector – shot the lights out, making it a difficult hurdle for active managers to match. Large-caps have outperformed small- and mid-caps in recent years too, especially in 2023 when the ‘Magnificent Seven’ dominated – a factor that has gone against active mangers who tend to hunt for undiscovered opportunities lower down the cap spectrum.

Launched in 2010, the iShares portfolio is the bigger of the two passive giants, with £66bn of assets under management (AUM) compared to Vanguard’s £40bn.

The latter was recommended by FE Investments analysts for offering “great benefits” to end investors, including an ongoing charge of just 0.07%, made possible through Vanguard’s corporate structure and economies of scale, which facilitate heavy cost-cutting.

Both funds have a FE fundinfo passive Crown Rating of five – the highest score.

Source: Trustnet. The red highlights indicate underperformance against the specified benchmark.

Although the table above is full of passive strategies, AB American Growth Portfolio and Alger American Asset Growth are the exceptions and have outperformed in seven of the past 10 years.

The £5.7bn AB American Growth Portfolio is co-managed by Frank Caruso, John H. Fogarty and Vinay Thapar, who invest in 55 US large-cap companies and charge 0.94%.

The top 10 holdings make up 50% of the fund and include five of the Maginficent Seven stocks, leaving out Apple and Tesla. In the past 10 years, its performance has moved in tandem with the S&P 500 index 91% of the time.

Alger American Asset Growth is a much smaller vehicle (£307m) under the responsibility of Patrick Kelly, Ankur Crawford and Dan C. Chung.

Based in New York, the team focuses on companies with rapidly growing demand, strong business models and market dominance, or where the managers can find catalysts that could drive additional growth, such as new management, product innovation or M&A activity.

The fund charges a 1% management fee and was 90% correlated to the S&P 500 during the past 10 years.

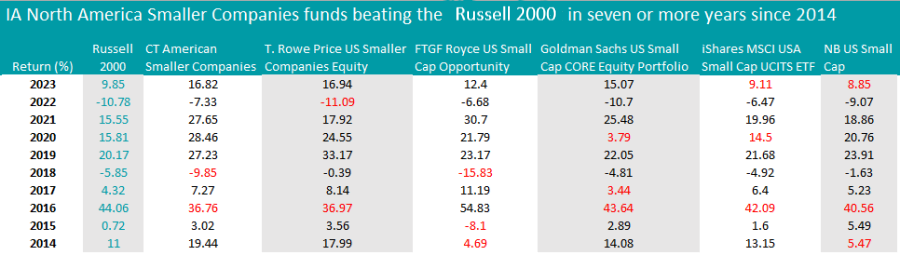

Active managers achieved more success in the IA North American Smaller Companies sector, where CT American Smaller Companies and T. Rowe Price US Smaller Companies Equity beat the Russell 2000 index for eight of the past 10 years.

Run by veteran manager Nicolas Janvier, the £946m Columbia Threadneedle Investments (CTI) fund was recommended by FE Investment analysts for the lead manager’s experience, CTI’s extensive analytical resources in New York and Boston, and the focus on bottom-up stock picking.

Limits are placed on the fund’s sector and factor bets, which “allows for more consistent performance relative to the small and mid-cap market, regardless of the stylistic and macroeconomic environment”, FE analysts explained.

Since 2021, the strategy has decoupled from its benchmark, the Russell 2500, and its average peer, keeping well ahead since then. It achieved a 249% return over the past 10 years against a sector average of 184.4%.

Its largest exposures are to industrials (19.9%), consumer products (17.9%) and telecom, media and technology (16.3%).

Source: Trustnet. The red highlights indicate underperformance against the specified benchmark.

The strategy shares the podium with the much larger £2.8bn T. Rowe Price US Smaller Companies Equity fund managed by Curt Organt and Matt Mahon.

While they prefer a slightly different sector allocation, favouring services (20.5%), media and tech (17.5%) and basic materials (15.3%), the two funds are 93% correlated to each other.

Another difference is T. Rowe Price’s small off-benchmark bet on European equities (1.4%), absent in the CT American Smaller Companies fund.

This article concludes our series on consistency. In previous instalments, we covered: Asia, Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds, cautious funds, balanced funds, adventurous funds, technology, healthcare and financials.