Fund managers pulled money out of emerging markets and put it into US stocks earlier this month after investors soured on China’s growth prospects while expecting a soft landing in the rest of the world, a closely watched survey shows.

The dramatic shift in exposure is found in the September edition of the Bank of America Global Fund Manager Survey, which polled 222 asset allocators running a total of $616bn on their positioning and outlook.

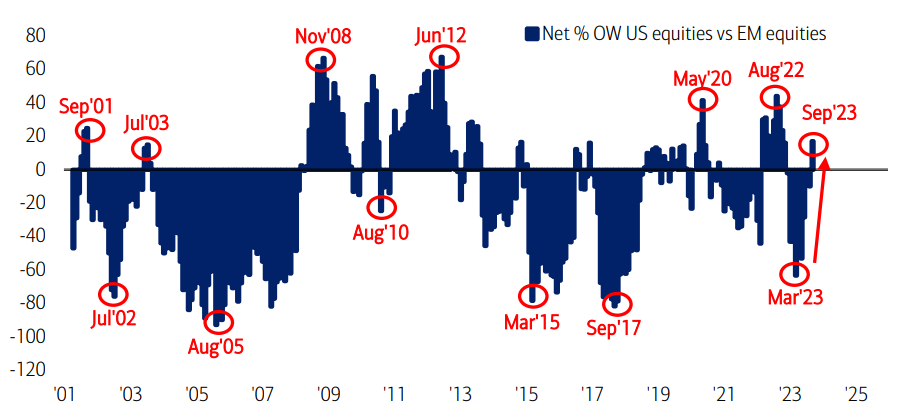

Participants reported the biggest ever jump in the US stocks allocation versus emerging market equities. The US has outperformed in 2023, with the S&P 500 making a 13.1% total return (in sterling terms) since the start of the year, compared with a gain of just 0.2% from the MSCI Emerging Markets index.

Net % overweight US stocks - net % overweight emerging market stocks

Source: Bank of America Global Fund Manager Survey

In early September, the allocation to US equities jumped 29 percentage points from a net underweight of 22% in August to a net overweight of 7% today. This is the first time that investors have gone overweight the US since August 2022.

Over the same period, the allocation to emerging market stocks went from a net 34% overweight down to an overweight of just 9%. This is a decline of 25 percentage points and takes emerging markets to their lowest overweight since November 2022.

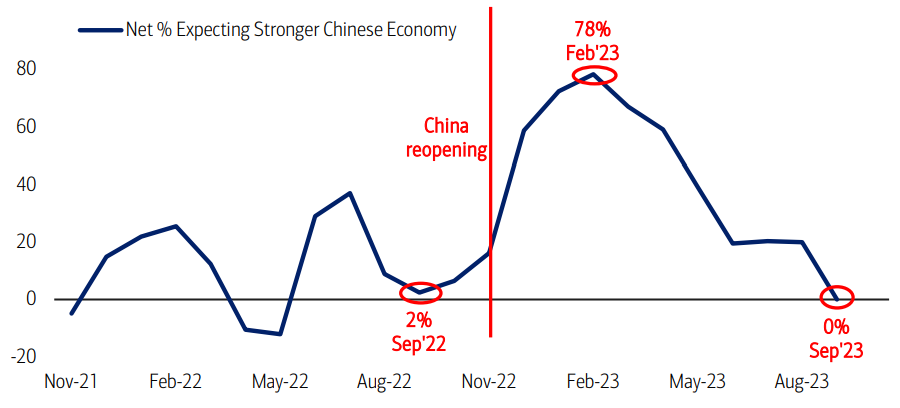

One of the causes of this seems to be a collapse in optimism about China’s economic growth.

Net % of fund managers expecting a strong Chinese economy in the next 12 months

Source: Bank of America Global Fund Manager Survey

“China growth expectations slumped back to ‘lockdown lows’, plummeting from 78% expecting a stronger economy in February 2023 to 0% in September 2023,” Bank of America’s analysts said.

“China growth optimism in the September 2023 Fund Manager Survey is actually lower than in the September 2022 Fund Manager Survey, just before the China reopening.”

Outside of China, however, fund managers are growing more optimistic.

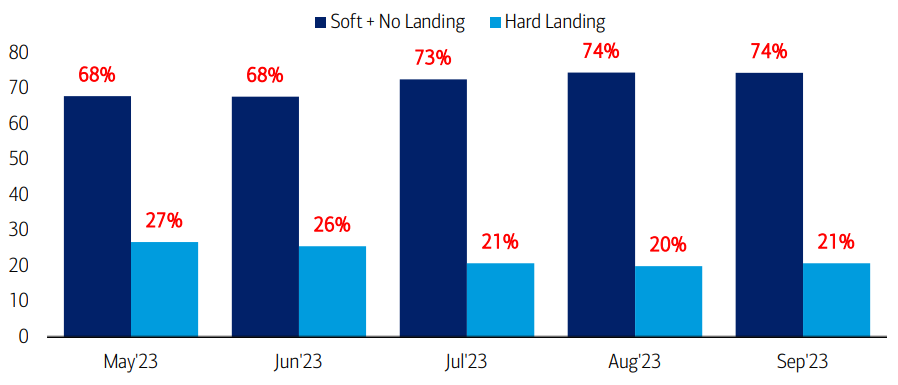

What is the most likely outcome for the global economy in the next 12 months?

Source: Bank of America Global Fund Manager Survey

Three-quarters of respondents now believe the global economy can avoid a ‘hard landing’, or a marked economic slowdown or downturn caused by central banks’ aggressive interest rate hikes.

Some 64% think the economy is heading for a ‘soft landing’ (or a slowdown that avoids recession) while 11% anticipate a ‘no landing’. In addition, almost 30% of fund managers think there will not be a recession in the coming 18 months.

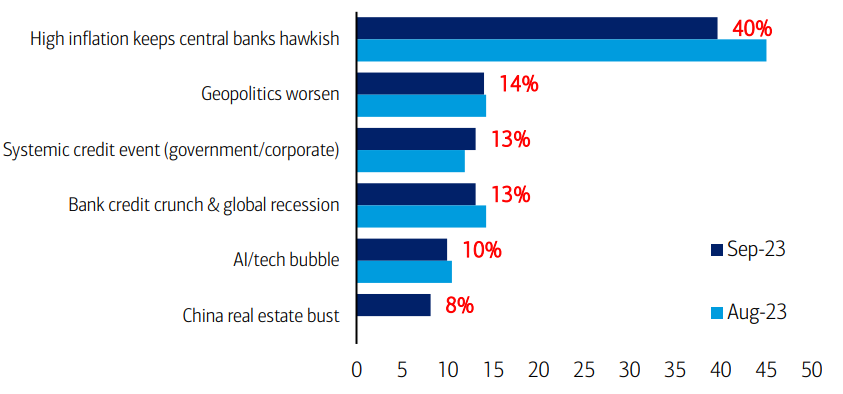

But this doesn’t mean investors think it’s all plain sailing from here.

Fund managers’ biggest tail risks

Source: Bank of America Global Fund Manager Survey

The over-riding concern is that persistently high inflation keeps central banks hawkish for longer than expected. The survey found that 60% of managers think the Fed is done hiking rates with 38% expecting rate cuts in the second half of 2024.

Managers are also worried by any further deterioration in geopolitics, a systemic credit event from either governments or corporates and a bank credit crunch. They are markedly less concerned by these than high inflation, however.

Overall, the survey found that managers remain relatively bearish.

Percentile rank of FMS growth expectations + cash level + equity allocation

Source: Bank of America Global Fund Manager Survey

The above chart shows Bank of America’s broadest measure of fund manager sentiment, which is based on their cash positions, equity allocation and economic growth expectations.

While there is a 17-month high in global equity allocation, cash positions sit at 4.9% (which is at the upper end of the normal 4-5% range) and growth expectations remain low (most think the economy will weaken over the next 12 months).

Bank of America said all this indicates fund managers “are still bearish, albeit no longer extreme bears”.