Professional investors have been buying up cyclical stocks such as banks and adding to emerging market equities in recent months even though they feel the ongoing rally will be relatively short-lived.

This is according to the latest edition of the Bank of America Global Fund Manager Survey, which polled 262 asset allocators running a total of $763bn on their positioning and sentiment in the first week of February.

Markets have been rising since late last yea, after signs of peaking inflation made investors more confident that central banks would soon start to ease up on interest rate hikes.

This means 2023 has got off to a good start. FE Analytics shows global stocks are up close to 7% (in sterling) over the year to date, led by ‘risk-on’ areas such as tech stocks and Chinese equities. Government bonds and corporate bonds have also risen.

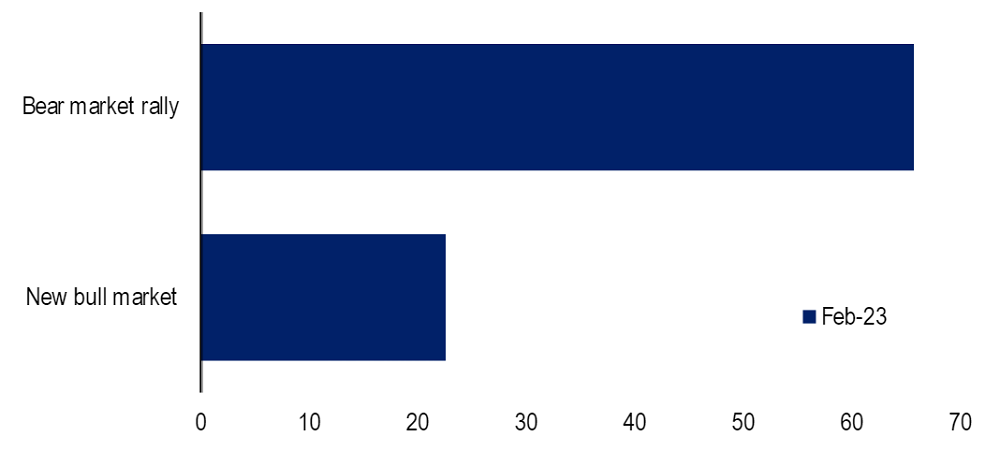

But when Bank of America asked fund managers if the rally that started late September/mid-October is a bear market rally or a new bull market, their answer was downbeat.

Is this a bear market rally or a new bull market?

Source: Bank of America Global Fund Manager Survey – Feb 2023

Two-thirds of investors think the stock market’s recent surge – which came after easing US inflation led to lower yields, less volatility and a weakening of the US dollar – is just a bear market rally.

However, this does not mean managers are sitting on the side lines as markets rise. While they remain pessimistic overall, their equity allocations, cash weightings and 12-month growth expectations are at their healthiest levels in more than a year.

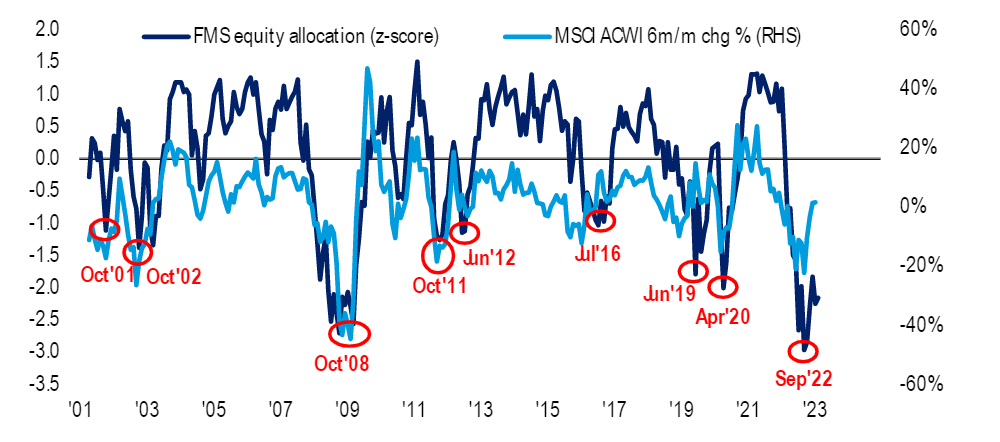

Net % overweight equities vs MSCI AC World 6m returns

Source: Bank of America Global Fund Manager Survey – Feb 2023

Fund managers have been returning to stocks this month, although they still remain underweight equities. In February, the equity allocation has risen to a net 31% underweight, significantly higher than the net 52% underweight just before the market rally started in September.

As the chart above shows, investors are still more than two standard deviations underweight equities relative to the historical average.

The allocation to cash continues to fall as funds put money to work. The average cash balance is now at 5.2%, down from 5.3% last month and 6.3% in October. Cash is now at the level it stood at just before the start of the Russia/Ukraine war a year ago.

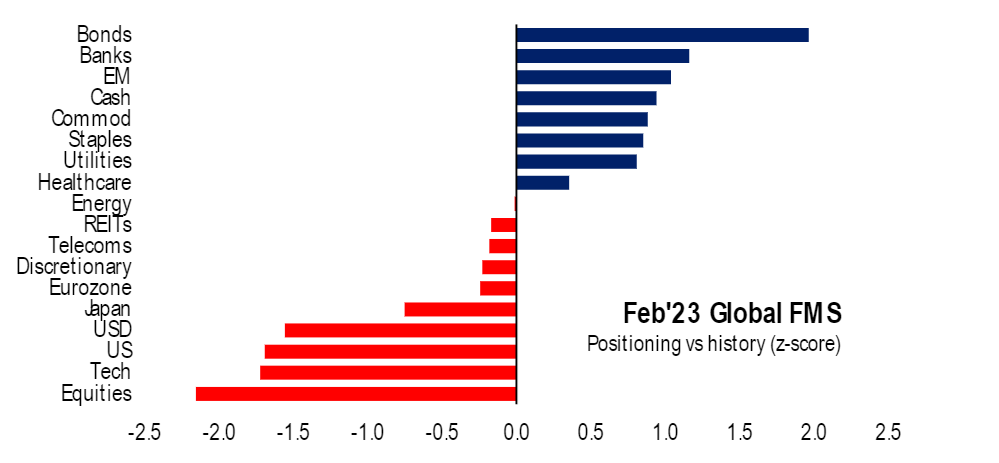

When fund managers’ positioning relative to history is looked at for all asset classes, equities sit at the bottom of the pile. Investors are also very underweight tech stocks and the US.

Fund manager positioning vs the past 10 years

Source: Bank of America Global Fund Manager Survey – Feb 2023

Relative to the past 10 years, investors are long bonds, cash and commodities, as well as banks and emerging market stocks.

On those last two examples, in February investors did tilt towards more risky stocks despite concerns about the health of the rally.

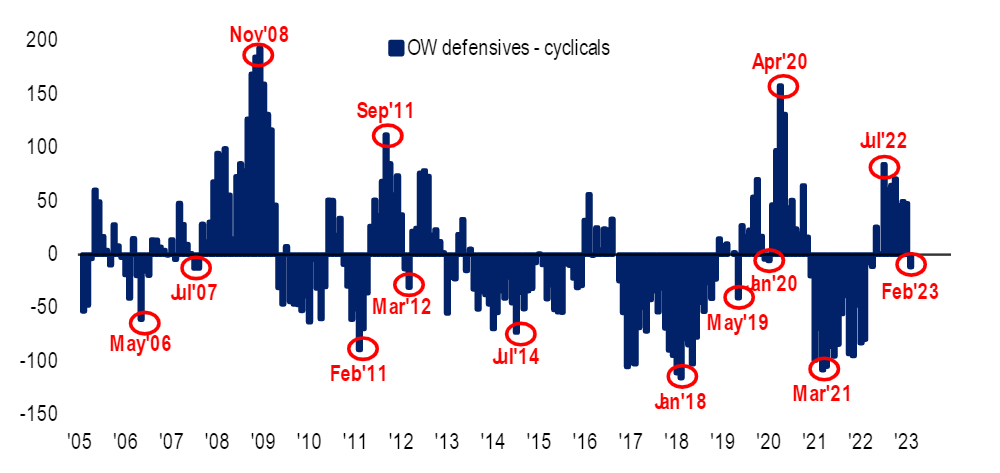

Managers have been rotating out of defensives such as healthcare, consumer staples and utilities while putting money into cyclical stocks like consumer discretionary, banks, energy and materials. They had been overweight defensives for the past several months, but this has flipped in February.

Net % defensives overweight vs net % cyclicals overweight

Source: Bank of America Global Fund Manager Survey – Feb 2023

There has also been a surge in managers investing in emerging market stocks, with the 51 percentage point increase in the overweight to the asset class over the past three months being the biggest on record. Bank of America labelled this as “euphoria” in emerging market equities.

However, managers highlighted Chinese stocks as the most-crowded trade in the market at the moment, followed by investment grade bonds and the US dollar.