Fund managers are sitting on big overweights to cash and avoiding areas such as tech and consumer discretionary stocks as they prepare portfolios for dreaded ‘stagflation’.

That’s the over-riding message from the latest Bank of America Global Fund Manager Survey, which polled 272 investors running a collective $790bn about their current thoughts on the market and positioning.

Analysts at Bank of America said that “sentiment is still uber-bearish” and below are five charts highlighting that assessment.

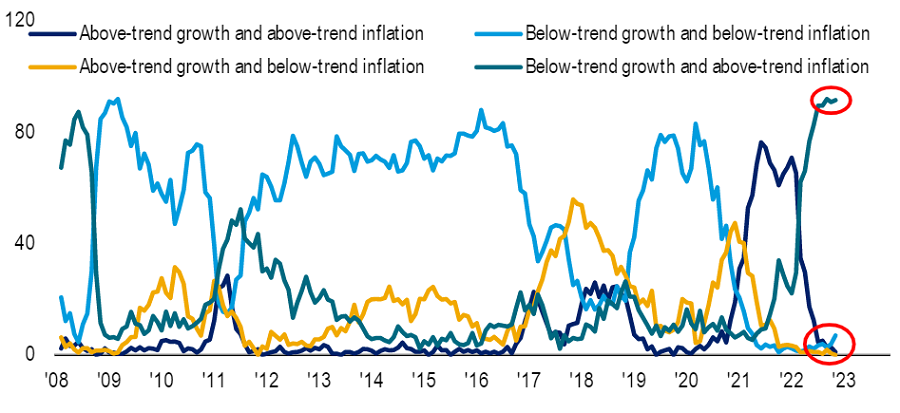

What economic conditions fund managers expect over the next 12 months

Source: Bank of America Global Fund Manager Survey

The vast majority of fund managers are expecting the global economy to go into a state of ‘stagflation’, which is widely viewed as one of the most challenging environments for markets.

‘Stagflation’ – which is high inflation combined with weak growth or recession – is now expected by 92% of the investors polled by Bank of America.

In contrast, none of the fund managers anticipate a ‘goldilocks’ outcome of above-trend growth with below-trend inflation. Some 7% see stagnation – or both inflation and growth ending up below-trend – on the cards.

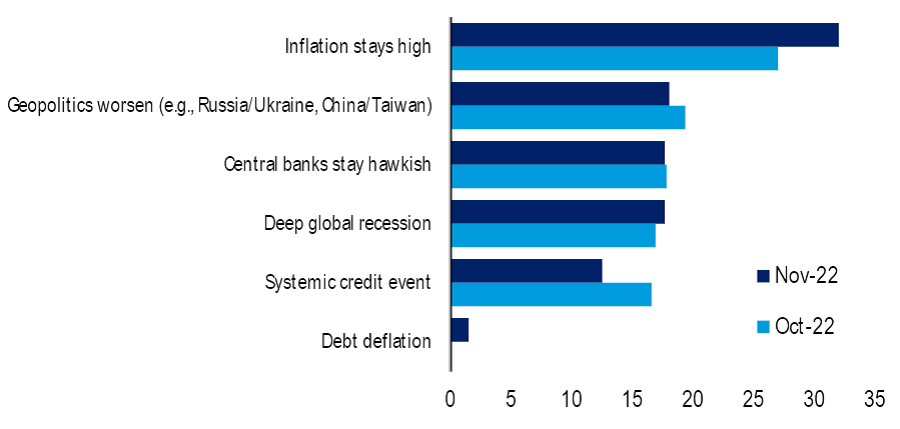

What managers consider to be the market’s biggest tail risk

Source: Bank of America Global Fund Manager Survey

When asked about the specific risks facing the market at the moment, fund managers highlighted high inflation as the most pressing, cited by close to one-third of respondents.

Central banks around the world have spent most of 2022 hiking interest rates in a bid to bring down inflation, which has reached multi-decade highs on the back of post-Covid supply bottlenecks and the war in Ukraine.

The next most pressing tail risks are a worsening geopolitical backdrop, hawkish central banks and a deep global recession, which were each cited by 18% of fund managers.

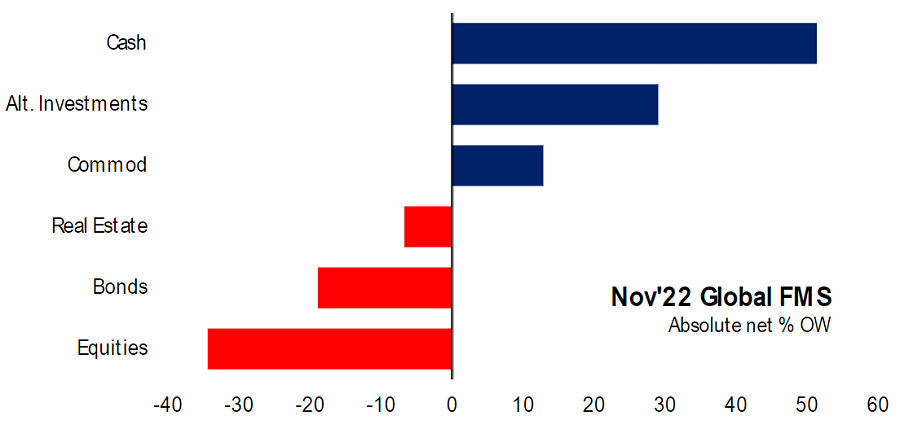

Absolute overweight (net %) to asset classes

Source: Bank of America Global Fund Manager Survey

This pessimistic viewpoint has led fund managers to go overweight cash, which is one of the most defensive assets despite its vulnerability to high inflation. The chart above shows there’s an overweight of about 50% to cash at present.

The average cash balance in the respondents’ portfolios stood at 6.2% in November, down slightly from the record high of 6.3% recorded last month and well above the historical average of 4.9%.

Managers are also running overweights to alternative investments, reflecting the fact that stocks and bonds have fallen in tandem this year, and commodities, which have surged in the inflationary environment.

Meanwhile, they hold a 35% underweight in equities and 20% or so in bonds, both of which have posted heavy falls in 2022’s volatile sell-off.

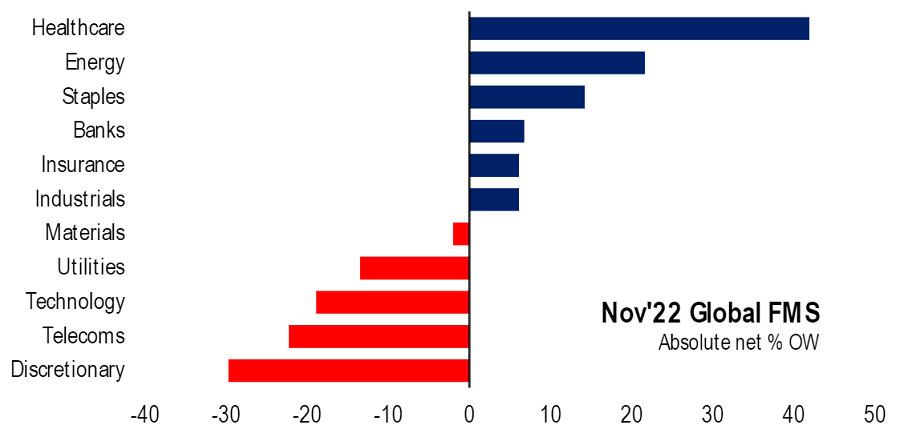

Absolute overweight (net %) to equity sectors

Source: Bank of America Global Fund Manager Survey

When individual equity sectors are considered, fund managers tend to be overweight more defensive areas such as healthcare, consumer staples and insurance, which have a greater chance of holding up in recession.

Sectors such as energy and banks are also common overweights, reflecting their respective correlations with higher inflation and interest rates.

Underweights are seen in consumer discretionary stocks, which come under pressure when consumers have to tighten their budgets, and tech, where high-growth shares are being hammered by rising rates.

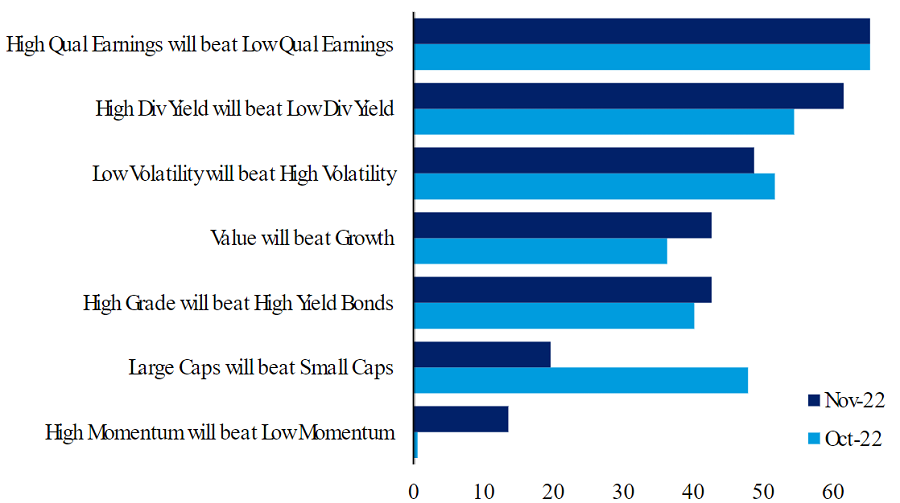

What fund managers think will do best over the coming 12 months

Source: Bank of America Global Fund Manager Survey

To end the article on a more positive note, the above chart shows the areas that fund managers think will outperform over the year ahead.

There’s a strong preference for quality over junk, with 72% of investors saying they expect companies with high-quality earnings to beat those with low-quality earnings and a net 43% preferring high-grade bonds over high-yield (a record high).

Meanwhile, a net 61% favour high dividend yield stocks for the coming 12 months while most managers expect value to keep outperforming growth as interest rates continue to rise.