Fund managers across the globe continue to be bearish after the brutal start of 2022 but sentiment is no longer completely crushed, according to closely watched research.

The August edition of the Bank of America Global Fund Manager Survey found professional investors are a little more optimistic than when the poll was carried out one month ago, but not by much.

Although global equity and bond markets sold off during the first half of 2022, they have been rallying since July after investors started to think central banks would slow or pause their rate-hiking programmes.

“Sentiment remains bearish, but no longer apocalyptically bearish as hopes rise that inflation and rates shocks end in coming quarters,” BofA’s analysts said.

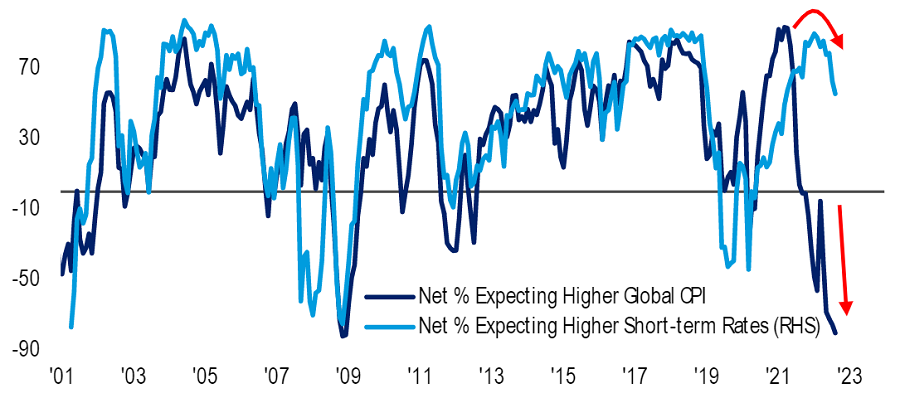

This is illustrated in the chart below, which shows a fall in the net percentage of fund managers who think global consumer prices inflation and short-term interest rates will rise over the coming 12 months.

Net % of fund managers expecting higher inflation and rates

Source: BofA Global Fund Manager Survey, Aug 2022

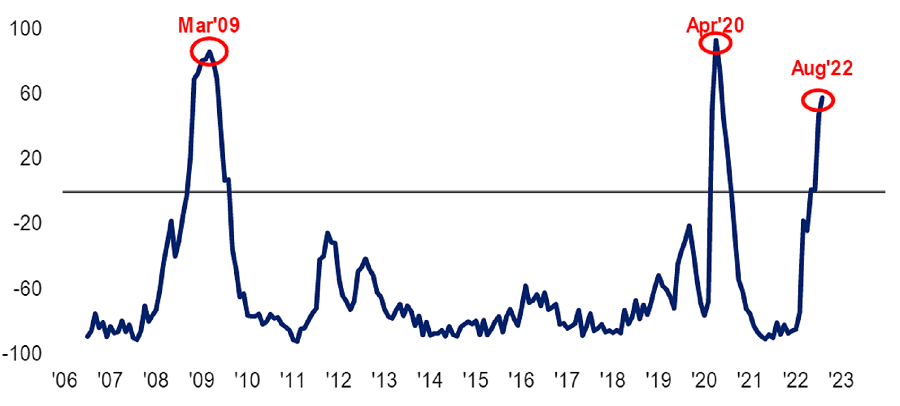

In July’s survey, there was an all-time low when it came to managers’ economic outlooks. A net 70% expected the global economy to deteriorate in the months ahead but this eased to 67% in August.

Likewise, the net proportion of investors thinking corporate profits will deteriorate eased from last month's all-time high.

However, they still expect a recession to hit the global economy in the coming 12 months with a net 58% of respondents (a rise from July’s levels) anticipating this. This is the highest reading since May 2020, when the global economy was shutting down for the Covid-19 pandemic.

Net % of fund managers saying recession likely in next 12 months

Source: BofA Global Fund Manager Survey, Aug 2022

On risks to the market, the one most commonly cited by fund managers is inflation staying high. Some 39% went for this option.

Another 24% said global recession is the market’s biggest tail risk, followed by hawkish central banks (16%), systemic credit events (8%), Covid-19 resurgence (4%) and the Russia/Ukraine war (3%).

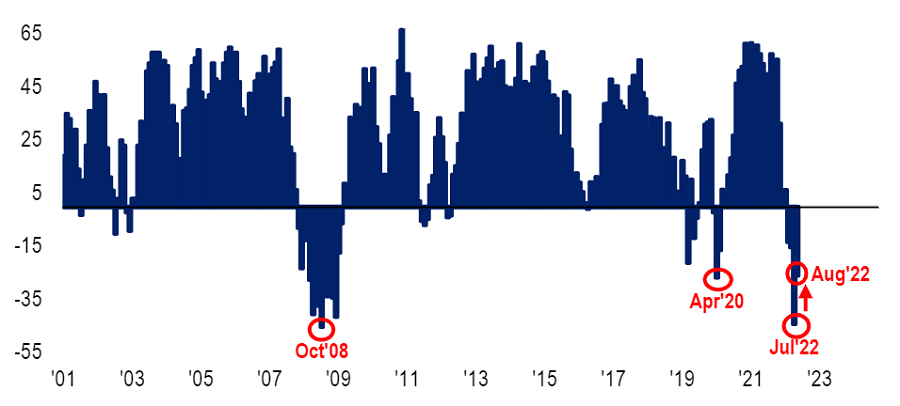

When it comes to portfolio changes this month, asset allocators have cut their underweight to stocks. In July, a net 44% of managers were running underweights to equities but this fell to 26% in August.

Net % of managers that are underweight equities

Source: BofA Global Fund Manager Survey, Aug 2022

As part of these moves, managers were selling out of consumer staples and utilities stocks while moving back into tech and consumer discretionary.

Similarly, more investors expect growth stocks to outperform value over the next year for the first time since August 2020.

The Bank of America Global Fund Manager Survey polled 250 asset allocators running a total of $752bn between 5 and 11 August 2022.