The Nasdaq 100 has been one of the best performing stock market indices worldwide over the past decade, as it benefited from the meteoric rise of US tech.

Therefore, Invesco EQQQ Nasdaq 100 UCITS ETF, which aims to replicate this particular index with the exclusion of its constituents from the financial sector, has been an exceptionally rewarding investment.

In fact, it is the fourth best-performing fund in the whole Investment Association universe over 10 years, just behind Fidelity Global Technology, L&G Global Technology Index Trust and SSGA SPDR MSCI World Technology UCITS ETF.

However, the fund remains inherently risky as it is extremely reliant on the fate of the US tech sector, with Costco being the only outlier in the top 10 holdings. Moreover, some individual names, such as Microsoft and Apple, have a heavy weight in the fund, as each account for 8-9% of the portfolio.

Although Nasdaq took action to address overconcentration risks last July with its ‘special rebalance’, the fund remains nonetheless a bet on US big tech.

Rob Morgan, chief investment analyst at Charles Stanley, said: “The exposure of the fund is concentrated towards the US tech mega caps and makes the fund a potentially volatile holding.

“When things are going well for this band of companies, as has been the case for the past year and a half, then it will reflect that. However, as 2022 illustrated, there can be large drawdowns. The fund fell around 24% in that calendar year.”

Due to the overreliance on the technology sector, high concentration in a handful of stocks and the lack of geographical diversification, investors in Invesco EQQQ Nasdaq 100 UCITS ETF may want to complement it with other funds offering something entirely different.

US value

Morgan suggested pairing the Invesco ETF with a value-focused fund such as Premier Miton US Opportunities, which takes a multi-cap approach and tends to be diversified across different sectors.

Performance of fund over 10yrs vs sector

Source: FE Analytics

“Being significantly different to the S&P 500 index and being more valuation-focused has meant the managers have had to paddle hard to deliver anywhere near market returns over the past 10 years, but going forward it could lend balance to any portfolio that may have become overweight in the big US names,” he said.

Another way to get exposure to US value stocks is to buy an S&P 500 ETF applying an equal-weight methodology. For that purpose, Alex Watts, investment data analyst at interactive investor, pointed to iShares S&P 500 Equal Weight UCITS ETF, which was launched in 2022.

He explained: “It attempts to invest the same in each of the S&P 500 constituents. This means that its price-to-earnings ratio is a bit lower than the broader S&P 500 market, at 21x compared with 26x, according to BlackRock.”

Since last Autumn, several wealth managers have moved away from market-cap weighted S&P 500 ETFs, preferring equally-weighted equivalents instead, due to concentration and valuation concerns.

Performance of fund since launch vs indices

Source: FE Analytics

Energy

Andy Merricks, portfolio manager at IDAD, noted there is “virtually no exposure” to energy in the Invesco EQQQ Nasdaq 100 UCITS ETF. As a result, investors may want to “cover their bases” against future energy price spikes as geopolitical risks emanating from the Middle East are escalating.

Therefore, he suggested pairing the tech-heavy ETF with iShares S&P 500 Energy Sector UCITS ETF.

Performance of fund over 5yrs vs sector

Source: FE Analytics

“Being US focussed, the iShares S&P 500 Energy Sector UCITS ETF is extremely concentrated as it does not hold the BPs, Shells and Totals that global energy funds hold. Therefore it fits geographically if that is how you allocate,” Merricks pointed out.

“Alternative energy sources were all the rage a couple of years ago and remain highly represented in the fund universe, but rightly or wrongly clean energy is finding widespread adoption more difficult to achieve than was first expected.”

UK and Europe

Laith Khalaf, head of investment analysis at AJ Bell, suggested looking at regions that have less exposure to tech stocks, such as the UK and Europe.

He mentioned Lyxor Core UK Equity All Cap ETF and Vanguard FTSE Developed Europe ex UK ETF as potential candidates for investors interested in diversifying away from technology.

Performance of funds over 5yrs

Source: FE Analytics

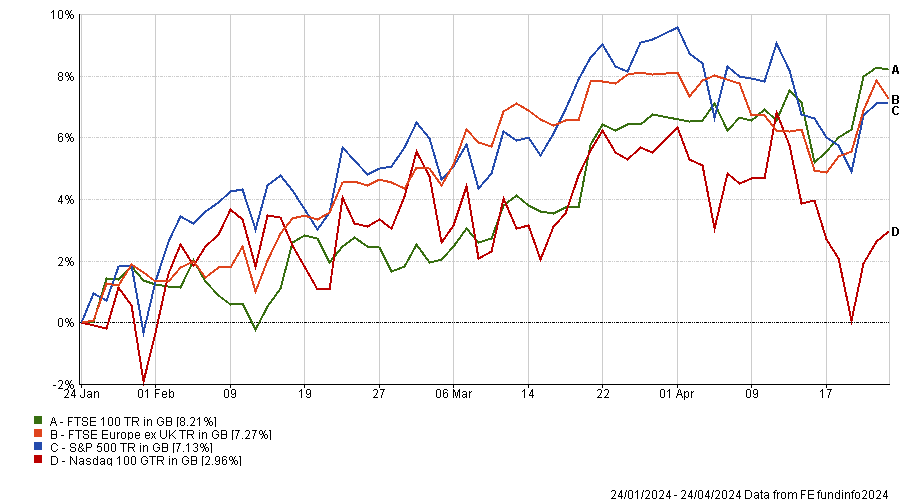

As GDP has been weakening across the pond in recent times while inflation has been proving stickier, both UK and European indices are ahead of the Nasdaq 100 and the S&P 500 over three months.

Dan Coatsworth, investment analyst at AJ Bell, said: “A sluggish GDP figure mixed with a rise in inflation has created a toxic cocktail, causing investors’ jaws to crash wide open and their eyes to pop out of their heads. The message is as clear as one of the giant billboards over Times Square – Welcome to Stagflation. No investor wants this scenario. It’s the worst of all worlds.

“It means the UK and US stock markets are now almost on the same level in terms of performance so far this year. It’s been a while since that’s happened as investors were getting used to the UK permanently lagging the US.”

Performance of indices over 3 months

Source: FE Analytics