Everyone makes mistakes and has regrets, which is true of even the most seasoned investors such as FE fundinfo Alpha Manager Gerrit Smit. His greatest career regret is not having paid up for high quality businesses such as Apple, because he thought they were overvalued at the time.

From this experience, Smit has concluded that growth investors should be prepared to pay rich valuations at times to participate in some of the world’s most promising companies.

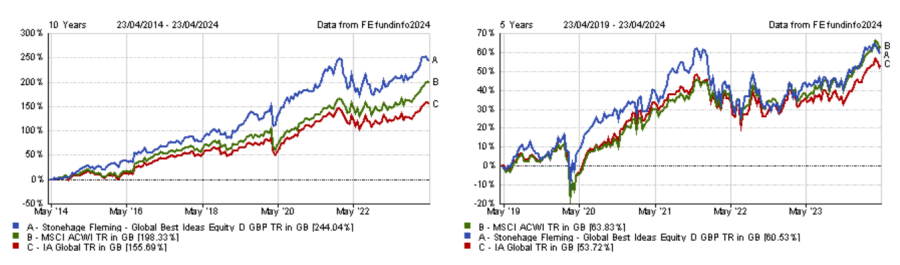

Smit has managed the Stonehage Fleming Global Best Ideas Equity fund since its inception in August 2013. The fund strongly outperformed the MSCI All Country World Index over the past decade but has delivered benchmark-level returns in more recent years. Overall however, the fund has comfortably beaten its sector and benchmark by buying quality companies and holding them over the long term.

Performance of fund over 10yrs and 5yrs vs sector and benchmark

Source: FE Analytics

Below, Smit dissects his performance and explains why investors have to accept that quality has a price.

Could you explain your investment strategy?

We aim to hold the world's best of breed, highest quality businesses. Each one has to have a strategic competitive edge. Lastly, they have to be attractively valued.

We emphasise having conviction in the quality of the management team. We spend a lot of time trying to understand the culture of a business and how management is orientating the business for sustainable growth over the long term.

In essence, we look to buy and hold the world's best businesses for an indefinite period.

That makes the fund a strong candidate for any investor looking for a conservative equity exposure that can be held continuously.

How important are top-down considerations in your investment process?

Our process is completely bottom up: we identify good companies that can keep growing. However, that growth depends on what happens in the world.

So it’s a combination of looking for the right company and understanding the macro-economic environment.

Along with that, we try to understand capital markets to identify when it would be a good time to buy a business and when not.

The fund has outperformed the MSCI World index over 10 years, but not over five. Why is that?

The fund is not always going to outperform. Over the past five years, the technology sector has done exceptionally well. We're not a technology fund, so we didn't keep up with that. However, when technology is underperforming for a certain period, the chances are that we will be outperforming.

However, an important point to make is that the fund has added value over the index after costs, with a level of risk below that of the market over the long term, because it is made of very high quality companies.

What have been the best and worst performing stocks in the portfolio over the past 12 months?

There are two ways of putting it: the stock that had the best performance and the stock that made the greatest contribution.

In terms of the best performance, it was Amazon, but in terms of contribution, it was Alphabet.

Alphabet and Amazon were the fund’s second and fourth largest holdings as at 31 March 2024, worth 7% and 5.5% of the portfolio, respectively. Alphabet rose 54% during the 12 months to 24 April 2024, while Amazon is up 72.2%.

The worst performer on both fronts has been Estee Lauder, which is down 40.4% over the past year.

Performance of stocks over 1yr

Source: FE Analytics

What is your outlook for the global equity market for the next five years?

Clearly, companies are sensitive to the economic and geopolitical circumstances, but I do believe that businesses make the economy rather than the economy making the business.

What’s more, this is the asset class that exposes you directly to the ability of humankind to create. There are not many other asset classes for which we could make that point.

Over the longer term, equities have delivered about an 8% per annum compounded return. I cannot find many reasons to believe that cannot continue to be the case, on the condition that you identify the winners. You cannot simply believe all equities will give you that type of return.

What are the greatest risks facing the equity market?

I perceive myself to be an optimist, but I do worry a lot, so I'm a very conservative optimist.

If I had to condense my concerns into a single issue, it would be the level of US inflation and the level of US interest rates. I emphasise the US, because capital markets anywhere in the world follow what happens in the US.

Also, one has to take geopolitical issues into account. One cannot ignore what's happening in the Middle East.

Along with geopolitical issues, there are developing sanctions in different sectors and industries and between certain countries.

As an investor, what are your biggest sources of pride and regret?

My biggest pride is that, despite being a conservative investor, the fund has been able to do better than the index. At times that has meant making difficult calls. For example, last year, the world thought Google was going to find it difficult to grow because of new competition from Open AI. We trusted the management and made the call to do nothing.

Most of my regrets involve not having been willing to pay up for some high quality businesses because I thought they were overvalued. From that, we've learnt that you cannot expect to get a good business at a low valuation. You have to be realistic and you have to be willing to pay for a good business.

For example, we missed Apple 10 years ago because we thought it was fully valued, but it has done well since. We still do not hold it. We have some reservations about the sustainability of the top line growth. It is probably one of the best managed businesses, but for four quarters in a row last year, the top line didn't grow. It's difficult for a management team to keep increasing the earnings if the top line doesn't grow.

Does that mean you don’t see any merit in value investing?

In a low growth economic environment, the typical value stock, let’s say tobacco, is not going to grow. It's trading at a low multiple and a higher dividend yield.

So the question may be: why not buying this tobacco stock for the dividend yield? We're not convinced that this dividend can grow forever and therefore inflation may erode the income that you think you're getting. That's the main issue.

If you buy something because it’s cheaply valued and, therefore, seems to be attractive, chances are that there's something wrong in the business.

What do you enjoy doing outside of fund management?

I'm fond of travelling and music and I read a lot. Very often, the three of those go together.