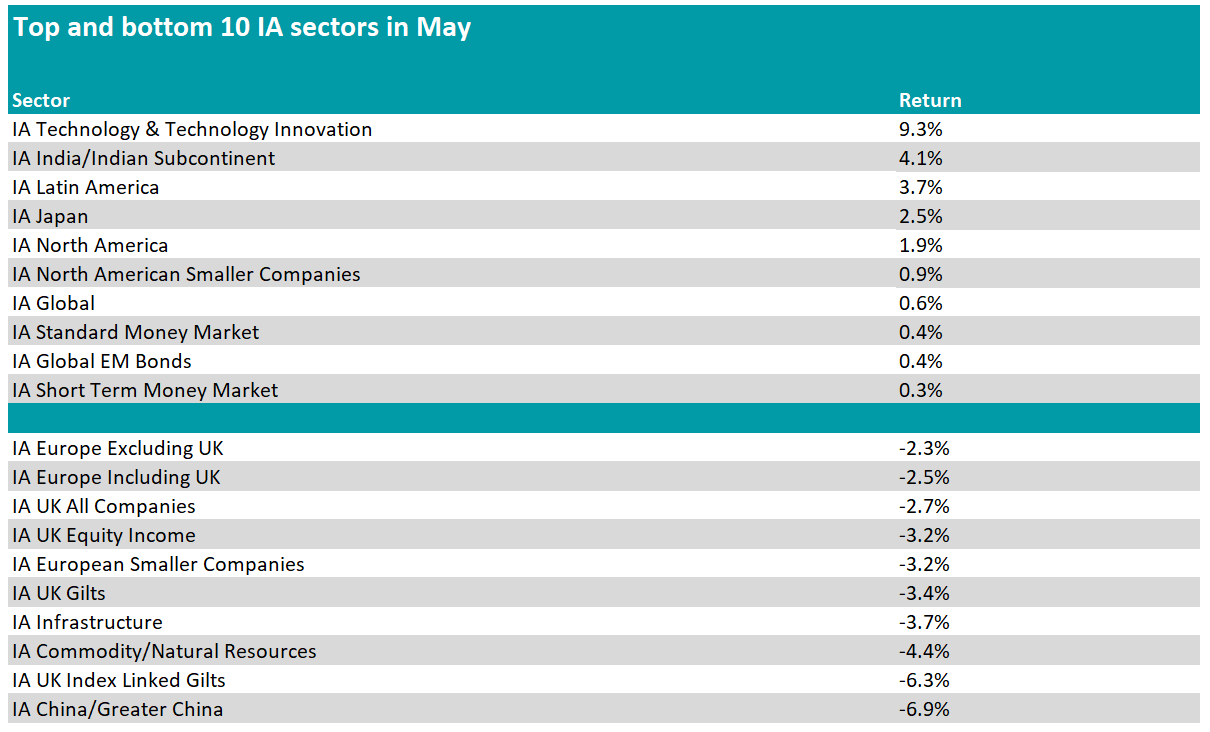

The IA Technology & Technology Innovation sector clearly dominated in May, data from FE Analytics shows, with nine out of the 10 best performing funds being tech related.

They were boosted by the focus on artificial intelligence (AI) in equity markets, which has powered the Nasdaq index to a 6.2% return. This was also illustrated by Nvidia, the fifth US company with a market cap of more than $1trn (£800bn) as its share price doubled in the past year.

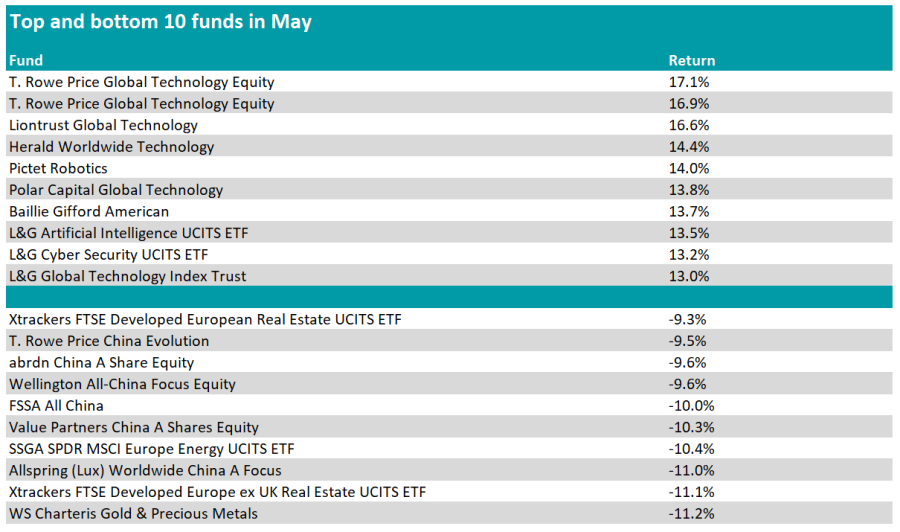

T. Rowe Price takes the top two spots with both the onshore and offshore versions of the Global Technology Equity fund.

Ben Yearsley, director of Fairview Investing, said: “It’s almost as if AI has taken over the stock market. Indeed it was the mainstream tech funds that performed best though it is interesting to see the likes of Pictet Robotics also feature.”

Source: FE Analytics

Source: FE Analytics

The third best performing fund was Polar Capital Global Technology, while Baillie Gifford American was the only fund in the top 10 that is not part of the IA Technology & Technology sector, although it still heavily geared into the theme.

India, Latin America and Japan were the next best performing sectors, with the Japanese index Nikkei 225 reaching a 33-year high.

Yearsley said: “Inflation seems finally embedded after 30 years of trying and the Nikkei has reached a level last seen when Margaret Thatcher ruled the country with an iron fist.

“In India, inflation rose at the slowest rate for 18 months in a sign that another central bank may have reached peak rates – one benefit the Reserve Bank of India has is that it is not being beholden to 2% inflation as it has a target range of 2% to 6%.”

At the other end of the spectrum, China, UK index linked gilts and commodities were the worst performing areas, with six funds from the IA China/Greater China sector among the bottom 10 funds.

Yearsley said: “China’s manufacturing sector suffered a shock contraction in April followed by a further slip in May adding to weakness in equity markets, however China’s economy did grow faster than expected in the first three months of the year.”

However, the worst performing fund was in the IA Commodity/Natural Resources, which came as a surprise for Yearsley.

He said: “Looking at individual funds, it was slightly surprising to see a fair few gold funds feature at the bottom – gold still trades near the $2,000 mark and only slipped marginally in May. Yet, many gold funds had near double-digit falls.”

The UK market was also back to being unloved in May, with the UK All Companies and UK Equity Income sectors in the bottom 10.

However, UK Gilts and UK Index Linked Gilts ranked even lower, with the latter being the second worst sector in May.

Source: FE Analytics

Source: FE Analytics

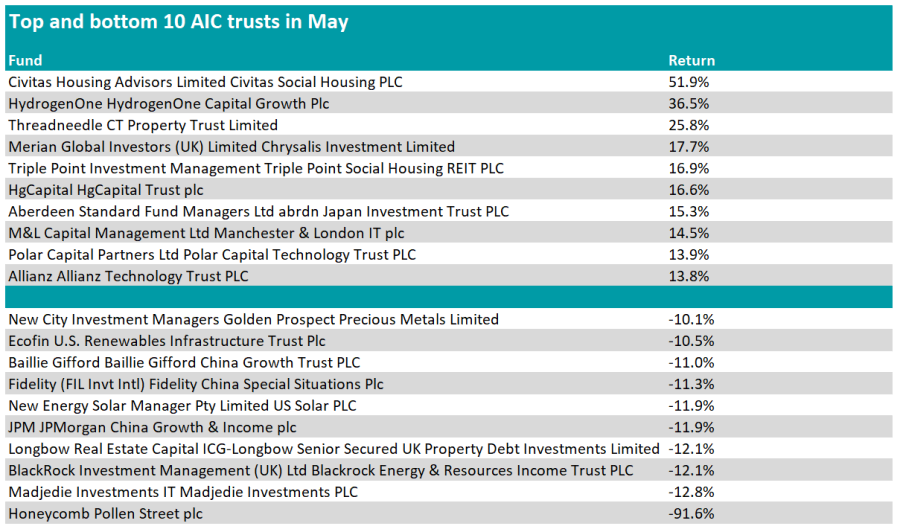

The investment trust universe shared common patterns with the Investment Association (IA) world. Technology also took the top spot, while India, Japan and Latin America featured in the top five sectors.

The IT China/Greater sector was the worst performing IT sector in May, followed by IT Property Securities and IT Property - UK Logistics.

Yearsley said: “Rare to see such commonality. Though as usual in the trust world there was an esoteric trust taking top spot. This time it was Civitas Social Housing with a gain of more than 50% after a recommended takeover approach – to put that in context though it’s still trading well below all-time highs (and NAV).”

Source: FE Analytics

The next best performing trusts were HydrogenOne Capital Growth plc and CT Property Trust Limited, respectively part of the IT Renewable Energy Infrastructure and IT Property - UK Commercial sectors.

Triple Point Social Housing REIT was the other REIT in top 10 investment trusts in May, ranking in fifth position.