The ability to consistently beat a benchmark is what makes a great active manager.

In the Investment Association Asia sectors, no funds managed to outperform the most common benchmark in their peer groups every single year for the past decade, although some funds achieved that feat in eight of the past 10 years. For Japan, seven years of outperformance was the high water mark.

To help investors select the funds that justify their fees, Trustnet highlights below which IA China, IA India, IA Japan and IA Asia Pacific Excluding Japan strategies can claim the title of the most consistent funds of the decade.

We used FE Analytics data and only considered funds with 10-year track records.

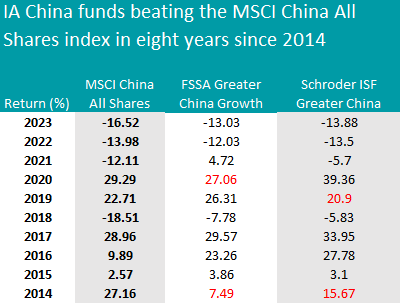

We begin with the IA China sector, where only two funds managed to consistently beat the most common benchmark of the peer group, the MSCI China All Shares index, since 2014 – FSSA Greater China Growth and Schroder ISF Greater China. Both have outperformed in eight years out of the past 10.

The former is a £428.5m benchmark-agnostic, multi-cap strategy co-managed by FE fundinfo Alpha Manager Martin Lau and Helen Chen, who has been working on the fund since 2019.

Square Mile analysts said that Lau and Chen focus on quality businesses, selected with a “rigorous bottom-up research process, where company and country visits help build their collective knowledge and assessment of a business's growth sustainability, franchise, financial strength and management.

“Overall, we see this fund as a very strong and wholly viable option for long-term investors who wish to access the greater China region in a more conservative manner, where the emphasis is on identifying high quality growth companies,” the analysts said.

In the past decade it underperformed the reference index in 2020 and 2014 only, as the table below shows.

Source: Trustnet, MSCI (for the 2014 index performance). The red highlights represent underperformance against the reference index.

The $2.2bn Schroder ISF Greater China portfolio managed by Louisa Lo achieved a similar performance – the two funds are in fact 95% correlated to each other and have a similar split between Asia Pacific equities and Asia Pacific emerging equities (14% and 84% approximately).

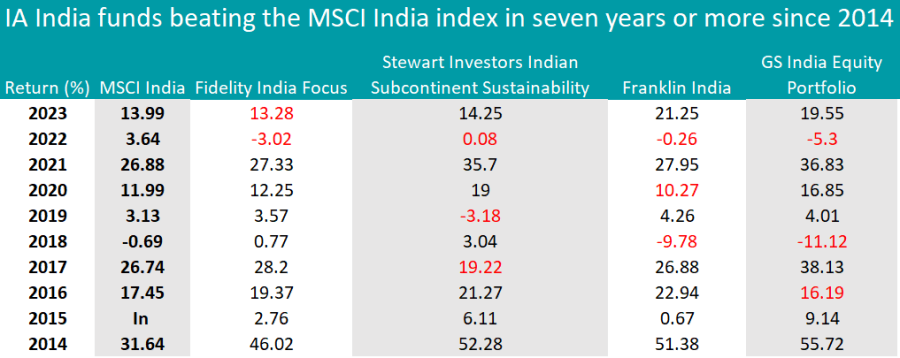

In the IA India sector, managers struggled to beat the most common benchmark, the MSCI India, during the past 10 years.

The only fund to achieve this feat in eight years out of 10 was the $2.5bn Fidelity India Focus fund managed by Amit Goel, who invests in sustainable businesses that are market leaders in sectors that benefit from India’s growth opportunities.

His current overweights compared to the MSCI India Capped 8% Index are financials (6.2 percentage points on top of the index’s 25%) and consumer discretionary (6.2 percentage points on top of the index’s 12.9%), while the main underweights are energy (where the fund remained 6.6 percentage points below the index at 4.1%) and utilities (which the fund doesn’t own but make up 4.6% of the index).

Source: Trustnet. The red highlights represent underperformance against the reference index.

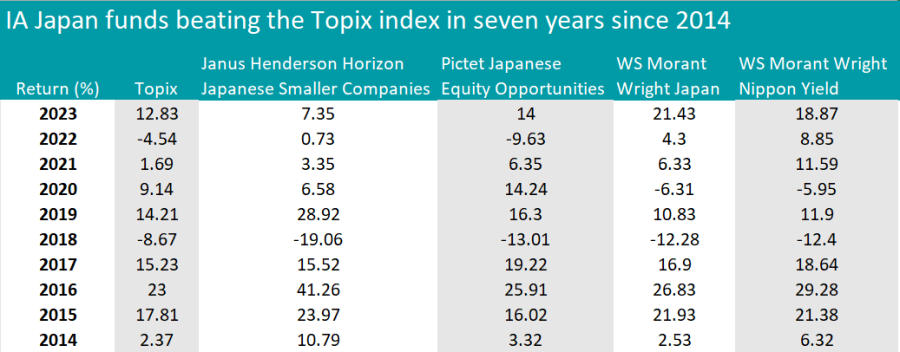

In the IA Japan sector, the Topix index proved to be a high hurdle to beat, with no more than four strategies outperforming it in seven years of the past decade – two of which are from the same provider, Morant Wright.

WS Morant Wright Japan and WS Morant Wright Nippon Yield are two similar strategies (98% correlated to each other), both with a FE fundinfo Crown Rating of five.

The management team is unconstrained from any benchmark and can choose companies across the market-cap spectrum.

The Nippon Yield fund’s value-style approach has become a large headwind in recent years, as Square Mile analysts noted. However, “while this has meant the fund has struggled, it has continued to present superior returns over its stylistic biases,” they said.

“There are risks involved with this strategy and the approach appears simplistic, but we believe this fund is a strong value option with a disciplined approach and focused team.

“The fund would suit investors who want to diversify their Japanese equity exposure but also those that are willing to accept volatility versus the benchmark over shorter periods.”

Source: Trustnet. The red highlights represent underperformance against the reference index.

Another strategy of note was the Janus Henderson Horizon Japanese Smaller Companies fund, managed by FE fundinfo Alpha Manager Yunyoung Lee, who has been in charge since 2005.

The portfolio now includes 53 holdings, 28% of which are in the industrial sector. At 14.8%, technology is a slight overweight for the fund against its benchmark, the Russell/Nomura Small Cap index, which has 12% in the sector. The biggest underweight is consumer discretionary (11.9% versus 20.8% in the index).

The only other fund in the table was Pictet Japanese Equity Opportunities, an Article 8 strategy investing in undervalued companies. Its top holdings include Toyota (4.9%), Mitsubishi (3.81%) and Sony (3.3%).

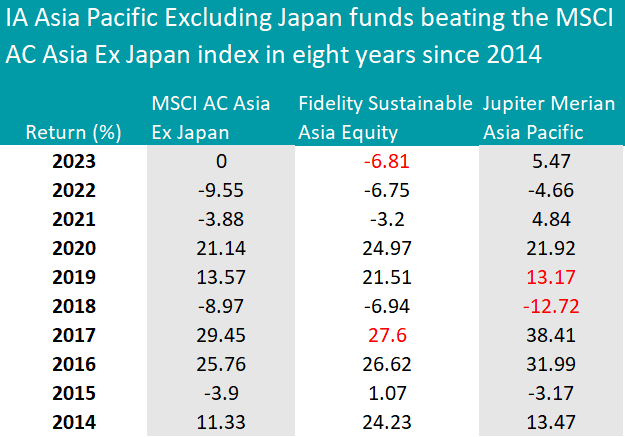

Finally, the standout vehicles in the IA Asia Pacific Excluding Japan sector were Fidelity Sustainable Asia Equity and Jupiter Merian Asia Pacific, both of which outperformed the MSCI AC Asia Pacific ex Japan index in eight years since 2014.

Source: Trustnet. The red highlights represent underperformance against the reference index.

Fidelity Sustainable Asia Equity is an £80m fund managed by Dhananjay Phadnis, who employs a quality-growth approach to select companies with sustainable returns that are mispriced or unrecognised by the market.

Jupiter Merian Asia Pacific, led by Ian Heslop, was described by Rayner Spencer Mills Research analysts as a highly-diversified long-only benchmark-aware portfolio that has consistently outperformed since the current management team took over in December 2011.

“The team has developed a systematic model over time which is now used in seven equity strategies at Jupiter and each of these strategies has delivered top quartile performance since launch with the first strategy dating back to 2005,” they said.

“This tried and tested process gives investors a strong option for investing in Asian equity markets.”

This article is part of an ongoing series on consistency. Previous instalments covered the following asset sectors: Emerging Markets, IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps, UK bonds, cautious funds, balanced funds, adventurous funds, technology, healthcare and financials.