UK equity Investment Association (IA) sectors, including All Companies, Equity Income and Smaller Companies, have come out on top of the list of best-performing peer groups in April, but the picture is more nuanced at a funds level.

The news won’t please those investors who have been withdrawing money from the domestic market this year, as Trustnet recently highlighted, but was no surprise to those who have been monitoring the FTSE index, including Ben Yearsley, director at Fairview Investing.

“Looking at fund sectors, it’s no surprise to see the UK featuring strongly after looking at the returns of global indices,” he said. “The FTSE was one of the best-performing markets globally rising 3.4%, indeed the UK generally had a good month with small- and mid-caps rising as well.”

The IA UK All Companies returned 2.5% in April, matched by India, which “often seems forgotten about”, according to Yearsley.

“India is an odd market, with many Asian fund managers liking the long-term prospects but getting nosebleeds at valuations.”

IA UK Equity Income occupied the third position in the list, gaining 2.3%. Further down the list, the IA UK Smaller Companies rose 1.9%, while positive news continued in Europe as well, as shown in the table below. Healthcare and infrastructure also feature.

Source: FE Analytics

With a 6.2% loss, the worst performers were funds investing in China, whose much-anticipated post-Covid growth keeps investors waiting.

Yearsley: “The fall in Chinese equities was more surprising when you consider that GDP numbers released during April beat expectations with a 4.5% expansion in the first quarter compared to a forecast 4%.”

“However, figures released on Sunday showed an unexpected manufacturing slowdown – maybe markets had already cottoned on? The Asia Pacific ex-Japan sector was also dragged down by poor China returns.”

Funds investing in UK index-linked gilts, probably the most volatile sector over the past year, finished second from the bottom in April falling 4.7% with some bond managers telling Trustnet that they prefer US treasuries to UK bonds.

More disappointment came from gilts and index-linked gilts, “the most volatile sector over the past year, as many bond managers prefer US TIPS to UK linkers” according to Yearsley, and the IA Technology and Technology Innovation sectors, which couldn’t keep the pace of a strong first quarter.

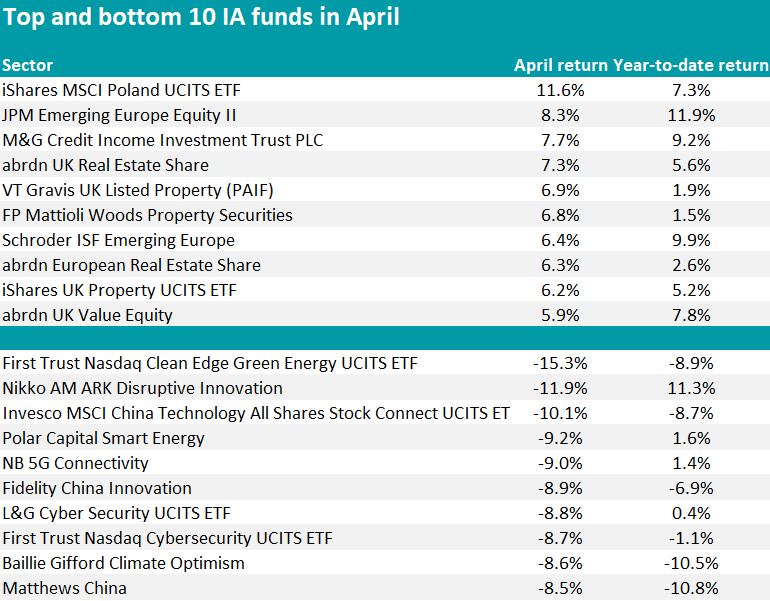

Turning to specific funds, the UK was overshadowed by Eastern Europe, with the iShares MSCI Poland UCITS ETF topping the table with a return of 11.6%, followed by the 8.3% of JPM Emerging Europe Equity II. Schroder ISF Emerging Europe also made the table.

Yearsley did not find any discernible reason for this, “except perhaps the phone call between [Chinese] president Xi and [Ukraine president] Zelensky. Is there hope for the end of the war?,” he asked.

Another dominant theme was property, with five funds featuring. The abrdn UK Real Estate Share fund finished fourth, with a gain of 7.3%.

As Yearsley noted, it was a good month overall for abrdn, with three funds in the top 10, as shown in the table below.

Source: FE Analytics

The bottom of the table looked “slightly odd” to the Fairview director, who nevertheless described it as a sour sentiment towards ultra-long-dated duration assets.

Environment, sustainability and governance (ESG)-focused strategies had a bad month despite the enthusiasm of the first three months of the year, with the First Trust Nasdaq Clean Edge Green Energy UCITS ETF losing 15.3%, followed down further by Polar Capital Smart Energy and Baillie Gifford Climate Optimism.

The Nikko ARK Disruptive Innovation fund, NB 5G Connectivity and the L&G Cybersecurity UCITS ETF were “still under the cosh with rates still on the up, albeit with more nuance now”, said Yearsley.

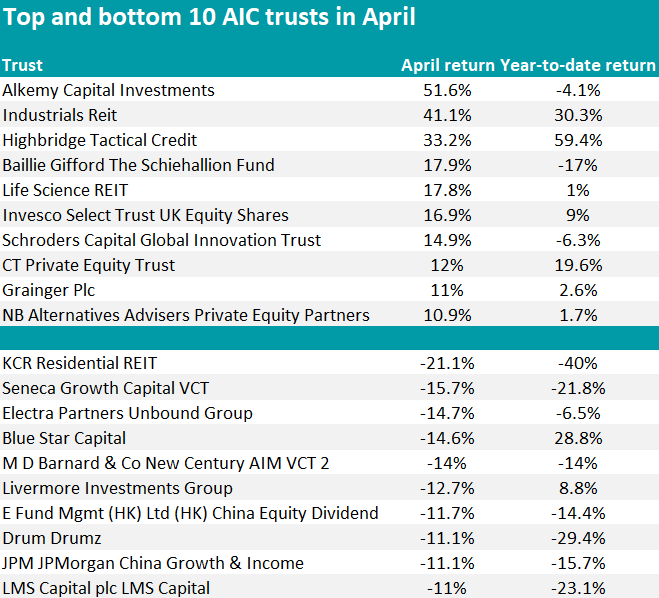

In the trusts universe, the table below shows “the usual esoteric mix”, according to Yearsley.

Source: FE Analytics

Here, the highlighted Baillie Gifford’s private equity vehicle Schiehallion finished fourth “with a gain of more than 17% on the back of a decent update”, while other private equity portfolios were flanked by real estate investments trusts (REITs), including Industrials REIT, Life Science REIT and Grainger.