Small-cap investing is where active managers should (in theory) shine. With fewer analysts covering stocks lower down the market capitalisation, savvy investors have more chance of finding hidden gems.

Those who have been in the industry a long time could have a leg up on their younger rivals, having been through many market cycles and seen all sorts of events in their careers.

As such, below, Trustnet looks at the three funds managed by the same person since at least 2004 that have produced top-quartile returns over the past three years – showing they remain at the top of their game.

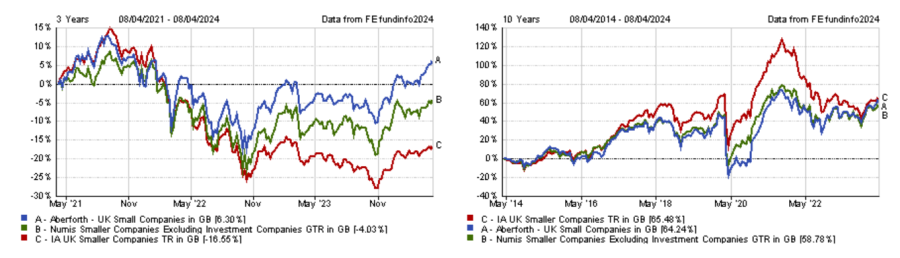

One of them is Aberforth UK Small Companies, which has been managed by Euan Macdonald since 2001, but who has since been joined by Peter Shaw in 2016, Jeremy Hall in 2018, Sam Ford in 2019, Rob Scott Moncrieff in 2022 and Rowan Marron last year.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

The fund is known for its value approach, with Macdonald and his colleagues looking for UK small-caps trading below their intrinsic value. As a result, the fund has benefited from the rotation to value in recent years.

M&A activities have also been a tailwind for the fund, as private equity firms and US companies have taken advantage of the low valuations within the small- and mid-cap segment of the UK equity market.

However, Aberforth UK Small Companies sits in the sector’s third quartile over 10 years, as the value style of investment has been out of favour for most of the past decade.

Moreover, the fund may not be for the fainthearted, as it has been the most volatile portfolio in the sector over the same timeframe.

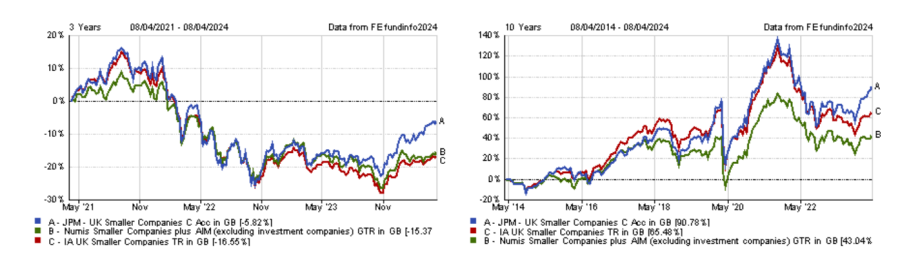

Another UK small-cap fund managed by a veteran manager that has made top-quartile returns over three years is JPM UK Smaller Companies.

Georgina Brittain has been at the helm of this fund since 2000 and was joined by Katen Patel in 2015.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

Unlike Aberforth UK Small Companies, the fund has lost money over three years, but to a much lesser extent than most of its competitors, explaining its presence among the sector’s top quartile performers during this time.

The past three years have been challenging for UK smaller companies, as the sector is down 16.6%, suffering from higher inflation and interest rates, as well as being part of an unloved market.

A further argument is that UK equities have been left without natural buyers and thus no valuation support, as British pension funds have favoured global equities since they are not required to hold any specific allocation to domestic equities.

The long-term performance of JPM UK Smaller Companies longer-term performance has been strong nonetheless, as the fund also sits in the top quartile over five and 10 years.

It has been one of the most volatile funds in recent years but has delivered some of the best risk-adjusted returns, with the fund’s Sharpe and information ratios both in the sector’s top 10.

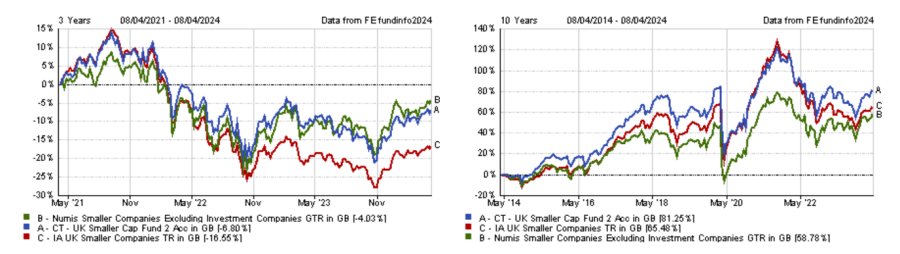

Finally, Catherine Stanley, manager of the CT UK Smaller Cap Fund, is the last of the veteran managers of UK funds to have delivered top-quartile returns over three years.

Performance of fund over 3yrs and 10yrs vs sector and benchmark

Source: FE Analytics

Stanley has been managing the fund since 2004 and was joined by Patrick Newens in 2019. They are growth investors, looking for UK small-caps exhibiting above average growth rates or good growth potential.

Just as the JPM fund, CT UK Smaller Cap Fund has made a loss over three years, but is still the 11th best performer over the period.

Over the long term, performance has been good as the fund has delivered second-quartile returns over 10 and 15 years, but it has rarely sat in the sector’s top quartile.

Yet, the fund has been one of the least volatile in the sector and has had one of the lowest drawdown – price drops from peak to through – over the past decade. This has also been true over the past three years.

Previously we looked at the IA UK All Companies sector, where there was only one veteran manager to achieve the feat.