Clean energy and blockchain have shone in 2023 despite investors’ scepticism last year, but analysts are mixed on their potential.

Interest in clean energy seemed to dwindle at the end of 2022, as oil rallied on the backdrop of shrinking supply and as people seemed to have come to terms with an energy transition that would take longer than expected.

Technology and blockchain were also areas where losses in 2022 scared investors away in favour of other investments that were perceived as safer.

Yet, both these areas have come back strongly over the year to date, as the chart below shows.

Themes with positive returns in 2023

_MA000015.png)

Source: FinXL

Below, three experts discuss these market swings and what they mean for investors.

The reassessment of sustainable energy as an asset class was due to the better long-term narrative, according to Andy Merricks, fund manager at 8AM Global.

With value investing back in vogue in 2022 and a series of shocks in oil supply, traditional energy companies had become more attractive – until 2023, when environmental, social and governance (ESG) solutions outperformed them.

“Now we are seeing that actually the case for environmental funds, clean tech and other ESG favourites is still in place. It got sold off, but people are buying back into it again because the longer-term summary has to be better than the long-term story for things like oil and coal,” he said.

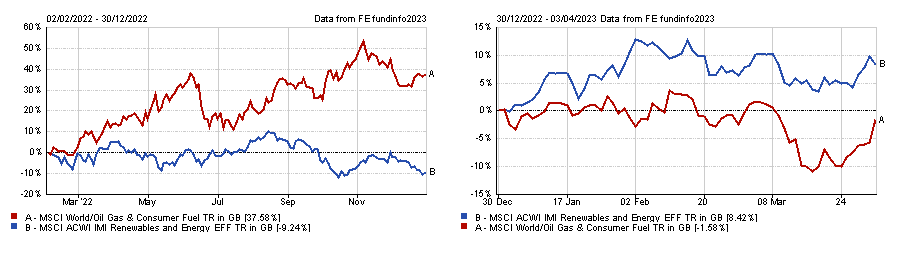

Performance of indices in 2022 and 2023

Source: FE Analytics

Kamal Warraich, head of equity fund research at Canaccord, attributed the comeback of ESG strategies to a realisation that investing in suitability and the energy transition isn’t always in contrast to investing in more traditional oil and gas companies.

“People have realised that they can't discount certain companies from their portfolios. Traditional energy companies are massive and make a lot of money but are also investing a fair amount into new energy solutions,” he said.

“We need to look at alternative methods of generating energy whilst we transition to renewable energy, and it’s perfectly reasonable and rational to think that we may need to use commoditised energy to get to that point. In the meantime, investors can get returns from it while believing in sustainable investing at all times.”

The best-performing theme of the year, however, was blockchain, which might surprise some, given the substantial sell-off and loss in value of 2022.

According to Rob Burgeman, senior investment manager at wealth manager RBC Brewin Dolphin, investments in blockchain or Bitcoin are “extraordinarily difficult to forecast because the drivers of returns are completely disengaged from reality – it is a sentiment-driven investment that shrugs off yet another fraud or custody implosion.”

Warraich sees this space mainly as a risk-on indicator.

“If Bitcoin is rallying hard, that shows you there's some depth to the risk appetite in the market,” he said.

“Now the broader question, of course, is: Has it become a good inflation hedge? I don't think we have enough data to establish that but it's an incredibly volatile asset which, as of right now, can be used as a risk indicator.”

Sheridan Admans, head of fund selection at Tillit, is more interested in the asset class and included a blockchain exchange-traded fund (ETF) in Tillit’s “wildcard” funds selection.

“Investors often consider digital assets, especially those related to blockchain, as high-risk, high-reward investments, similar to tech growth stocks,” he said.

“But blockchain indices not only have exposure to high-growth companies, but also to quality large-cap value/growth companies which have delivered relative stability year to date, such as Rio Tinto, Intel, Oracle, Sony, Santander, IBM, and Mastercard in the case of the CoinShares Blockchain Global Equity index.”

“When thought of as separate from cryptocurrencies, blockchain technology has broad and far-reaching appeal, as it allows to greatly reduce costs, speed up transactions and promote greater financial inclusion by streamlining cross-border and remittance payments for companies”.

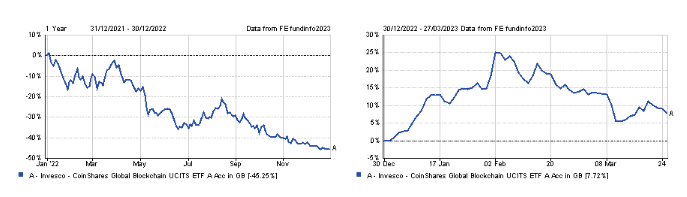

Performance of fund in 2022 and over the year to date

Source: FE Analytics

So what should investors make of these changes in sentiment?

According to Simon Evan-Cook, multi-asset manager at Downing Fund Managers, they should “forget trying to call the macro”.

“If inflation hasn’t been put back in its cage yet, then we may well see some of this year’s winners come under pressure again,” he said.

"Investors should find a good selection of investments that they think will fare well over the next ten years and that can withstand this irritatingly swirling wind in the market”.