Tech funds continued to outperform in the opening quarter of 2024, although market watchers have warned that a correction could be on the cards.

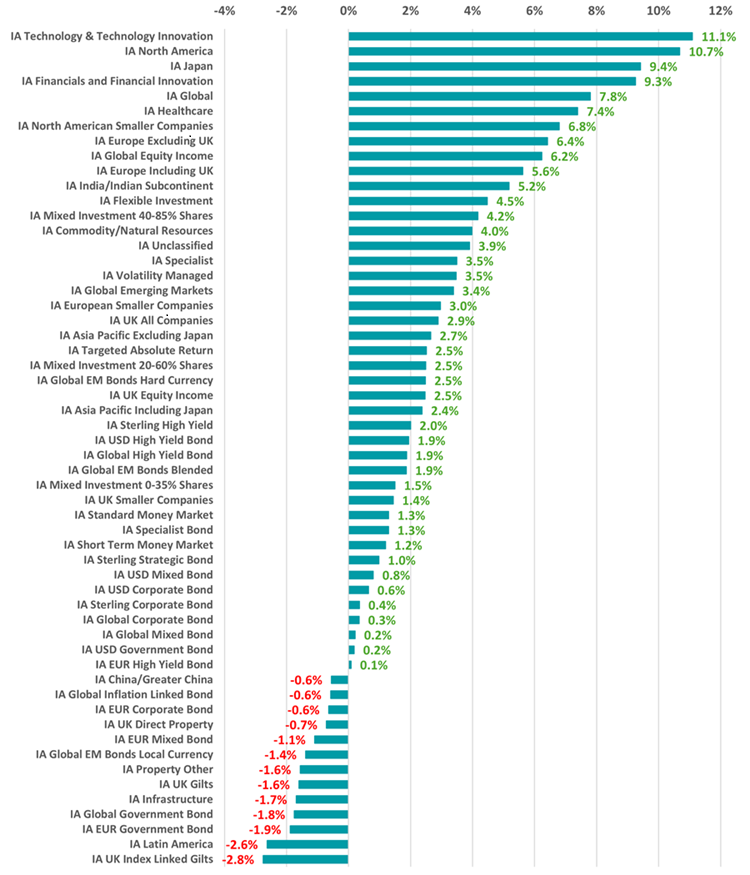

As the chart below shows, the best performing Investment Association sector over the past three months has been IA Technology & Technology Innovation, with an average total return of 11.1%. This follows strong performance last year (the average tech fund made 38.9% in 2023) after the sector recovered from a brutal interest rate-induced sell-off in 2022.

While tech stocks initially struggled when central banks were hiking rates to curb surging inflation, they have bounced back strongly as enthusiasm around artificial intelligence (AI) has grown over the past 18 months or so.

Performance of Investment Association sectors in Q1 2024

Source: FE Analytics

However, there are some concerns around the extended run that tech stocks, and by extension the funds that invest in them, have enjoyed. The momentum investing style – which is now heavily tied to tech – outperformed by a significant margin in the opening quarter of 2024 but there have been warnings that this could be followed by a correction.

Meanwhile, in recent weeks tech bosses such as Peter Thiel, Jeff Bezos and Mark Zuckerberg has sold hundreds of millions of dollars of their companies’ shares, adding to the worries that tech stocks are approaching a peak.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “Speculation is mounting that a big tech wobble could be looming after the recent spectacular bull run.

“Exuberance for all things AI has helped fuel the big rally, but with the ratio of corporate insider selling to insider buying at the highest level since 2021, the canary in the coalmine is squawking about whether we’ve reached the peak and should prepare for a correction.

“The analysis data compiled by Verity LLC, which tracks insider trading disclosures, has highlighted that big tech bosses are among the biggest sellers of stock since the start of the year, taking profits as uncertainty lies ahead.”

IA North America funds also had a good first quarter, supported by tech stocks, while IA Japan came in third as investors continue to warm to the country thanks to shareholder-friendly corporate reforms, solid earnings and a supportive central bank.

The worst performers of the quarter tended to be fixed income sectors, which stalled after stickier-than-expected inflation pushed back expectation for interest rate cuts.

Source: FE Analytics

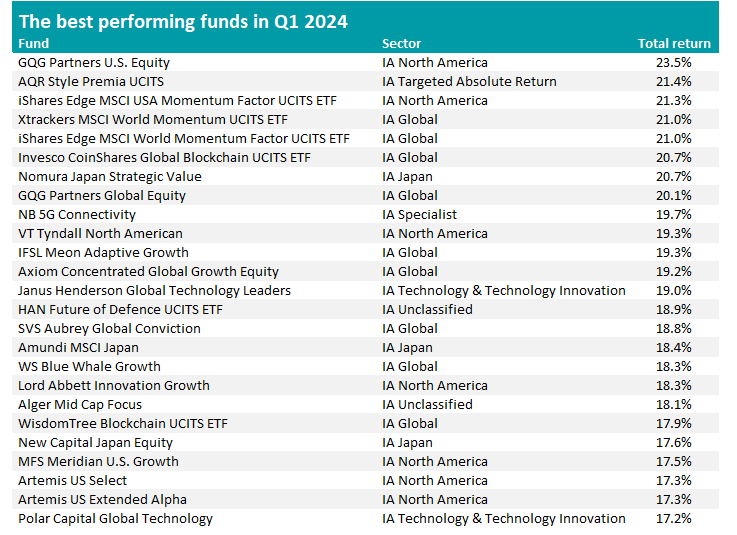

But when it comes to individual funds, only two members of the IA Technology & Technology Innovation sector made it into the top 25: Janus Henderson Global Technology Leaders and Polar Capital Global Technology.

The best performer of the quarter was GQG Partners U.S. Equity, which is managed by Rajiv Jain, Brian Kersmanc and Sudarshan Murthy – all of whom hold FE fundinfo Alpha Manager status.

The £1.1bn fund looks for US stocks with strong balance sheets and competitive advantages that can benefit from industry trends. The team combines conventional fundamental stock analysis with non-traditional investment information sources such as forensic accounting, investigative journalism and capital structure analysis to gain additional insight.

Analysts with FE Investments said: “Lead manager Rajiv Jain has a proven track record over a long career. The fund combines a strong focus on quality companies with a flexibility to adapt to macroeconomic conditions which provides multiple avenues for generating outperformance. The macro ‘switch off’, whereby entire sectors can be exited quickly in the event of new risks emerging, has been highly successful at limiting damage in falling markets.”

In second place is AQR Style Premia UCITS, an absolute return fund that targets attractive risk-adjusted returns with low correlation to traditional stock and bond portfolios. To do this, it can invest both long and short across five different asset groups (stocks & industries, equity indices, fixed income, currencies and commodities) and four investment styles (value, momentum, carry and defensive), with the aim of being market neutral.

The rest of the top five is completed by three trackers of the momentum style: iShares Edge MSCI USA Momentum Factor UCITS ETF, Xtrackers MSCI World Momentum UCITS ETF and iShares Edge MSCI World Momentum Factor UCITS ETF.

During the first quarter, the MSCI ACWI Momentum index made a 22.1% total return, beating the 9.2% from the MSCI AC World and displaying a clear market leadership. However, as alluded to above, this has prompted warning from the likes of JP Morgan strategist Marko Kolanovic and former ‘bond king’ Bill Gross that momentum-led markets are often hit with a sell-off.

Source: FE Analytics

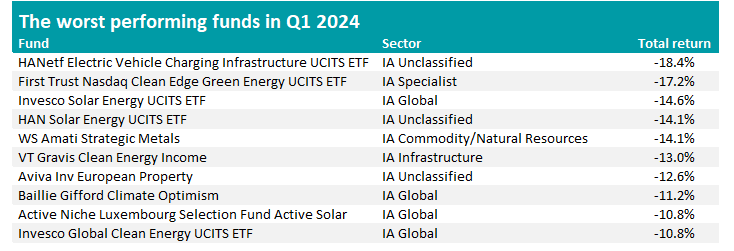

At the very bottom of the first-quarter performance table is HANetf Electric Vehicle Charging Infrastructure UCITS ETF with an 18.4% loss. Several other clean energy funds also appear among the bottom 10 (only two of the funds in the table above do not fit into this theme).

Clean energy stocks are especially sensitive to interest rates for several reasons: some rely on debt to finance large and expensive projects, some generate bond-like cash flow streams so higher rates cause the net present value of these to fall and others take long duration bets on the future with low profitability today and high profitability tomorrow.