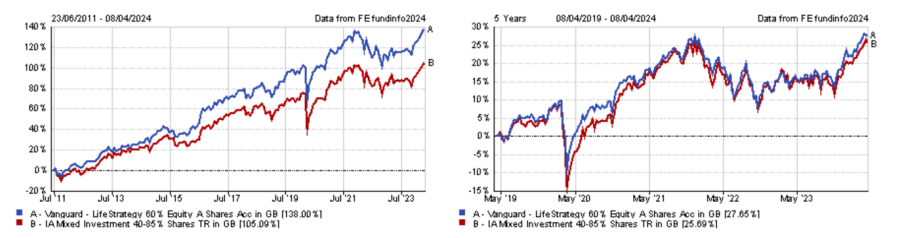

The Vanguard LifeStrategy 60% Equity has been a success since its launch in June 2011, outperforming the IA Mixed Investment 40-85% Shares sector by more than 30 percentage points over the past 13 years.

The recipe of the £14.9bn fund’s success has arguably been simple: offering investors a low-cost balanced portfolio mixing diversified assets, underpinned by the traditional negative correlation between equity and bond markets.

Mohneet Dhir, head of multi-asset product specialism at Vanguard, Europe, said: “The equity sleeve of the fund is designed to do the heavy lifting regarding generating returns, while the primary purpose of the fixed income allocation is to act as a hedge against equity market volatility.

“By holding a balanced portfolio, you are therefore looking to protect yourself against the fluctuations of the market, without having to second guess it. Nobody can see around corners, after all.”

While the fund has delivered on its objectives, experts stressed that the Vanguard LifeStrategy 60% Equity is not foolproof either. Below, they discuss the strengths and weaknesses of this fund of index funds.

Performance of fund since launch and over 5yrs vs sector

Source: FE Analytics

Tom Poulter, head of quantitative research at Square Mile Investment Consulting and Research, likes the low costs of the Vanguard LifeStrategy 60% Equity and highlighted the fact it is one of the cheapest offerings in its sector.

He said: “This cost advantage means that, over the long term, the fund has a good chance of outperforming peers net of fees.”

However, he warned this passive approach and the “static” asset allocation mean that there is no manager to divest when an asset class looks extremely overvalued or, conversely, to take benefit of an excessively undervalued asset class.

Furthermore, Poulter stressed that the nature of the fund also means it is unlikely to be the best performing portfolio in the IA Mixed Investment 40-85% Shares sector.

He added: “We should not expect this fund to be top of the pile unless active managers have seriously underperformed, nor should we expect it to be bottom of the pile unless active managers have seriously outperformed.”

For Gavin Haynes, co-founder of Fairview Investing, the Vanguard LifeStrategy 60% Equity should be a good long-term “all-weather” holding, but noted that the negative correlation between equities and bonds as broken down in recent years, especially in 2022.

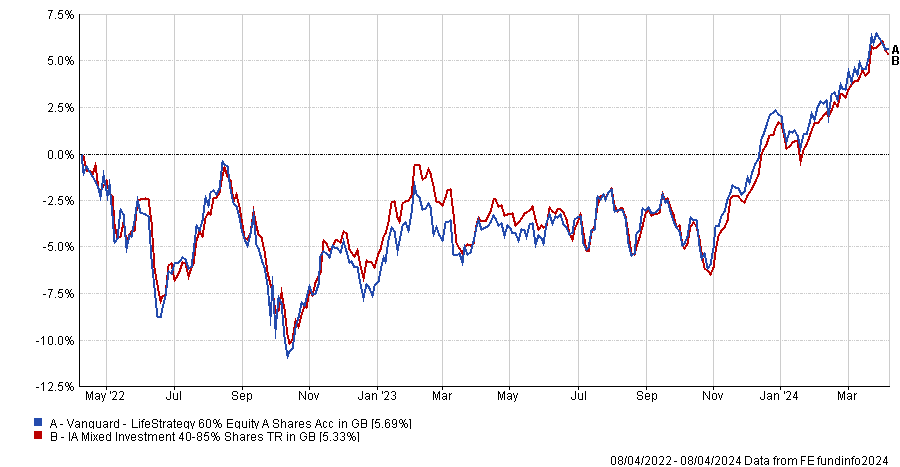

This hurt the fund’s performance as it could not seek refuge in any other asset class, unlike many of its competitors. As a result, the Vanguard LifeStrategy 60% sat in the third quartile of its sector in 2022, falling 11.2%.

Performance of fund over 2yrs vs sector

Source: FE Analytics

Dhir acknowledged the recent years of simultaneous decline for stocks and bonds but stressed that the usual relationship between the two asset classes is starting to reestablish itself.

He said: “It’s worth remembering that the death knell of the 60/40 portfolio has been rung many times before. The first 60/40 style balanced fund was launched in 1929. It has seen a great depression, a world war, bear markets, bull markets, periods of much higher inflation than we have today, rising rates, declining rates, and yet the approach continues to deliver for investors. It is a time-tested strategy.”

Alex Watts, investment data analyst at interactive investor, added that the outlook for 60/40 portfolios is positive.

Although bonds have been slow to recover from the market rout of 2022, he explained yields remain high as strong economic data has pushed back monetary easing. Moreover, inflation hasn’t met central bank’s targets in most developed markets, although it is trending down.

He said: “In all, suppressed bond prices and high yields offer an attractive outlook for investors in fixed income securities.

“Outlooks for equities – the main growth driver in a 60/40 portfolio – are looking improved versus last year, meaning the risk return characteristics of the 60/40 portfolio is attractive.”

Another thing Haynes pointed out is the ‘home bias’ in the equity sleeve of the portfolio, where the UK accounts for 15%.

He said: “The fund has a structural bias towards UK equities as it is designed for the UK adviser market but this has been a headwind over the past decade. More active asset allocation would have helped.”

However, Watts argued that this home bias may prove beneficial if UK valuations revert towards historic norms or serve as a buffer if the US market experiences a correction.

Dhir concluded: “Financial markets are difficult to predict. Often, a stock market that is in favour today, may not be tomorrow. The catalyst of changes in markets are even harder to predict. For investors, the best approach to tackle this is diversification.”