Funds offering protection from market volatility, diversified income streams, stakes in high-quality companies and exposure to themes such as artificial intelligence and the energy transition are among those that RBC Brewin Dolphin suggests investors take a look at this ISA season.

With some tax allowances being cut from April 2024, it is arguably more important than ever to make full use of the £20,000 ISA allowance this year and next. The wealth management firm said investors should consider using as much of their ISA allowance as they can either side of the 6 April deadline, in order to shield their money from cuts to dividend, capital gains and interest income allowances.

Below, Rob Burgeman, a senior investment manager at RBC Brewin Dolphin, highlights 12 funds that investors could look at for their ISA this year. To keep this relatively concise, we’ve concentrated on the reasons why RBC Brewin Dolphin likes these funds; for more on their performance, positioning and other information, feel free to click through to their Trustnet factsheets.

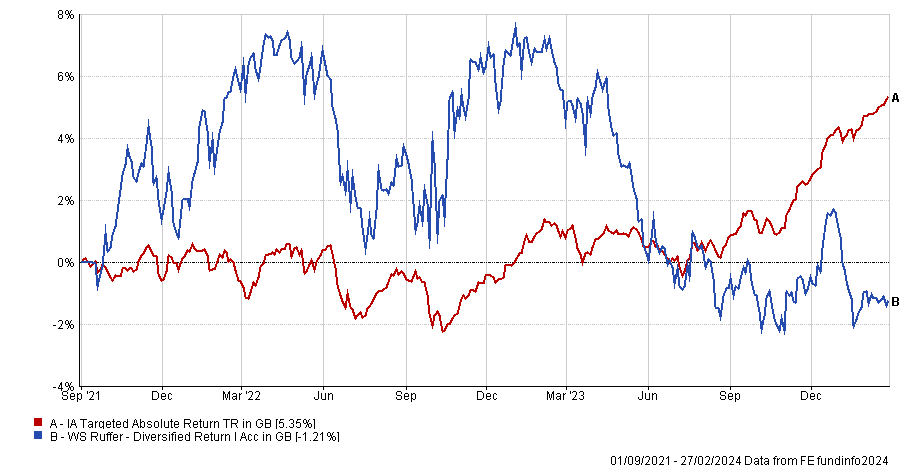

Starting with a cautious pick, Burgeman suggested the WS Ruffer Diversified Return fund, which aims for a positive total annual return across market conditions. It invests across asset classes, geographies and sectors with significant positions in inflation-linked bonds and gold.

“If global risk assets rise sharply, this fund is very unlikely to fully participate,” he added. “However, Ruffer has demonstrated over many years its ability to weather the inevitable storms that sometimes hit markets.”

Performance of fund vs sector since launch

Source: FE Analytics

Turning to income-focused investors, Burgeman pointed to the BNY Mellon Global Income fund, which seeks to generate income and long-term capital growth through global equities; it has a historic yield of 3.2%. “While UK-based investors have traditionally looked to domestic companies for income, going global has become increasingly important as a diversifier,” he said.

Another option for income seekers is the WS Evenlode Global Income, aiming for income and capital growth with a historic yield of 2.1%. It focuses on companies in developed markets with strong cash flows and low business risk. “These should, in turn, lead to a growing dividend stream and the potential for capital growth as well,” Burgeman added.

For exposure to the UK, he highlighted Vanguard FTSE U.K. All Share Index as a cost-effective way to track the broad market, with a net ongoing charge of 0.06%. “This tracker fund provides cheap and straightforward exposure to the UK’s biggest companies,” he explained.

Merchants Trust, established in the 19th century, predominantly invests in UK equities and offers an “attractive” yield of more than 5%. It is one the Association of Investment Companies’ ‘dividend heroes’ thanks to a 41-year track record of dividend increases.

Another active UK fund tipped by Burgeman is Liontrust Special Situations, which seeks long-term capital growth by investing in UK companies with durable competitive advantages. He added: “The team approach that Liontrust operates has resulted in a quality-growth bias, which defends in cyclical downturns but also captures the upside of rising markets.”

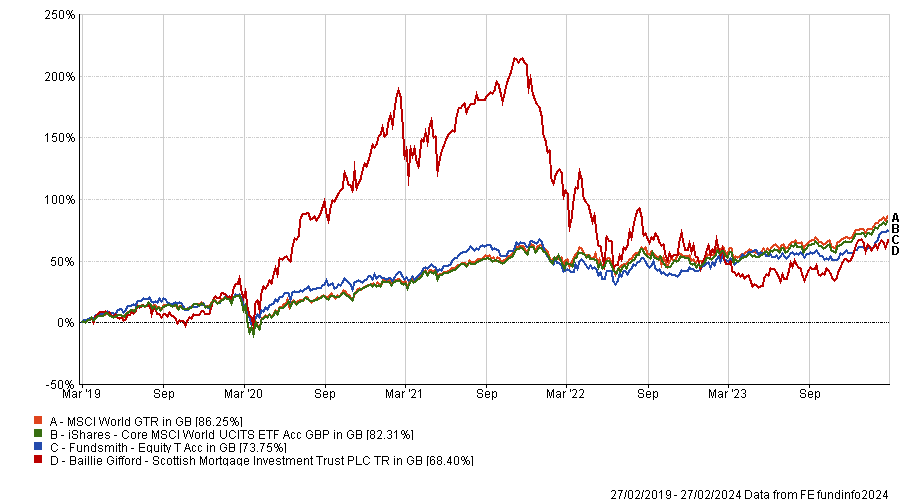

Performance of funds vs index over 5yrs

Source: FE Analytics

For global investors, RBC Brewin Dolphin suggested Fundsmith Equity, well-known for its long-term growth strategy and strong long-term track record. “The fund applies a stringent screening process to find high-quality businesses which can offer a high return on invested capital, leading it to companies with an edge that is difficult to replicate, an absence of leverage, high levels of cashflow, resilience to change and exceptional management teams,” he said.

Another active suggestion is Scottish Mortgage Investment Trust, which has a delivered impressive long-term returns through buying growth-oriented, disruptive companies, despite some tough times more recently. Burgeman noted: “Its current discount of around 12% looks to be a good entry point to this longer-term growth trust.”

Meanwhile, the iShares Core MSCI World UCITS ETF offers broad exposure to global equities at a low cost, suitable for those seeking straightforward, global market access. “If you want cheap, uncomplicated exposure to the biggest names in the world economy, iShares Core MSCI World could be the ETF for you,” Burgeman suggested.

Performance of funds vs index over 5yrs

Source: FE Analytics

For exposure to Asia, the Morgan Stanley Asia Opportunity fund invests across the continent, offering high potential returns. However, RBC Brewin Dolphin warned that it “is not one for the cautious”, pointing to its significant exposure to China.

Burgeman also has two suggestions for more adventurous investors, with the first being the Polar Capital Technology Trust. It invests in a broad range of tech stocks but has a particular interest in the opportunities presented by artificial intelligence. However, he said investors need to be aware of the performance fees attached.

Lastly, the Schroder Global Energy Transition fund offers exposure to companies involved in the energy transition, excluding nuclear energy and fossil fuels. “We feel this fund offers an attractive vehicle to benefit from the changes which are likely to be required over the years ahead,” Burgeman finished.