The S&P 500 is notoriously hard to beat, which means it can be dangerous for managers to deviate too much from it.

Yet, research by Trustnet has uncovered five top-quartile funds which did exactly that and which have been amply rewarded for the risks they took.

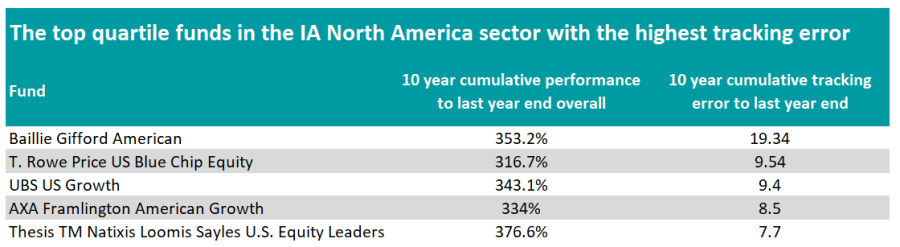

Baillie Gifford American, T. Rowe Price US Blue Chip Equity, UBS US Growth, AXA Framlington American Growth and Thesis TM Natixis Loomis Sayles U.S. Equity Leaders all outmatched the US index over 10 years and sit among the sector’s top-quartile funds while having a high tracking error.

Source: FE Analytics

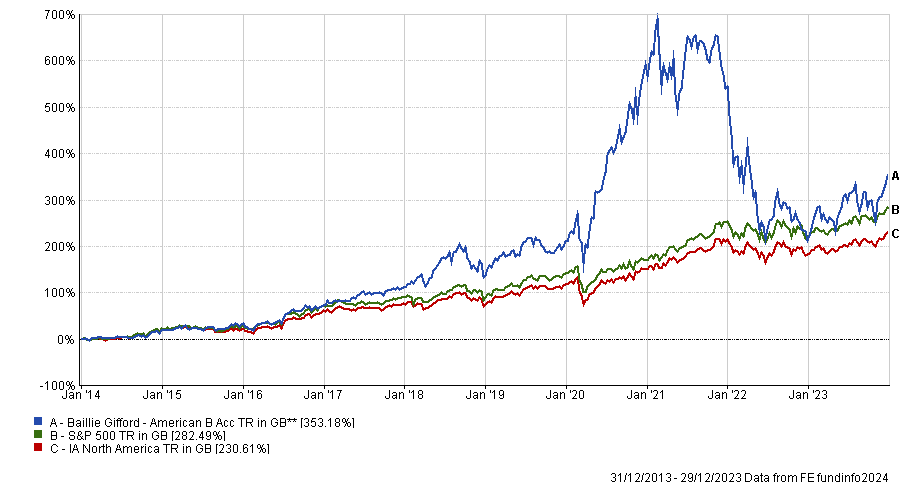

At the top of the list with a tracking error of 19.3, Baillie Gifford American departed the most from the S&P 500, by far. It is also the second-best performing fund in this cohort,

The fund, managed by FE fundinfo Alpha Manager Tom Slater, Kirsty Gibson, Gary Robinson and Dave Bujnowski, invests in growth stocks across the whole market cap spectrum, but with an emphasis on mid-caps.

Its large weighting in the information technology sector led the fund to strongly outperform in 2020, as Covid restrictions accelerated demand for technology.

However, the fund struggled in 2022 when markets rotated from growth to value, but rebounded in 2023 when disruptive technologies linked to artificial intelligence came back into fashion.

Analysts at FE Investments said: “The fund exhibits above-average volatility due to it being heavily concentrated in high conviction positions. The team chooses not to dilute the impact of strong companies in the name of diversification.

“The benchmark-agnostic approach suggests that the fund may behave nothing like the S&P 500 – rather, it will be a case of the underlying stocks being heavily skewed towards those that use disruptive technologies.

“Higher than average allocation to mid-cap companies makes the portfolio more volatile with respect to large-cap peers, and most suited to an investor with a long-term investment horizon, as well as one that can tolerate high volatility.”

Performance of fund over 10yrs (to year-end 2023) vs sector and benchmark

Source: FE Analytics

Another top quartile fund that deviated from the S&P 500, albeit much less than Baillie Gifford American, is UBS US Growth, which typically holds 35 to 55 growth stocks.

Managers Peter J. Bye, Albert Tsuei and Alia Aziz invest in three categories of growth companies.

First, classic growth companies are widely recognised by the market but the managers try to take advantage of short-term market movements to purchase them at attractive prices.

The other categories are elite growth companies, which are firms in a hyper-growth phase, and cyclical growth companies, which tend to have more short-term horizons.

Analysts at Rayner Spencer Mills Research (RSMR) said: “The strength of the research resource feeding into this strategy, and the experience of the manager, are key differentiators for this fund.

“These factors are complemented by a disciplined investment process which seeks diversified sources of growth.

“The fund has performed well over the long-term and has generated consistent returns in line with the benchmark, while maintaining a high active share.”

They suggested using this fund as a satellite rather than as a core holding.

Performance of fund over 10yrs (to yearend 2023) vs sector and benchmark

Source: FE Analytics

AXA Framlington American Growth has achieved the same feat as Baillie Gifford American and UBS US Growth.

It is a high conviction growth fund, with managers Stephen Kelly and David Shaw seeking companies with strong balance sheets, high quality management and expanding market shares.

Analysts at RSMR said: “The investment process, which is implemented by a highly experienced team, is highly disciplined which means that the investment style will be the same across all market cycles. It also puts fundamental research at the heart of the process which results in a high active share and focus on absolute risk.”

As for UBS US Growth, they also suggested using AXA Framlington American Growth as a satellite holding.

Performance of fund over 10yrs (to year-end 2023) vs sector and benchmark

Source: FE Analytics

Other outperformers that deviated significantly from their benchmark include T. Rowe Price US Blue Chip Equity and Thesis TM Natixis Loomis Sayles U.S. Equity Leaders.

It should be noted that TM Natixis Loomis Sayles U.S. Equity Leaders is the fund in the list that has made the best returns over the past 10 years, but it also has the lowest tracking error of the group.