More than 900 cash accounts offer rates greater than inflation – that’s more than half the market.

However, savers need to be aware that many savings accounts with high street banks will not protect their hard-earned money from the corrosive impact of inflation, especially given that rates have tumbled in the past few months.

Because savings rates change quickly, savers must act now and shop around for the best offers before they are gone.

January’s inflation reading – released this morning – remained unchanged from December’s 4.0%, meaning that by now, savings accounts have caught up, said Rachel Springall, finance expert at Moneyfactscompare.co.uk.

“It has been six months since the market last felt a base rate rise and many providers have likely caught up with these rises by now,” she said. “Any future improvements to the top rates will be down to competition.”

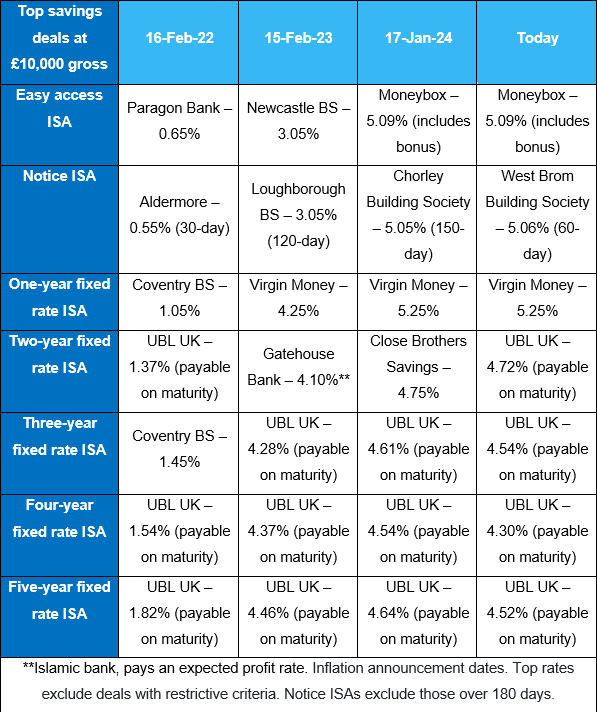

She expects providers to improve their ISA rates at this time of year and suggested savers consider using their ISA allowance as the new tax year in April approaches.

There are many other good reasons to act now. “Inflation is predicted to come down to around 2.7% by the fourth quarter of the year and, based on today’s top rates, savers would be able to make a return on their cash in most savings accounts should interest rates hover around current levels,” Springall said.

“Savers who have not reviewed their existing rate would be wise to do, as well as taking time to compare the latest deals on the market and sign up to rate alerts for any table-topping rates.”

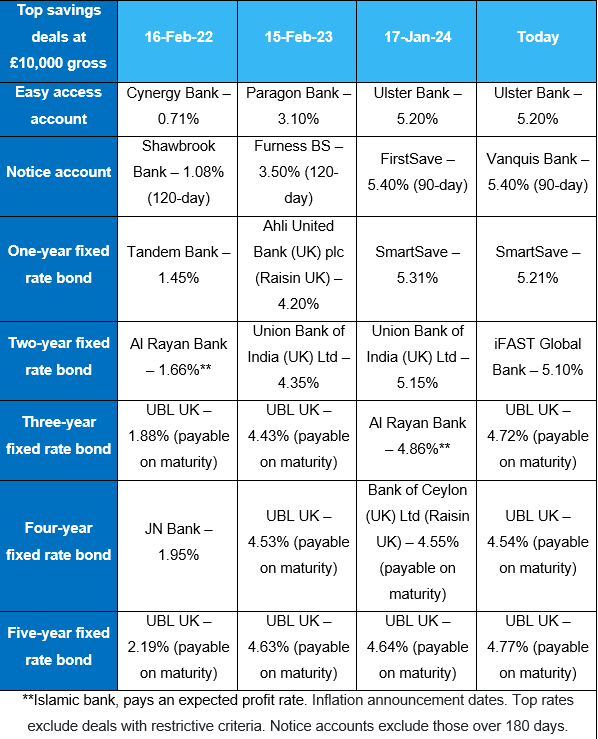

So where to find the top rates?

The highest rate available today is 5.40% offered by Vanquis Bank on its 90-day notice accounts. It is followed by SmartSave, which pays 5.21% on a one-year fixed term basis, and the easy-access account by Ulster Bank came third with a yield of 5.20%.

“Challenger banks sit towards the top end of the fixed savings market,” said Springall, “while the convenience of putting cash in an easy access account with the biggest high street banks comes at a cost, as they pay much less than the top easy access accounts, which pay around 5%.”

Savings market analysis

Source: Moneyfactscompare.co.uk

The ISA market remains some percentage points behind, with Virgin Money offering 5.25% on a one-year fixed account and Moneybox 5.09% (including a bonus) on its easy-access ISA.

Virgin Money’s account was selected by Moneyfactscompare’s Caitlyn Eastell as her pick of the week, as the rate was increased, “taking a prominent position in the market when compared against bonds of a similar term”.

Earlier access is not permitted for the account, but further additions can be made while the issue remains open.

ISA market analysis

Source: Moneyfactscompare.co.uk

While cash is still king for Brits, they shouldn’t prioritise it over investments, said Emma Prince, financial planner at Quilter.

“In the same way that banks are quick to pass on rate hikes when it comes to interest on borrowing, they will be equally quick to claw back interest paid on cash savings. As such, if the Bank of England does begin to cut rates, savers will notice a rapid fall in any returns they may be getting,” she said.

“Increasing financial resilience by building cash savings, paying down debts and making overpayments on mortgages are among the top financial priorities for Brits this year, but it is key that people do not overlook the benefits of investing for the longer term.”