A fortnight’s four-star holiday in the Mediterranean, three long weekends in the UK, a budget of £1,500 a year for clothing and footwear, and £1,000 of gifts to family members – to afford this lifestyle, pensioners will need almost £100,000 more in retirement savings going forward, compared to just last year.

These benefits are what defines a ‘comfortable’ retirement according to the Pensions and Lifetime Savings Association, which has released its latest Retirement Living Standards research today.

Based on the new data, the pension pot needed for living ‘comfortably’ in retirement has grown from £645,000 to £738,000 – that’s a 14.4% increase in a single year, according to calculations from Quilter.

How about being able to afford £74 a week on food, two weeks in Europe and one long weekend in the UK every year, plus gifting £1,000 to family? That’s a ‘moderate’ retirement, which has become even more expensive, going up from £301,000 in 2023 to £459,000 today, a 52.5% increase.

The main culprit? Inflation, said Tom Selby, director of public policy at AJ Bell.

“It was inevitable the surge in inflation we have seen over the last two years would filter through to Brits’ living standards in retirement, but these figures are nonetheless eye-watering,” he said.

“A ‘moderate’ standard of living in retirement now costs a single person £8,000 more than it did in 2022-23, with this increase driven in part by higher food, energy and motoring costs.”

But inflation is only half of the story.

Jon Greer, head of retirement policy at Quilter, said: “The massive annual leaps in the amount needed to achieve the three levels of retirement standards don’t just reflect the impact of higher food and energy costs,” he said.

“These changes have impacted those on a moderate and lower expenditure level to a greater extent, but the latest update reflects some key changes to the composition and expectations on what should be included from income.”

The report has taken into account people’s expectations from their retirement, which have changed after the pandemic and during the cost-of-living crisis. Pensioners now attach greater importance to helping family members financially and want to enjoy more activities outside of the home, like eating out and holidays, compared to the pre-Covid era.

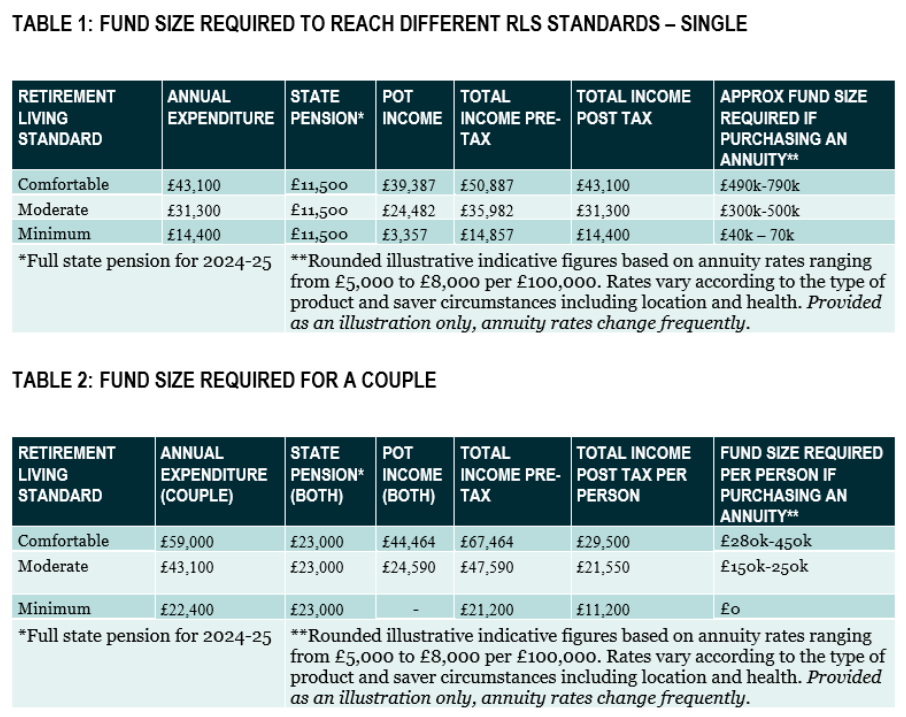

Source: PLSA

Crucially, none of these calculations include housing costs, even though up to 3.6 million retired households could be renting by 2041 (1.9 million more than today), according to the Pensions Policy Institute (PPI).

“The major worry is that these figures are all based on the assumption that the pensioner does not have any housing costs on top of any lifestyle costs,” Greer said.

“For future generations that have not been able to secure a home and are renting in retirement or perhaps are still paying off marathon mortgages, this is going to eat further into someone’s pension pot.”

When people retire, Selby stressed the importance of making the right choice between annuities and drawdowns.

“Drawdown offers you total flexibility over how you access your fund from age 55 (rising to age 57 in 2028), meaning you can create a withdrawal plan that suits your needs and lifestyle. Because your fund remains invested until needed, there is the potential to benefit from long-term investment growth,” he explained.

“Buying an annuity, on the other hand, takes investment risk off the table, provides income security and means you don’t have to engage with your pension. The main downside of annuities is you forgo the potential to benefit from long-term investment growth or vary your income as your circumstances change.”