ISA millionaires make ample use of investment trusts, have well-diversified portfolios (rather than making risky bets), invest more than a third of their ISAs in direct equities, and hold less cash than other investors, according to data from interactive investor (ii).

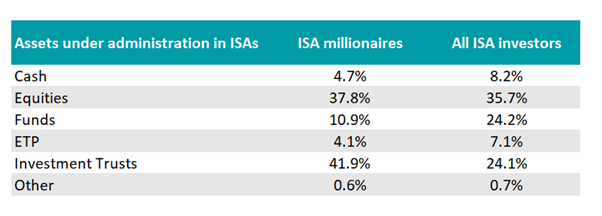

Investment trusts comprise 42% of the average ISA millionaire’s portfolio, compared with 24% for the broader cohort of ISA investors using ii’s platform.

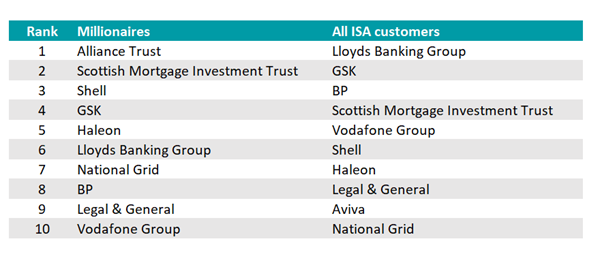

This is reflected by the most popular assets among ISA millionaires, for whom Alliance Trust and Scottish Mortgage are the two most-owned investments. Conversely, Lloyds Bank and GSK are the top choices among all ISA customers. On the latter list, Scottish Mortgage appears in fourth place, while Alliance Trust does not crack the top 10. Both millionaires and those with smaller ISA portfolios displayed a preference for dividend-paying blue chip stocks.

Top 10 holdings

Source: interactive investor

Alliance Trust has a £3.4bn global equity multi-manager portfolio and benefits from the manager selection might of Willis Towers Watson, an institutional investment consultant.

Scottish Mortgage is helmed by Baillie Gifford's Lawrence Burns and FE fundinfo Alpha Manager Tom Slater and is a growth-oriented portfolio. It has come under scrutiny in recent years but its long-term performance has been stellar, as the chart below shows.

Performance of trusts versus sector over 10yrs

Source: FE Analytics

Open-ended funds are less popular than their closed-ended rivals. The broad cohort of ISA investors hold a quarter (24%) of their portfolios in funds but this drops down to 11% among those with seven-figure portfolios. Millionaires keep less than 5% of their ISAs in cash compared to 8% for the average ISA saver, as the below table shows.

How ISA millionaires invest their portfolios

Source: interactive investor

The number of ISA millionaires on interactive investor’s platform has jumped to an all-time high of 1,001 (up from 852 on 31 January 2023) following a positive year for equity and bond returns. The average ii customer with a seven-figure portfolio returned 9.3% in 2023 versus an 8.3% median for lower value portfolios. The average age of an ISA millionaire using interactive investor’s platform is 74.

Myron Jobson, senior personal finance analyst at ii, said: “Time, patience and the magic of compounding returns are the not-so-secret strategy to becoming an ISA millionaire. Admittedly, you’d need to be able to afford to invest significant sums, but the principal of patience and diligence is also enriching for those investing more modest amounts.”

There are almost twice as many male ISA millionaires as female – a 65%/35% gender split. Women hold more investment trusts (43.6%) and significantly fewer stocks and shares (34.1%) than men (40% in investment trusts and 40.5% in direct equities). Male millionaires trade more often, logging 26.6 trades a year compared to 14 for women.

ISA millionaires are early birds, investing 40% of their ISA allowances in April 2023 alone, giving their money as much time as possible to generate returns.

Jobson pointed out, however, that “another good option is to drip feed your investments on a monthly basis to remove some of the risk of market timing, and it is also well suited to those with smaller sums to invest”.