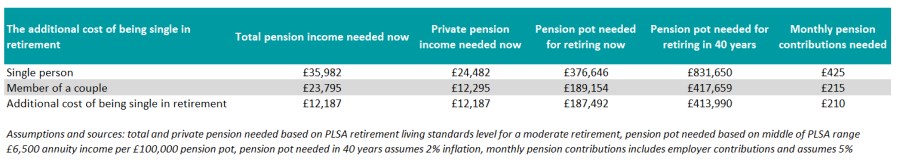

Single people need £187,000 more in their pension pot than those in a couple to afford moderately comfortable living conditions once their career comes to an end, according to data from interactive investor based on the latest Pensions and Lifetime Savings Association retirement living standards.

The firm also found that this gap will have grown into a £410,000 chasm in 40 years.

Alice Guy, head of pensions and savings at interactive investor, highlighted that the cost of being single is often underestimated and can be a double whammy.

She said: “The problem is that many of our living costs are fixed and don’t vary much with household size. Running a car or owning a dog costs the same whether you’re a couple or a single person.”

Therefore, singles have to build a bigger pension pot than individuals living in a couple to enjoy the same standards of living in retirement.

With a higher bar to secure moderately comfortable living conditions in their old age, single people are often poorer in retirement. Previous research from ii found that single people expect a retirement income of £18,000 on average, which compares to £19,000 for those cohabiting and £25,000 for those who are married.

Source: ii

Tips for building up retirement wealth as a single person

As singles will need to build a larger pension pots to retire, Guy suggested they make sure to join their workplace pension and pay in more than the minimum contribution levels.

Singles may also should check their pension savings at least once a year to ensure they are on track for the retirement they want, which can be done with the help of tools such as an online pension calculator.

Guy also urged singles to think ahead about their retirement plans as they may affect the pension savings required.

She said: “Many of us want to retire earlier than the state pension age and may need to use private pension savings to bridge the gap until we reach the state pension age.”

Another tip Guy gave to singles is to check their state pension forecast to see if they have a full entitlement. She added: “If you have gaps in your national insurance record, it may be worth paying voluntary contributions to increase your state pension, depending on your circumstances. Check the government website for more details.”

Couples also have to prepare for the unexpected

Married individuals also have to prepare for the possibility of unexpectedly becoming single. This may come as a result of a divorce or a death.

Guy said: “Even if you’re part of a couple, it’s worth building your own pension wealth and not completely relying on your partner, not least because your circumstances could change.”

For that reason, Guy urged couples to plan ahead and to ensure the widow will have enough to survive on their own when one of the spouses passes away.

For instance, they might want to fill in a form with their pension provider to specify what they want to happen with their pension pot after they die, as it can be passed on completely free from inheritance tax to the surviving spouse.

Guy also reminded that many final salary pensions only pay out half the amount to a surviving spouse.

Moreover, most people will receive only one state pension even if their spouse passes away. There are, however, exceptions for older couples who retired before April 2016.