There has been a notable decrease in average savings rates, with fixed rate bonds and ISAs undergoing the most substantial monthly rate cuts in almost 15 years, the latest Moneyfacts UK Savings Trends Treasury Report shows.

This trend marks a significant shift in the savings landscape, impacting a wide range of financial products, after the Bank of England paused its interest rate-hiking cycle and the market started to eye the prospect of rate cuts somewhere down the line.

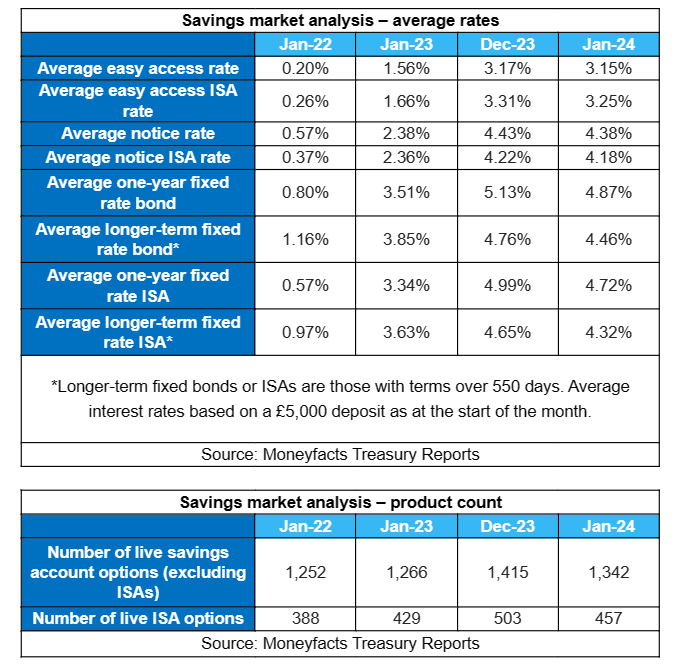

The report noted a consecutive monthly fall in the average easy access rate to 3.15%. Similarly, the average notice rate has decreased to 4.38%, marking its first month-on-month decline since February 2022.

The best easy access rate currently on the market (based on a £25,000 lump sum), according to Moneyfacts, is Ulster Bank’s Loyalty Saver at 5.2%. Savers willing to give up to 90-days notice, however, can find rates as high as 5.4% from FirstSave.

Meanwhile, the average one-year fixed bond rate fell for the third consecutive month to 4.87%, dipping below 5% for the first time since July 2023. This represents the largest month-on-month fall since February 2009.

Al Rayan Bank has the highest-paying offering here, with its 12-Month Fixed Term Deposit product paying an expected rate of 5.3%.

The average longer-term fixed bond also decreased for the fourth consecutive month to 4.46%, another largest month-on-month fall since February 2009. Isbank Raisin UK pays the best five-year rate, at 4.5%.

Within ISAs, the average easy access ISA rate dropped month-on-month to 3.25% and the average notice ISA rate fell to 4.18%. The Moneybox Cash ISA currently has an easy access rate of 5.09% while Chorley Building Society’s 150 Day Notice Cash ISA is paying 5.05%.

The average one-year fixed ISA rate fell for the second month running to 4.72%, which is its biggest month-on-month decline since March 2009. The average longer-term fixed ISA rate also fell for a consecutive month to 4.32%, also taking its largest month-on-month decrease since March 2009.

Rachel Springall, finance expert at Moneyfacts, said: “The significant cuts seen across fixed rate bond and fixed ISA rates month-on-month are the biggest recorded in almost 15 years. This will no doubt come as a shock for savers who use these accounts to earn a guaranteed return on their hard-earned cash and have waited a couple of months to invest.”

However, she pointed out that despite these falls, average rates remain higher than at the start of 2023, offering better returns for those coming off a fixed rate and looking to reinvest.

“Longer-term fixed rates are currently returning less than one-year options on average, but with interest rates expected to fall this year, some savers may decide to fix for longer,” Springall added.

The Moneyfacts UK Savings Trends Treasury Report also showed overall product choice in the savings market decreased month-on-month to 1,799 savings deals, including ISAs.

Springall finished: “Product choice has taken a hit month-on-month, but this should not deter savers from shopping around.

“A new ISA season should bring a flurry of activity from providers, and due to the interest rate rises of 2023 and upcoming ISA reforms, they may be in more demand from savers who are close to breaching their personal savings allowance.”