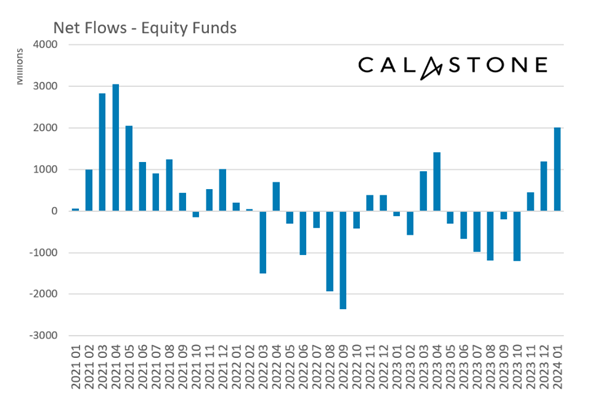

Risk appetite has returned as UK investors funnelled £2bn into equity funds in January 2024, the highest inflows since April 2021 and the eighth best month of equity inflows in nine years, according to Calastone’s Fund Flow Index.

There was particular enthusiasm for US equity funds, which raked in £1.4bn – more than half of January’s inflows – after strong performance last year. Global funds, most of which have a large US exposure, took in almost as much, with £1.1bn.

Net flows into equity funds from UK investors

Source: Calastone

Edward Glyn, Calastone’s head of global markets, said: “November and December saw growing investor confidence as inflows to equity funds returned, but January saw the bulls return in full force.

“Interest rate bulls are creating the financial weather right now. The markets are convinced that disinflation will bring rate cuts earlier and faster than previously expected, especially in the US. This has driven an equity market rally, particularly among the US tech stocks whose share priced benefit most from lower bond yields. Inflows have surged as a result.”

European equity strategies, which had their second best month on record in December 2023, continued to benefit in January, enjoying their third best month with £471m of new money added.

“Investors judge that the current weakness of the European economy is already priced in and are looking beyond to the rate cuts that must follow,” Glyn said.

Sustainable investment strategies garnered a large chunk of the US and European equity inflows. Equity funds with environmental, social and governance (ESG) strategies pulled in a record £1.6bn in January – a reversal of fortunes after aggregate outflows of £3.7bn between April and December 2023.

Glyn said that after months of negativity, it was too soon to call renewed interest in sustainability a trend. “Strong markets are good for ESG inflows, particularly if the market rally is driven by US technology companies,” he noted. “But none of the bigger questions about the sector such as the greenwashing debate have gone away.”

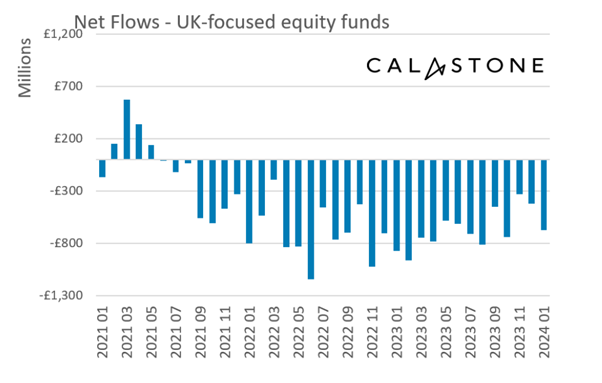

Bullish sentiment stopped short of the English Channel. UK equity funds suffered outflows of £673m in January 2024 after enduring average monthly outflows of £649m last year, as the chart below shows.

UK equity funds are still in outflow mode

Source: Calastone

Emerging market equities had an average month, pulling in £184m, which was less than half of November’s record £413m. However, investors took £211m out of Asia Pacific funds in January, as China’s economic woes spurred investors to run for the hills.

Most of last month’s equity investments were funded out of cash. Investments in money market funds – last year’s darling – slowed to a trickle in January.

Meanwhile, fixed income funds gained £367m – an acceleration compared to December, but below their long-run average.