Investors backed passive fund houses in 2023 despite a bleak year overall for the asset management industry, which suffered record net outflows, according to the closely watched Pridham Report.

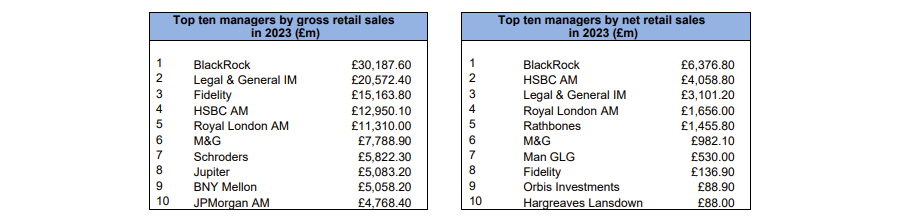

US behemoth BlackRock proved popular over the course of the year, raking in £6.4bn in new money, while gross retail sales of £30.2bn were around a third more than the next-most backed rival.

It marked the 10th year in row that the world’s largest asset manager attracted the most new business into its UK domiciled open-ended investment funds.

Legal & General Investment Management was second, with a 26% rise in gross sales compared with 2022, although it dropped to third when comparing net retail sales (inflows minus outflows).

The £3.1bn of net new money in the company sat behind HSBC Asset Management, which took in £4bn in new money last year. HSBC's gross figure of £13bn was good enough for fourth place, with Fidelity in third at £15.1bn.

Source: The Pridham Report

M&G and BNY Mellon were new entrants to the top 10 for gross new business with sales growth of 90% and 22% respectively, compared with 2022.

The former was boosted by the return to prominence of Japan, with the M&G Japan fund ranked among the best-selling retail funds of 2023, while the M&G Emerging Markets Bond fund was another top seller.

Man GLG also benefited from this trend, the report found, as strong sales of the Man GLG Japan Core Alpha fund contributed to boosting its position to join the top 10 net sales table (as shown above).

For BNY Mellon, the Multi-Asset Balanced fund garnered attention as a top choice among retail investors.

Royal London Asset Management was the top ranked active fund manager for both gross and net sales. However, investors shifted their approach.

Having previously topped the charts on the back of the success of its environmental, social and governance (ESG) range, last year inflows were driven by its short dated fixed income and money market funds.

Indeed, investor enthusiasm for sustainable investments waned across the board, with ESG funds recording their first year of net withdrawals.

Anna Pridham, editor of the report, noted: “Gross sales show that established groups like Schroders, Jupiter, BNY Mellon and JPM are attracting significant new flows. However, as mature businesses, they also contend with high levels of natural outflows and switches.”

Against a backdrop of an impending general election in the UK and ongoing economic uncertainty, the outlook for asset managers in 2024 remains uncertain, said Pridham.

“However, with the prospect of easing inflation and anticipated interest rate cuts, investors may be finally ready to deploy the record amounts of cash waiting in the wings. The fund groups with the right products stand to benefit,” she concluded.