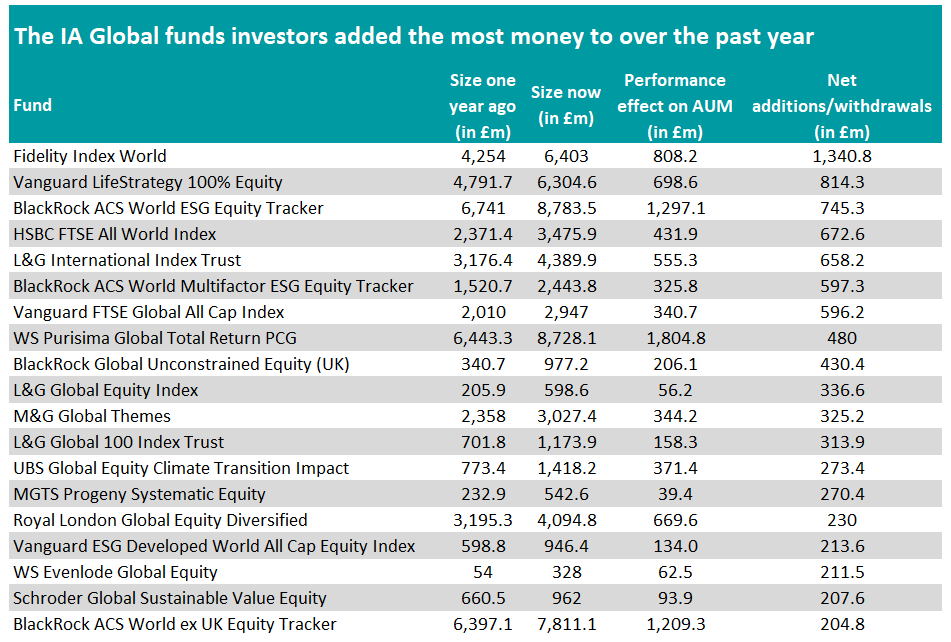

Investors showed a clear preference for passive funds for their exposure to global equities last years, as the five funds that received the most inflows were all trackers.

In this study looking into the most bought and sold funds of the year, we have focused on the portfolios where investors added to or withdrew more than £200m.

In total, there were 19 funds in the IA Global sector where investors added at least £200m over the past year, while 15 funds were hit by withdrawals in excess of £200m.

Fidelity Index World, Vanguard LifeStrategy 100% Equity, BlackRock ACS World ESG Equity Tracker, HSBC FTSE All World Index, L&G International Index Trust, BlackRock ACS World Multifactor ESG Equity Tracker and Vanguard FTSE Global All Cap Index all received net additions in excess of £500m, highlighting the dominance of passive funds in 2023.

WS Purisima Global Total Return PCG is the active fund that received the most inflows, with investors injecting £480m into it.

Other active funds to have received net additions in excess of £200m include M&G Global Themes, UBS Global Equity Climate Transition Impact, MGTS Progeny Systematic Equity, Royal London Global Equity Diversified, WS Evenlode Global Equity and Schroder Global Sustainable Value Equity.

Source: FE Analytics

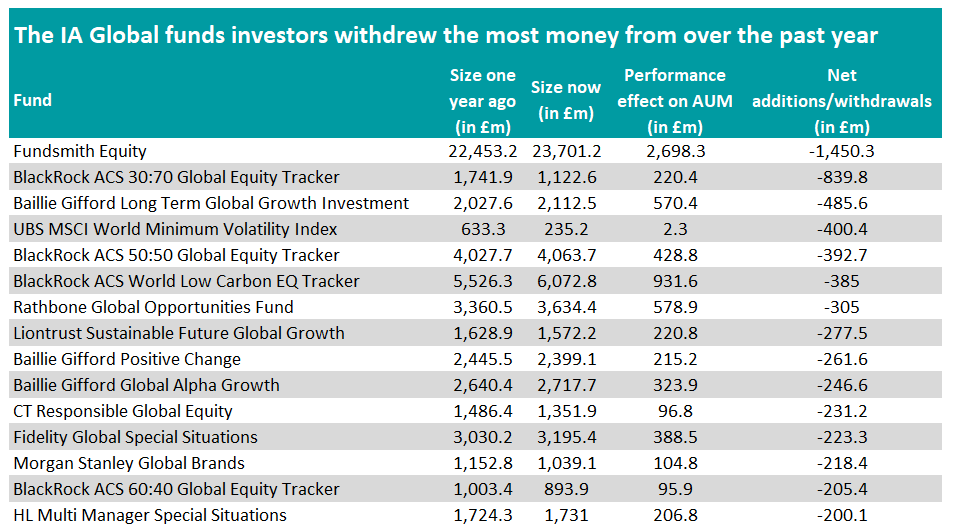

Active global funds with a growth bias were particularly hit by outflows, with investors taking out more than £200m out of three funds from the Baillie Gifford house: Baillie Gifford Long Term Global Growth Investment, Baillie Gifford Positive Change and Baillie Gifford Global Alpha Growth.

Investors also withdrew around £1.5bn out of Fundsmith Equity, the largest fund in the sector. As such, it is the fund that experienced the most outflows over the past year, but this was compensated by performance, as Fundsmith Equity made £2.7bn. As a result, the fund is now £1.2bn larger than it was one year ago.

Other active funds that lost at least £200m through withdrawals include Rathbone Global Opportunities Fund, Liontrust Sustainable Future Global Growth, CT Responsible Global Equity, Fidelity Global Special Situations, Morgan Stanley Global Brands and HL Multi Manager Special Situations.

Source: FE Analytics

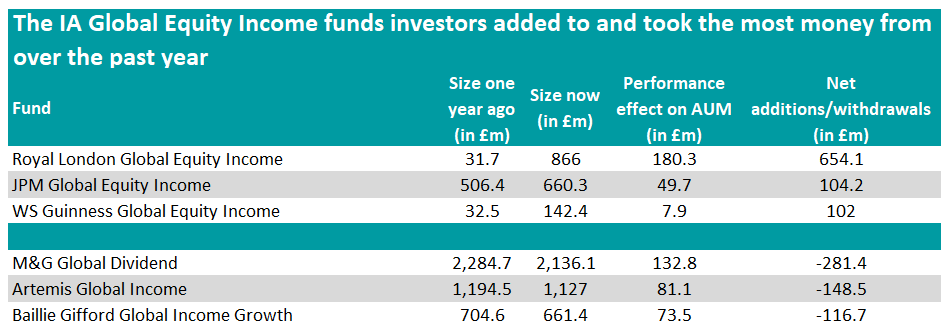

In the IA Global Equity Income sector, we looked at the funds that attracted or lost at least £100m and there were three of them in each case.

Royal London Global Equity Income received the most inflows, as investors poured £654.1m into this fund.

They also added 104.2m and 102m JPM Global Equity Income and WS Guinness Global Equity Income respectively.

Source: FE Analytics

The other way around, investors withdrew £281.4m out of M&G Global Dividend, which shrank £148.6m in size as a result.

Finally, both Artemis Global Income and Baillie Gifford Global Income Growth also had to deal with withdrawals in excess of £100m.