US, European and Japanese equities all had their moments in the sun last year, backed by themes such as artificial intelligence, a luxury boom and corporate reforms.

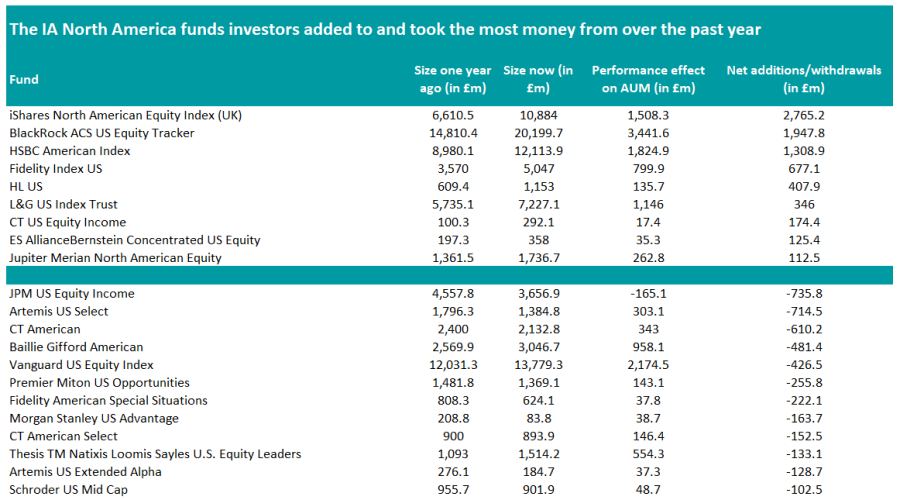

In the below study, we have looked into the most bought and sold funds of the year in the IA North America, IA European Excluding UK, IA Japan and IA Emerging Markets sectors in 2023. We have focused specifically on funds where investors added or withdrew at least £100m.

Within the IA North America sector – one in which active funds tend to struggle to beat their benchmark - investors favoured passive funds, with iShares North American Equity Index (UK), BlackRock ACS US Equity Tracker and HSBC American Index attracting more than £1bn of inflows.

CT US Equity Income, ES AllianceBernstein Concentrated US Equity and Jupiter Merian North American Equity were the only active funds in which investors poured more than £100m last year, but none received more than £200m.

Source: FE Analytics

Active funds JPM US Equity Income, Artemis US Select and CT American were the most affected by outflows, as they shed more than £500m in assets under management (AUM).

There was also no stylistic preference from investors, as they withdrew money from both growth strategies such as Baillie Gifford American and neutral funds such as Fidelity American Special Situations.

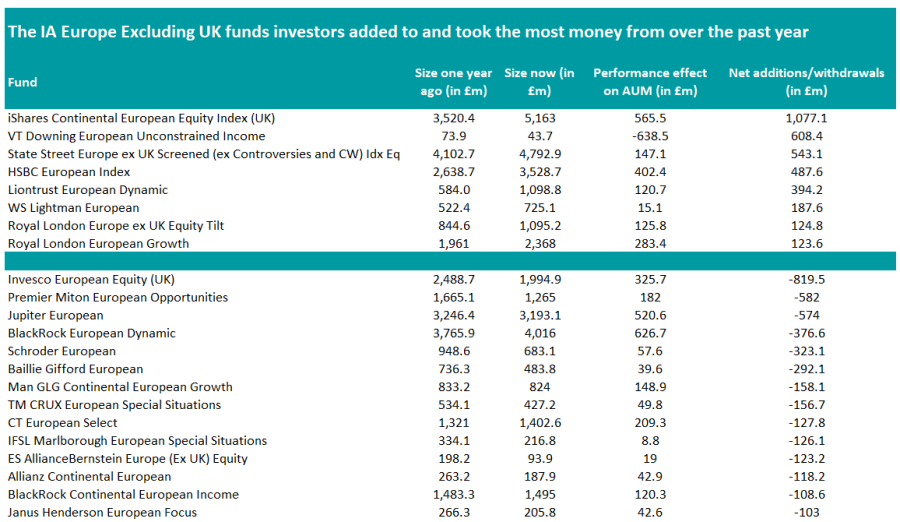

In the IA Europe Excluding UK sector, investors also favoured index funds, but a few active portfolios also managed to attract more than £100m of inflows, including VT Downing European Unconstrained Income, Liontrust European Dynamic, WS Lightman European and Royal London European Growth.

Source: FE Analytics

Yet, all the funds that shed more than £100m in AUM were active, with Invesco European Equity (UK), Premier Miton European Opportunities and Jupiter European losing more than £500m.

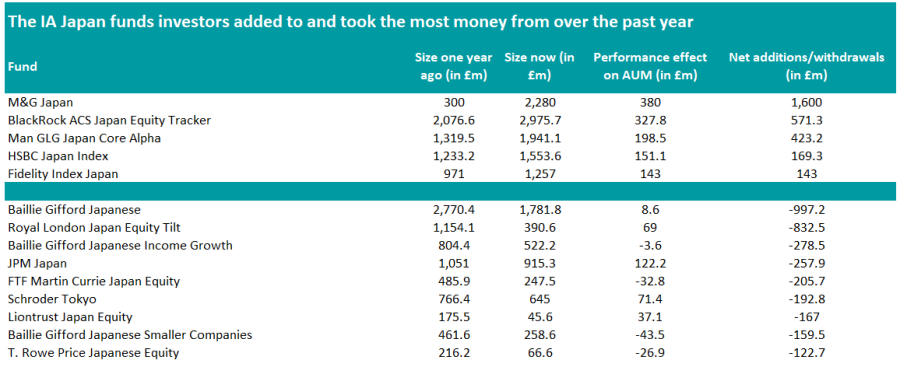

In Japan, investors favoured active funds, with M&G Japan getting almost ¥300bn (£1.6bn) from investors and Man GLG Japan Core Alpha £423.2m.

However, investors shunned portfolios with a growth bias, with funds such as Baillie Gifford Japanese, Baillie Gifford Japanese Income Growth and JPM Japan shedding more than £100m.

Source: FE Analytics

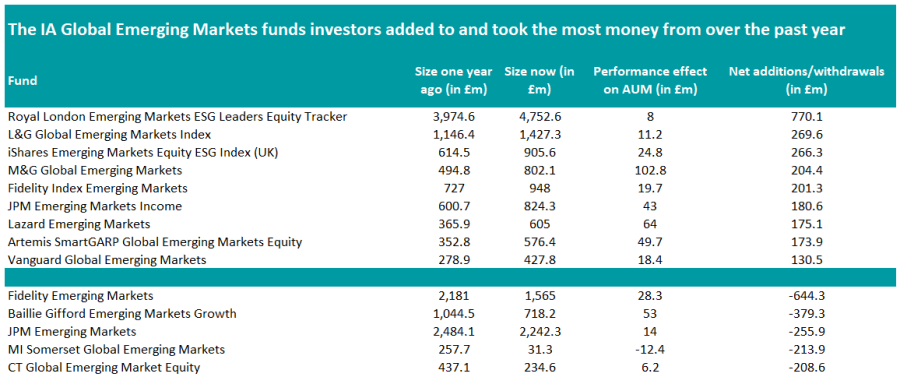

Unlike the US, Europe and Japan, emerging markets had a difficult 2023. The MSCI Emerging Markets index has not only lagged the MSCI World, the S&P 500, the STOXX Europe 600 and the TOPIX, but also delivered negative returns.

In terms of funds, investors have shown a preference for index trackers with an environmental, social and governance (ESG) tilt, with Royal London Emerging Markets ESG Leaders Equity Tracker and iShares Emerging Markets Equity ESG Index (UK) among the three funds in the IA Global Emerging Markets sector that received the most additions.

M&G Global Emerging Markets, JPM Emerging Markets Income, Lazard Emerging Markets, Artemis SmartGARP Global Emerging Markets Equity and Vanguard Global Emerging Markets were the active funds in which investors poured more than £100m last year.

Source: FE Analytics

Fidelity Emerging Markets is the emerging markets fund that shed the most, with investors taking out £644.3m out of it over the course of 2023.