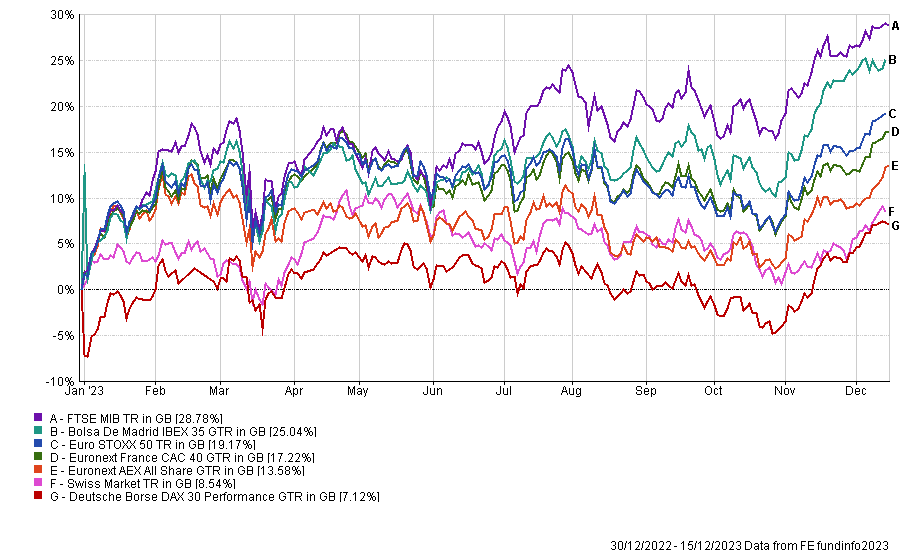

Few were expecting a strong performance from European equities at the beginning of the year, with a war on the European continent and severe energy supply issues.

Arguably, it has not been as bad as predicted, with several European indices, including the Spanish IBEX 35 and Italian FTSE MIB outperforming the MSCI World and the US S&P 500 year-to-date.

Some European stocks even had their moment in the sun in 2023. For instance, the European luxury sector surprised on the upside in the first half of the year, with companies such as LVMH and Hermes International benefiting from China’s reopening.

Danish healthcare company Novo-Nordisk shone in the second half of the year with its weight loss drug Wegovy, leading to a strong re-rating of the company’s shares.

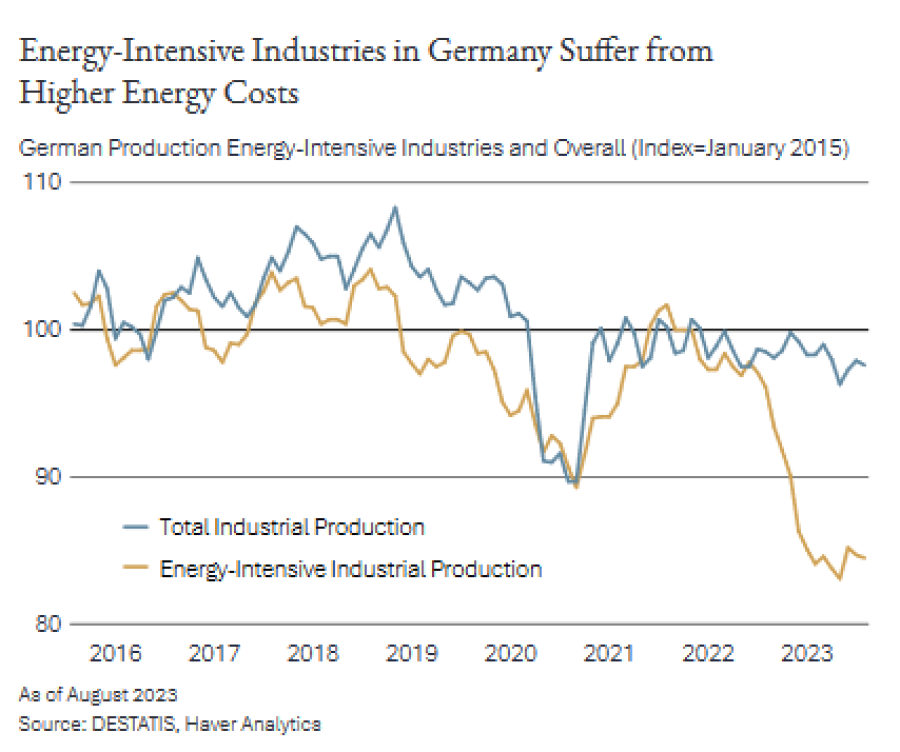

On the negative side, Germany fell into a technical recession in the first quarter of 2023, while its purchasing managers’ index has been falling for six consecutive months, according to S&P Global. As a result, the DAX has been one of the weakest European indices year-to-date.

Performance of indices YTD

Source: FE Analytics

Moreover, the energy crisis in Europe is not solved. While Europe has made progress in reducing its dependence on Russian energy, the process is likely to take several years.

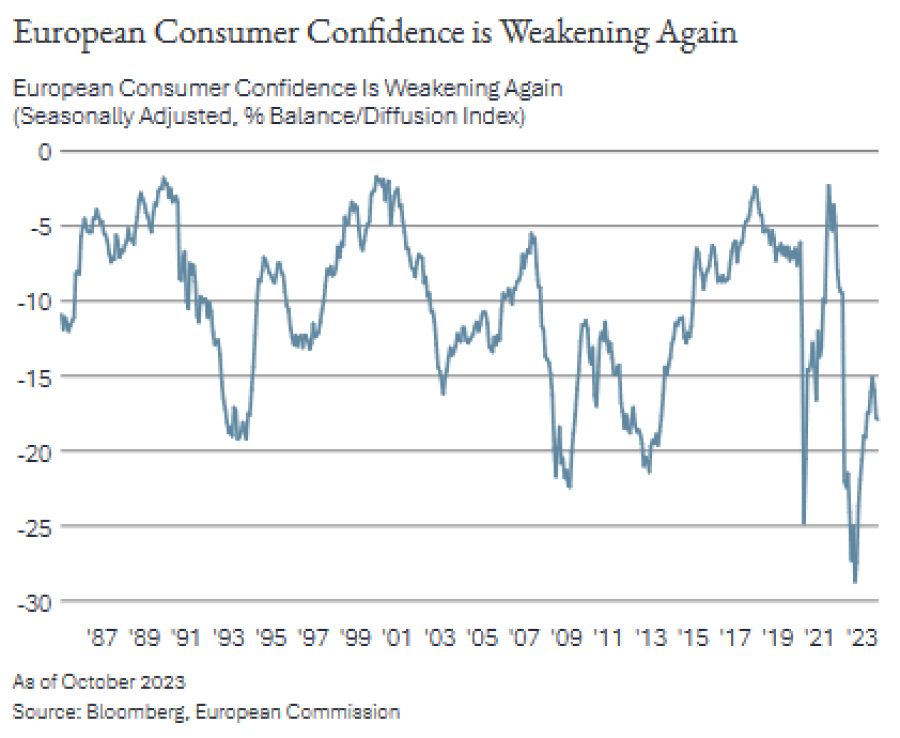

Sam Morse, portfolio manager of the Fidelity European fund and Fidelity European Trust, said: “Consumer spending, the main component of GDP in the West, held up remarkably well in 2023, buoyed by pandemic savings, a robust stock market and higher interest rates on deposits, but investors sense that the outlook is less rosy.”

Indeed, Ronald Temple, chief market strategist at Lazard, anticipates a recession in the Eurozone as a whole next year.

He said: “The absence of fiscal stimulus comparable to the United States, impacts from the Ukraine-driven energy price shock and ECB interest rate hikes are placing the Eurozone economy on the brink of recession.

“I estimate the likelihood of a recession in the Eurozone at about 50% over the next 12 to 18 months, although it is potentially already underway given the GDP reading of -0.1% quarter-over-quarter in the third quarter of 2023.”

While Temple believes that the ECB is done with its rate hike cycle, he does not expect any rate cuts until the second half of 2024 due to the single price stability mandate that restricts easing rates to boost employment.

Another concern is real wage resistance – the ability for workers to bid up wages and for firms to protect margins, creating, thus, an inflationary spiral – which is a bigger issue in Europe than in the US.

As a result, Zehrid Osmani, manager of FTGF Martin Currie Global Long Term Unconstrained, is concerned about the prospects of stagflation – an environment of slow economic growth and high inflation, coupled with high unemployment.

He said: “Wage inflation could fuel structural inflation, which, whilst easing in some geographies, remains elevated.

“Deglobalisation and technological fragmentation are leading to diseconomies of scale, so it is important for investors to focus on companies that can benefit from such trends, or that can limit any negative effects.”

Due to the uncertainties ahead, managers have been positioning their portfolio cautiously.

For example, Morse is wary of companies that have historically demonstrated limited pricing power and are, therefore, more exposed to margin pressure. Instead, he’s been increasing his exposure to companies with superior pricing power and balance sheets, which should be more resilient in a weaker economic backdrop.

Osmani also called for investors to focus on companies with resilient earnings that can resist downward revisions or that can surprise positively, notably if supported by exposure to structural growth drivers such as the energy transition, the ageing population and artificial intelligence (AI).

Mark Nichols and Mark Heslop, both European equities fund managers at Jupiter Asset Management, highlighted ASML, VAT Vakuumventile and ASM International as European winners of the AI theme.

ASML produces lithography machines used in chip production, while VAT Vakuumventile makes vacuum valves employed in chip manufacturing and ASM International specialises in wafer processing equipment that should benefit from increasing chip complexity.

They also named Kingspan, which makes insulation products that reduce building emissions, and Carel Industries, which produces heating and cooling components, as beneficiaries of the green economy.

Finally, Oliver Collin, co-head of European Equities at Invesco, stressed that European equities are trading on attractive valuations compared to other regions, while Europe is one of the few equity markets to still be attractively priced relative to bonds.

He is seeing “exciting opportunities” in businesses that have been overlooked by investors and mis-priced by the market, but have the potential to produce the “greatest returns”.

“Cyclical, non-consumer facing sectors such as industrials, where earnings expectations are already at recessionary lows, are interesting. Traditionally defensive areas such as large-cap pharmaceuticals are attractive given the growth potential from research and development,” Collin said.

“Energy names continue to benefit from high oil and significant cash generation. Higher interest rates are relatively supportive for capital-intensive sectors and banks.”

Is it time to dive in European small-caps?

Buying small-caps ahead of a recession is certainly a questionable decision, as smaller companies tend to be more sensitive to economic cycles. Historically, small-caps have grown more than the global GDP during economic expansions but contracted more in periods of economic weakness.

Yet, Ollie Beckett, manager of the Janus Henderson European Smaller Companies fund and The European Smaller Companies Trust, noted that European small-caps have already fallen at the lower end of their historic range, trading below 12x P/E.

European small-caps are also trading at a 5% discount to their large-cap peers instead of the more typical 16% premium.

Performance of indices over 3yrs

Source: FE Analytics

Beckett said: “When we encounter such extreme valuations at either the stock or asset class level, we question whether it signals a structural change or is merely cyclical. Our analysis leads us to believe that it is primarily cyclical.

“Small-caps are likely to continue benefiting from GDP growth due to their inherent characteristics of being less mature and having room to expand as well as having more exposure to cyclical sectors such as consumer discretionary and industrials.

“While interest rates may rise during this cycle, small-caps do not possess excessive leverage and can still access debt markets. Although financing costs will increase, it is unlikely to reach a level that significantly hampers returns, considering previous periods with similar interest rate levels in the mid-2000s.”

Philipp Schweneke, co-head European Equities at DWS, also likes European small-caps, but for their “solid” balance sheets and earnings growth higher than that of blue chips, rather than as a recovery play.

He also highlighted that many European smaller companies are market leaders in their niches and are characterised by high rates of innovation. Also, shareholders may benefit from corporate takeovers, which generate share price premiums, although Schweneke noted that M&A activity is currently very weak in Europe.

Beckett anticipates a return of M&A activity in 2024, with cash-rich private equity firms seeking attractive valuations for investment. However, he believes that it will mostly be concentrated in the UK rather than in continental Europe, as persistent capital outflow from UK pension funds and wealth managers have removed any sense of valuation support.