Japan will be the standout market of 2024, but the times they are a-changin’ in the majority of sectors covered by Fidelity International analysts, where recession fears have given way to optimism.

Fidelity’s annual analyst survey released today found that for the first time since the pandemic, more analysts expect companies’ cost inflation to fall in the year ahead. Companies now feel sufficiently confident to plan for future growth.

Gita Bal, global head of fixed income research, said in North America “no one talks about inflation anymore”.

“Labour wages were the last sticky aspect, but these seem to be normalising quickly as well,” she said. “Meetings with management teams have been surprisingly positive on the 2024 outlook, despite immediate geopolitical risks on the horizon.”

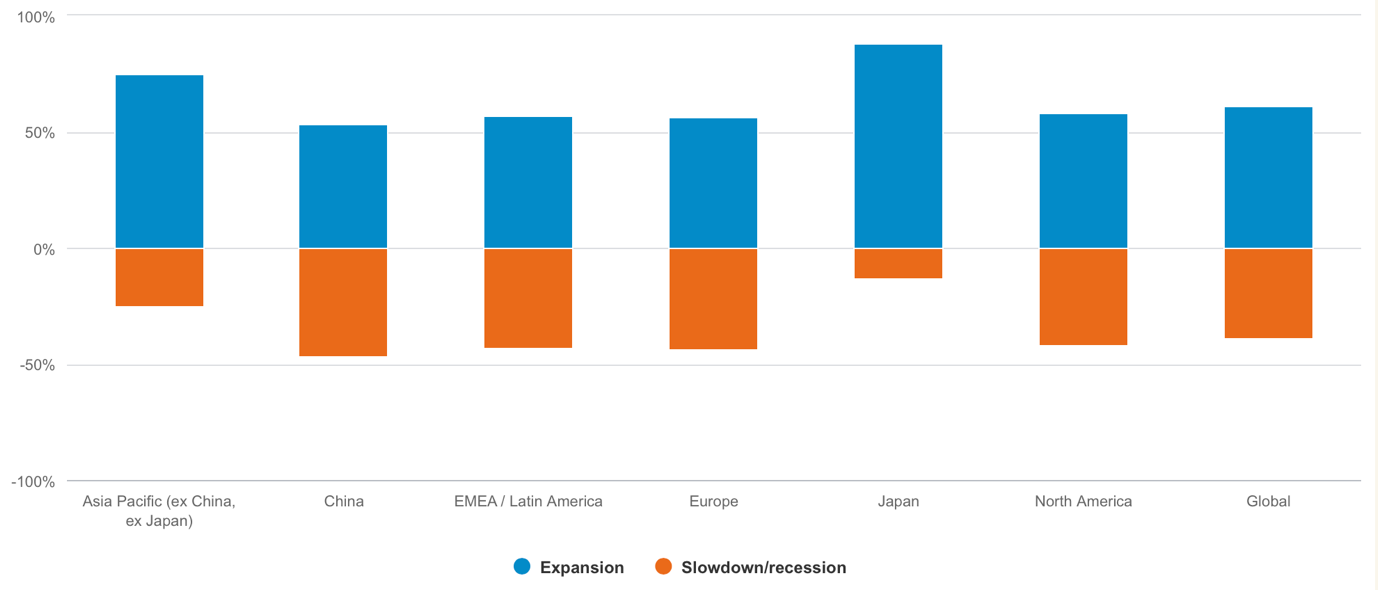

Optimism was widespread, with 61% of analysts expecting their sector to be in expansion mode in the next 12 months.

That went up to 88% for Japan, where expectations for revenue and earnings growth were higher than for any other region, as shown in the chart below.

Expansion or slowdown expectations per geography in the next 12 months  Source: Fidelity

Source: Fidelity

Japan was ahead in terms of expected capital expenditure, returns on capital, dividend increases and companies’ ability to pass on costs to consumers. According to the report, the country is set to become “the world’s economic bright spot in 2024”.

Bal explained: “The Japanese economy has finally emerged from more than two decades of recessions and stagnation, with encouraging signs of broad-based price increases.

While inflation has been a big headache for much of the world over the last few years, it’s a good problem to have in Japan right now.”

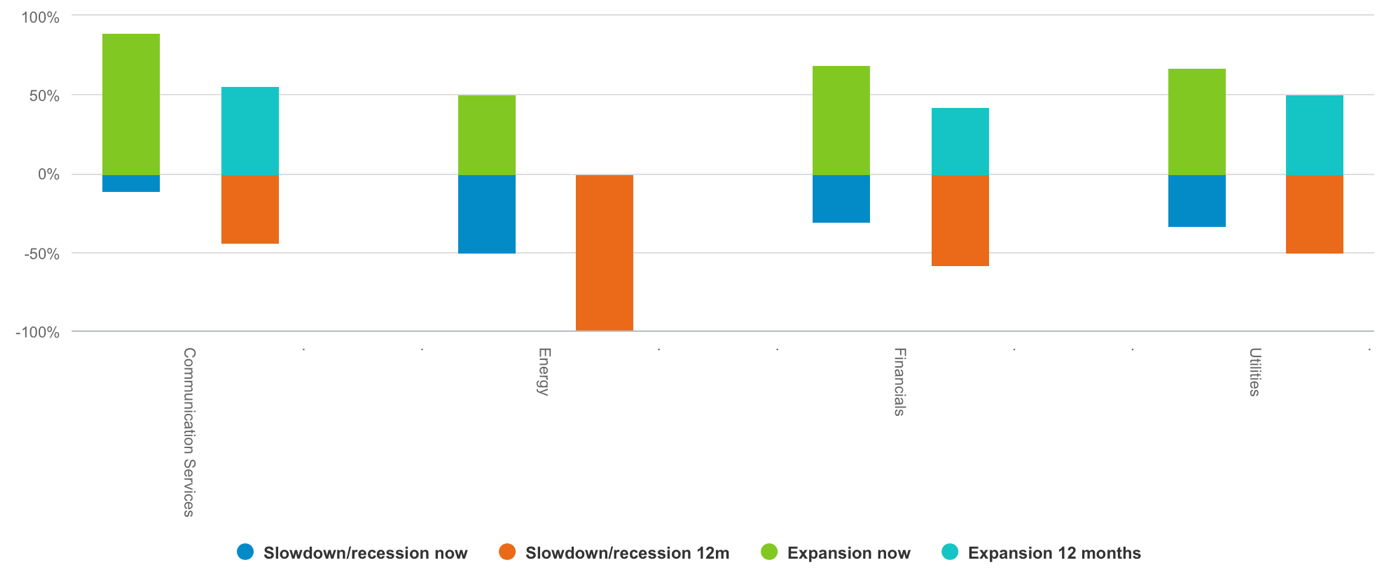

The tide of improving economic conditions will not raise all boats, however. As the year goes on, lower commodity prices may become a headwind for North American and European oil and gas companies, while the retreat in interest rates will hinder growth for the financial services sector.

Sectors under threat Source: Fidelity

Source: Fidelity

Meanwhile, corporate managers seem to be overlooking an obvious risk – the disruption that might emerge from global elections. Two thirds (65%) of Fidelity analysts reported that managers are not talking about elections at all and only 28% said that the current geopolitical backdrop is affecting investment plans of the companies they cover.