Pictet Asset Management has upgraded global equities to overweight and taken a more bullish stance on information technology while reducing cash to underweight.

The move is conceived as a short-term allocation shift to make the most out of the present economic resilience, said Pictet’s chief strategist Luca Paolini, who said equities will continue to look attractive as long as the Goldilocks scenario holds, or interest rate hikes don’t crash the economy.

“Much like Goldilocks’ porridge won’t stay the perfect temperature forever, we believe the global economy will eventually start to cool and bonds will regain the upper hand over equities,” he said.

“Indeed, our global leading indicator of business activity points to a likely slowdown going into the second half of the year, with survey data around the US economy increasingly gloomy and anaemic growth in the Eurozone.”

But a slowdown will only come through in the second quarter of this year, according to Paolini and his team, when lower levels of liquidity will make “stretched equity valuations” look unsustainable.

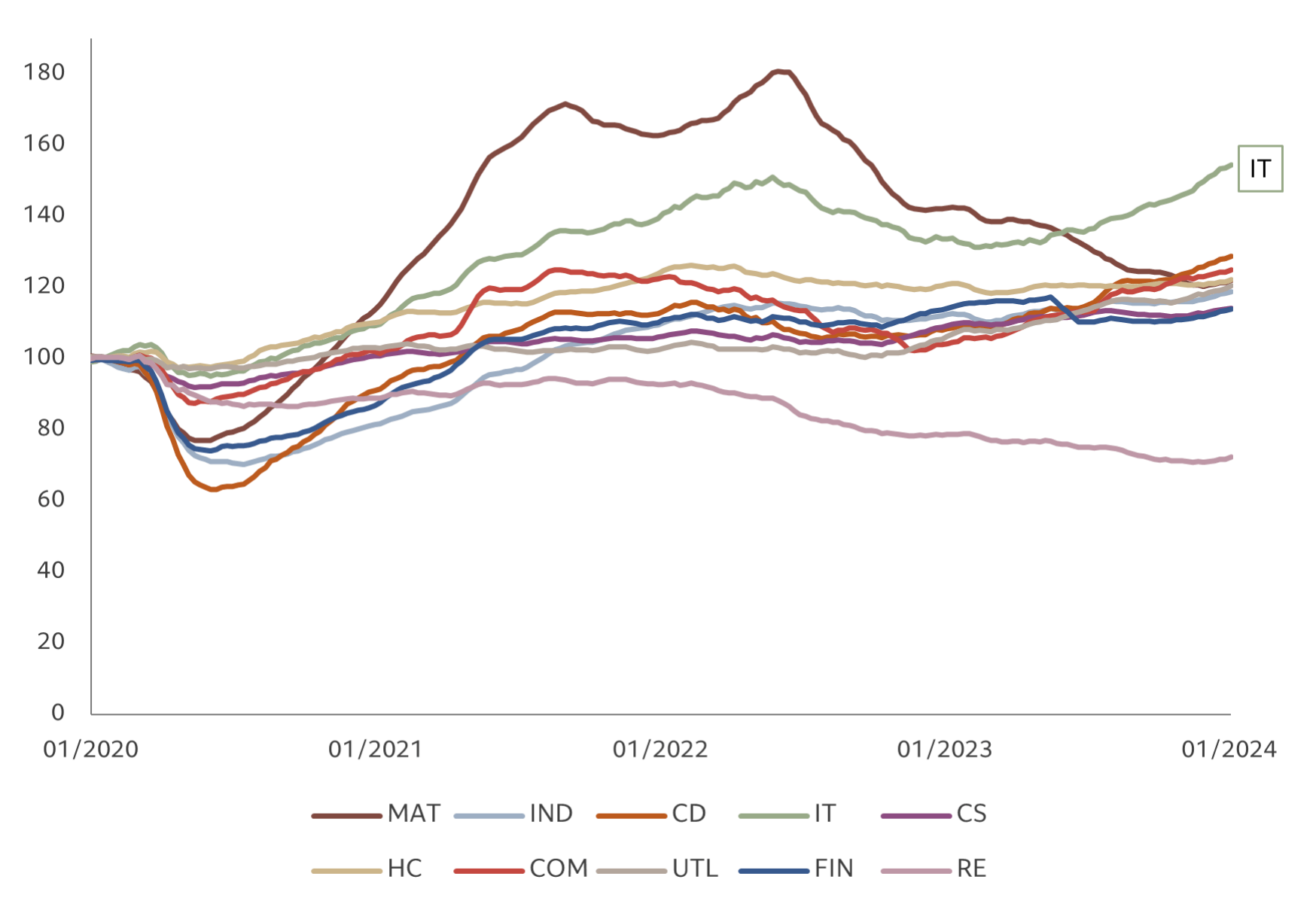

Until then, information technology will continue to lead the pack and equities offer “the strongest earnings growth estimates at a time when revisions are positive for both 2023 and 2024”, he said.

“Growth opportunities for companies operating in the tech sector, particularly those generated by advances in artificial intelligence (AI), justify IT’s lofty valuation,” added Paolini, who was also positive on communication services stocks, which offer exposure to the AI theme at more reasonable valuations.

MSCI World index sectors 12-month EPS estimates (rebased to 100 pre-Covid)

Source: MSCI, IBES, Refinitiv, Pictet.

Sentiment at Pictet has warmed a little towards the US, with its stance upgraded to neutral and the 2024 earnings growth forecasts raised from 2.5% to 4.3%.

This wasn’t enough to move the US to overweight, as Pictet still has concerns around slowing household spending and business investment.

Instead, Paolini favoured Japan (which was also tipped by Fidelity as the world’s economic bright spot in 2024) and Switzerland, where Pictet is overweight.

“The Swiss market provides exposure to quality and defensive stocks, which we consider are important holdings in an environment of moderate global growth,” he said. “The country has the highest share of defensive stocks among major economies such as pharmaceuticals and consumer staples.”

On the other hand, the Eurozone remained neutral and energy was downgraded to neutral from overweight, with the team “no longer seeing value” in using oil stocks as a hedge trade due to geopolitical risks in the Middle East.

The switch to equities does not impact Pictet’s positive outlook for fixed income, which continues to be the area where the team remains the most constructive. Here, UK government bonds look “particularly good value”.

“The bonds are relatively cheap, not least because we consider the recent upward surprises in the UK inflation numbers to be transient. We expect inflation to start falling again in response to weakness in the economy, which is already being reflected in softening inflation expectations,” said Paolini.

“Easing price pressures will, in turn, give the Bank of England the room to start its easing cycle and cut rates before any other of the developed world’s major central banks.”

Other areas where the team remains overweight are US Treasuries and investment grade bonds, emerging market local currency debt and gold.