Tech stocks might be market’s darlings at the moment but investors should be shifting towards more unloved parts of the market such as Europe, Japan and smaller companies for the next leg of the rally, BlackRock strategists suggest.

Helen Jewell, chief investment officer for BlackRock Fundamental Equities EMEA, said equity market momentum can be maintained in the second quarter of 2024 as falling inflation in the US, Europe and the UK allow central banks to start considering interest rate cuts rather than hikes.

This would be positive for equities, although returns are likely to be more muted than during the “cheap money era” that followed the 2008 global financial crisis. The rally is also expected to broaden out from the narrow band of companies that have done well recently, but there is still expected to be a greater gap between the stock market’s winners and losers.

Jewell pointed out that US tech stocks have led the market again so far in 2024 “for good reason”, noting their strong earnings on the back of digital disruption and artificial intelligence (AI).

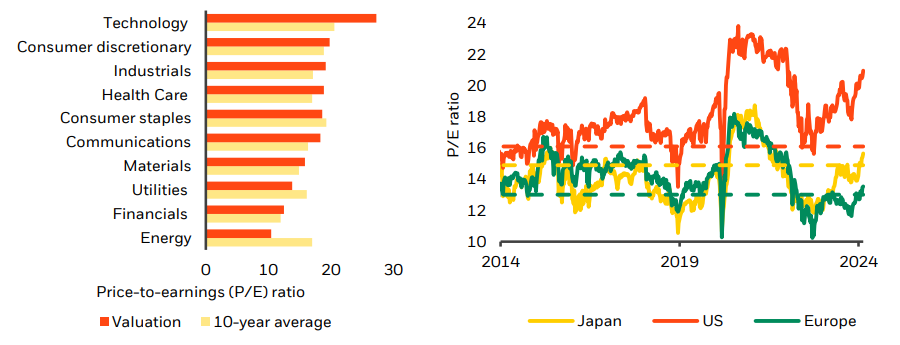

“Valuations for these companies are lofty (as the charts below show),” she added. “We believe potential rate cuts could lead momentum to broaden out to areas of the market that are cheaper and also home to quality companies with attractive long-term earnings growth potential.”

Global sector valuations (left) and regional equity market valuations (right)

Source: BlackRock Investment Institute, 7 Mar 2024

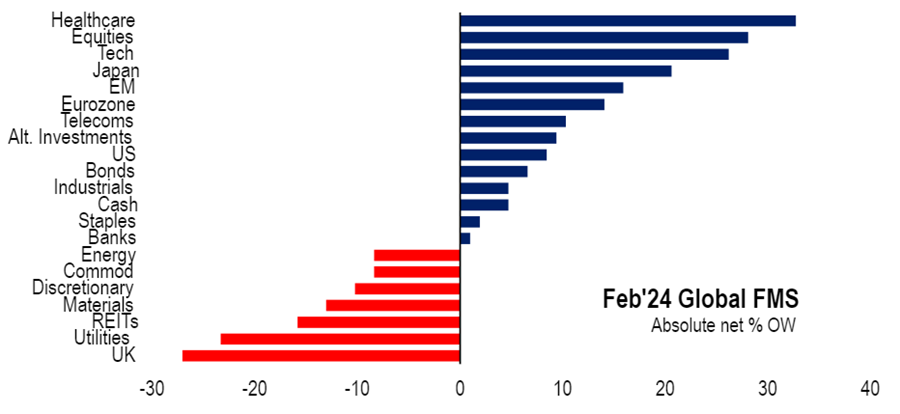

The latest edition of the Bank of America Global Fund Manager Survey showed that being long the ‘Magnificent Seven’ group of leading tech stocks is seen as the most crowded trade in the market at present, while investors are split on whether or not AI stocks are in a bubble.

BlackRock highlighted three areas of the market that it thinks will be worth watching in the months ahead, with the first being European equities. Other investors appear to agree, with Bank of America’s survey finding that fund managers have performed the biggest rotation in European stocks in almost four years over recent weeks.

“European equity markets have reached record highs this year – yet remain at a historically wide discount to US stocks,” Jewell said. “We don’t see this gap closing, due to the earnings power of some of the biggest companies in the US. Yet we see three reasons why it may narrow in the medium term.”

Firstly, the economic environment in Europe is improving with economic activity picking up and energy prices stabilising, creating a more supportive backdrop for European equities. This is bolstered by strong consumer savings and wage growth, enhancing consumer spending power.

Secondly, the potential for rate cuts by the European Central Bank, in response to inflation falling closer to its target, hints at a more favourable climate for European stocks, especially benefiting small- and medium-sized companies with higher debt levels.

Lastly, the resurgence of buybacks as companies purchase their own shares at attractive prices promises an additional return avenue for investors, particularly as some European banks are poised to return significant capital to shareholders.

Fund managers’ overweights in Mar 2024

Source: Bank of America Global Fund Manager Survey, Mar 2024

BlackRock also likes Japanese equities, which have performed strongly in 2024; the Nikkei 225 recently surpassed its 1989 high as sustained inflation returned to Japan. The fund management firm thinks this run can continue for several reasons.

“Japanese equity valuations are close to average levels from the past decade,” Jewell said. “Yet overall return on equity – which indicates company profitability and efficiency – has gone up after many years of corporate reforms. The measure remains well below the global average, so we see further room for improvement.”

Other factors supporting Japanese stocks include the combination of the Japan Exchange Group pushing companies to improve shareholder returns, the government expanding tax-free savings initiatives for investors and the Bank of Japan ending the era of negative interest rates.

In addition, corporate Japan is being boosted by ‘friend-shoring’ as international business diversify supply chains geographically by increasing their capital expenditures in the country, such as by building new factories in Japan.

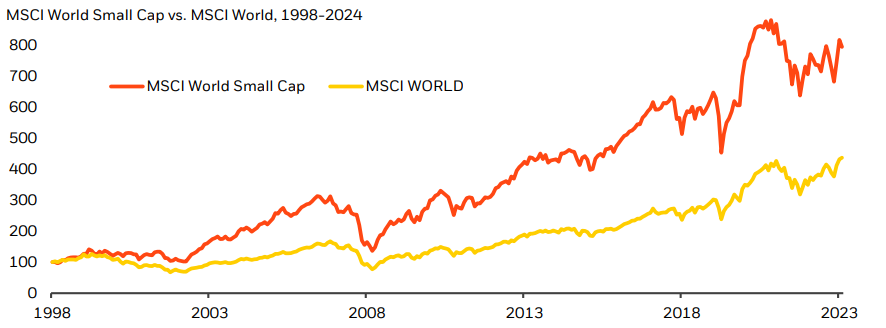

Another opportunity highlighted by BlackRock strategists is small- and medium-sized companies (SMIDs). The firm believes these companies are undervalued, as global small-caps are trading at around a 26% discount to large-cap companies versus a historical premium of around 10%.

Small-caps’ history of outperformance

Source: BlackRock, MSCI as at 31 Jan 2024

As the chart above shows, global small-caps have outperformed the broader market by an average of 2.7% per annum over the past 25 years. BlackRock argued that their recent underperformance reflects “misplaced” macroeconomic fears rather than weak company fundamentals.

“What could spur a rebound in the performance of the SMIDs?” Jewell finished.

“Inflation has been falling towards central bank target levels in many developed markets, notably the UK, and this could lead to interest rate cuts during 2024. During previous market cycles, the outperformance of SMID caps has been greatest over the first 12 months after a recession-linked equity market low.

“We believe falling inflation, lower rates and economic recovery could persuade investors to reappraise the opportunity among SMID caps at current valuations. If market leadership extends to a broader range of areas, small- and mid-sized companies stand to benefit, in our view.”