China was the biggest disappointment of 2023, with the market plummeting 32% over the past 12 months but investors considering buying the dip in the hope that it will re-rate soon should think again, because it can stay cheap for a while, according to Mobius Investment Trust manager Carlos Hardenberg.

The trust, which belongs to the IT Global Emerging Markets sector and could invest in China, chooses instead to have no direct investment in the country.

“Yes, China is cheap, but it can stay cheap for quite some time,” he said. “The tasks for the Chinese government are very difficult and will not be resolved this year or the next. It's going to be a long-term struggle.”

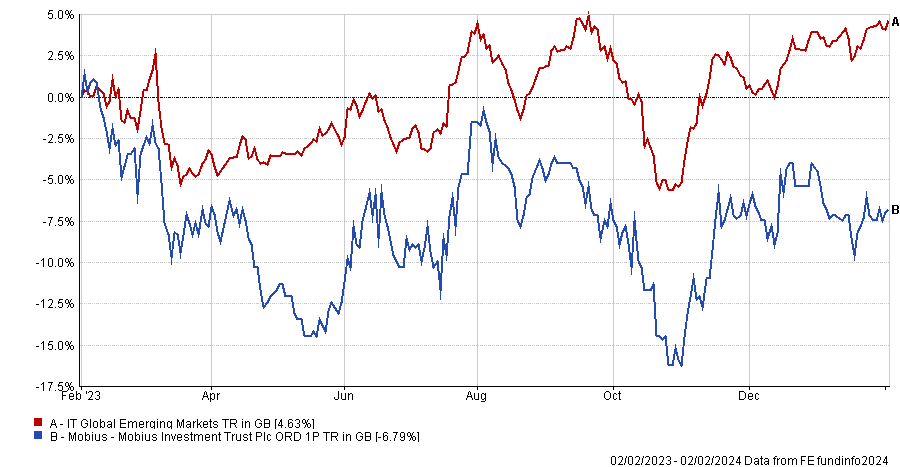

Performance of index over 1yr

Source: FE Analytics

One of the biggest problems for the country is that the economy structurally depends too much on exports as well as on fixed capital investments in order to grow. On top of that, the country needs to transition to more consumption-based economic growth, which “will not be so easily achieved”. But this is only the tip of the iceberg.

“Everything also relates to the issues with the property market. About 70% of the wealth of the middle class is tied to real estate. The Chinese need to restructure the real estate sector dramatically,” said Hardenberg.

“They also need to ensure that foreign direct investments keep coming in and invest in the new sectors where they want to become a global leader, including semiconductors, but they have a long way to go. It’s a very mixed picture”.

Hardenberg therefore avoids direct investments in the country, but he does invest in China through other Asian countries.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“We are looking at individual opportunities in China but whenever we spent time there, we always struggle with governance, very volatile management teams, poor audits with very unstable numbers and poor transparency overall,” he said.

“So predominantly, we prefer to invest via Korea and Southeast Asia. This is where you find business models or businesses that are not just strong in their own country, but also exporting to China very successfully.”

Not everyone agrees, however. Kelly Chung, investment director and head of multi-assets at Value Partners Group is one with a different point of view.

“In China, although economic data remains weak, there are early signs of stabilisation and gradual recovery, and the government continues to provide liquidity and support to the market,” she said.

“We expect the market to be bottoming out, with some funds starting to reposition for a U-shape rebound this year, and we foresee an economic recovery to start in the second quarter.”

Also on her side was Dominic Bokor-Ingram, FE fundinfo Alpha Manager of the Fiera Oaks EM Select fund, who recently spoke in favour of the biggest Asian market – despite not investing in it himself.

“China has still got some way to go in terms of emerging,” he said in an interview with Trustnet. “People are getting a bit carried away with China at the moment and there's a lot of anti-Chinese rhetoric around, probably for political reasons, but it’s still the second-largest economy in the world growing strongly at 5.5%.”