UK monthly GDP dropped 0.3% in October, falling to its lowest level since July, according to figures from the Office for National Statistics (ONS). This was below economists’ expectations of flat GDP growth.

The infamously terrible British weather was one of the reasons behind the economy’s dismal performance as it has been exceptionally wet, which may have affected construction, retail, pubs and tourism, the ONS report said.

Analysts at Investec said: “This is at best a partial explanation: most of the fall in industrial production for instance reflected a hefty drop in manufacturing output (down 1.1% on the month), where weather effects should have played no role.

“And although new work within construction fell by 1.7%, repair and maintenance posted a rise of 1.3%, despite the weather conditions.”

Weakness in the services sector, which fell 0.2%, was another important factor as it accounts for a significant portion of the UK economy.

Within services, the information and communications industry was the main detractor. The ONS attributed this weak performance to a fall in output from consumer programming, consultancy and related activities on the one hand and motion picture, video and TV production on the other.

Meanwhile, output in consumer-facing services shrank for a fourth consecutive month and is yet to revert to its pre-pandemic level.

Lindsay James, investment strategist at Quilter Investors, said: “Services in the UK has always been the strongest part of the economy, but this month it has driven the fall in GDP as a result of information and communication services struggling.

“If the UK is to avoid recession it is the services sector that is likely to prevent it, so seeing such a sharp fall on the month will be cause for concern.”

Charles Hepworth, investment director at GAM Investments, suggested that negative GDP growth may add pressure on the Bank of England (BoE) to begin to cut rates next year. However, he is still expecting the BoE to maintain interest rates at their current level tomorrow, as the UK central bank is aiming to bring inflation back to the 2% target.

Mike Riddell, head of Macro Unconstrained at Allianz Global Investors, added that this week’s data might be enough to discourage the remaining hawks at the BoE who voted for a further hike last time from doing so again.

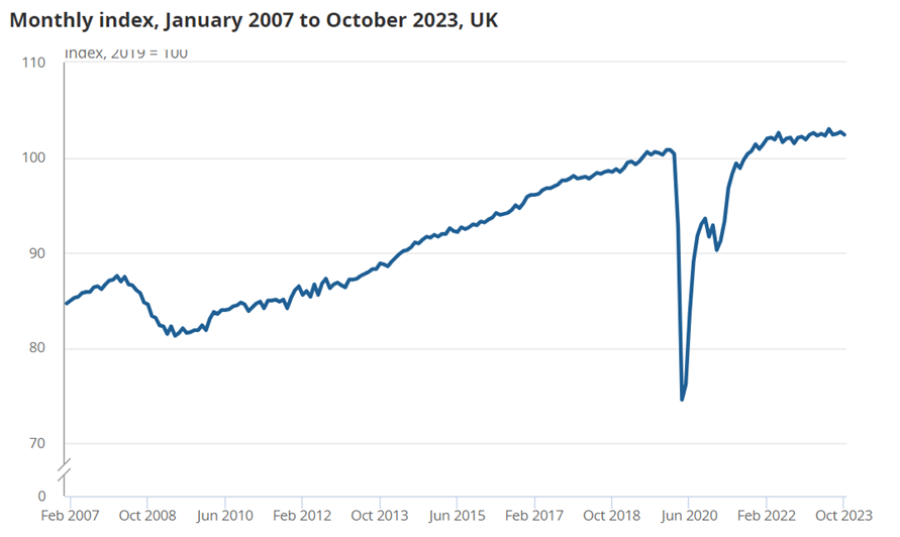

Source: ONS

Danni Hewson, head of financial analysis at AJ Bell, warned that the UK economy will be “treading water” until rate hikes can start to be unravelled, but expects that some of the factors responsible for the weak economic performance in October won’t be repeated.

She said: “Screen writers and actors have ended their walkout, which means action can resume on sets that had been dark.

“Consultants have reached a deal with the government, which could mean an end to at least some of the disruption that’s crippled the NHS. And people are finally getting to a checkout and finding their weekly shop has only gone up by a few pennies, rather than the pounds they’ve come to expect.”

She stressed, however, that real growth is likely to prove “elusive” for at least the next year, even if the UK manages to avoid a recession.