The UK may have entered a shallow, technical recession but some cyclical sectors are suffering a deep recession with a significant decline in their sales volumes. This has gone largely unnoticed by investors, however, because price increases have offset the impact of falling volumes to keep revenues more or less flat.

When the outlook for cyclical sectors improves and sales volumes increase – at a higher price point due to inflation – the boost to profits should be substantial, according to FE fundinfo Alpha Managers Henry Dixon and Jack Barrat. They manage the £1.4bn Man GLG Undervalued Assets fund, which is a top-quartile performer over one and three years.

Industries that have suffered what Dixon and Barrat describe as “a hidden volumes recession” include commodity chemicals, the semi-conductor supply chain and recruiters.

Housebuilding and related industries such as brick manufacturers and DIY retailers have also had a torrid 18 months due to higher mortgage rates depressing the housing market.

“Brick manufacturers are trading below the value of their factories, let alone below the value of the clay in the ground,” Barrat said. When interest rates start to normalise, house building will increase again, sparking demand for bricks.

The catalysts to revive some of the other cyclical sectors are not as easy to pinpoint, he continued. “It’s often hard in those darkest before the dawn moments to see the spark.”

The very fact of valuations being so depressed implies a lot of upside going forward, Barrat added. He and Dixon see this as a buying opportunity for cyclicals.

The Man GLG Undervalued Assets fund’s top 10 holdings include Grafton Group, a distributor of building materials and DIY products, and Breedon Group, whose products include concrete, mortar and roof tiles.

Corporate profitability is usually closely tied to nominal GDP with a 0.92 correlation (with a score of 1 being perfect correlation). At the end of 2023, nominal GDP in the western world was 30% higher than in 2019. Corporate profitability should, therefore, be 30% higher but a challenging market for businesses has depressed profitability.

Dixon and Barrat think that consensus expectations are still anchored to 2019 profitability as the destination but, once cyclicals start to recover, they should be able to achieve much higher margins. “We're finding lots of opportunities in cyclical names where we believe earnings are depressed that will be beneficiaries,” Barrat said.

Fidelity International’s Alex Wright, another Alpha Manager with a value style, has also found opportunities in cyclical areas such as media and industrials, where he said “some stocks have de-rated sharply and factored in overly pessimistic scenarios.”

Wright’s largest sector exposure in Fidelity Special Situations and Special Values PLC is financials, although he has taken profits after a period of strong performance. The higher rate environment may have spooked industries linked to housebuilding but it has bolstered banks’ profitability.

“Our largest bank holding is AIB Group, which is not only an interest rate story but also benefits from an improvement in Ireland’s banking industry, where the number of competing groups has recently shrunk from five to three,” he explained.

Wright has reshuffled his insurance exposure. “Last year, we sold our holding in Legal & General on near-term concerns over its asset management business and real estate exposure and invested some of the proceeds into Direct Line, which has since been bid for,” he said.

“More recently, we also switched some of our Phoenix exposure into Just Group, a move that paid off handsomely in light of the very strong set of results recently announced.”

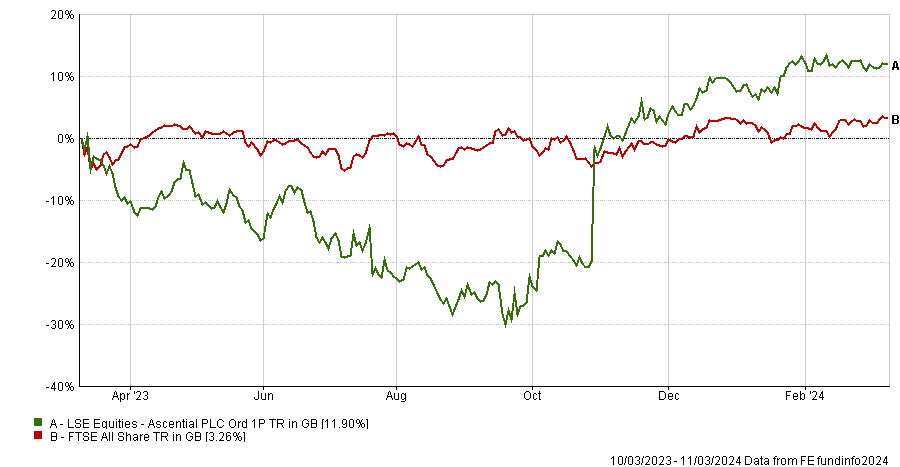

The UK equity market’s relative unpopularity and the “lack of interest from other investors” has enabled Wright to pick up some high quality companies at attractive entry points. The best example is one of his small-cap holdings, Ascential, which “really typifies the current market malaise”, he said.

“Ascential is a conglomerate made up of three different businesses and a little over 12 months ago it announced that it was to sell one, and list another, to focus on its core events business. The stock initially went up around 20% on that announcement. But a high proportion of the shareholder base were UK equity funds that were seeing redemptions so the shares retraced their gains, despite the fact nothing had changed.”

Wright started buying the stock last summer and in October Ascential announced that it had found buyers for its two assets.

Performance of Ascential vs FTSE All Share over 1yr

Source: FE Analytics

Despite value investing being out of favour compared to growth, Man GLG Undervalued Assets and Fidelity Special Situations have outperformed the IA UK All Companies sector and the FTSE All Share index, as the chart below shows.

Funds versus sector and benchmark over 10yrs

Source: FE Analytics