UK dividends increased 4.9% to £15.6bn in the first quarter of 2024, the latest Computershare Dividend Monitor report revealed.

However, most of this growth was driven by one-off payments. Underlying dividend growth remained steady at 2% – a “healthy but unexciting” trend, which will continue for most sectors throughout the year, reflecting a sluggish global economy, Computershare said.

With prospective yields on UK equities stuck at 4%, income-seeking investors may gravitate towards higher-yielding bonds and cash, said David Smith, manager of the Henderson High Income Trust.

“The UK equity market is attractively valued but cash and bonds are now greater competition for investors’ capital. The advantage that equities provide is inflation protection through dividend growth, but that is likely to be relatively low this year,” he said.

But there is light at the end of the tunnel for equity income investors. Things are expected to improve throughout the second half of this year as cost pressures ease, interest rates are cut and economies start to recover, driven by real wage growth and a more buoyant consumer.

Computershare experts upgraded their headline forecast from £93.9bn to £94.5bn in total payouts for 2024 – a 4.3% year-on-year increase against the previous forecast of 3.7%.

Most of this will be driven again by special dividends, which Computershare expects will be significantly larger than in 2023. Regular dividends are expected to be worth £89.5bn, up 1.5% year-on-year on a constant-currency basis.

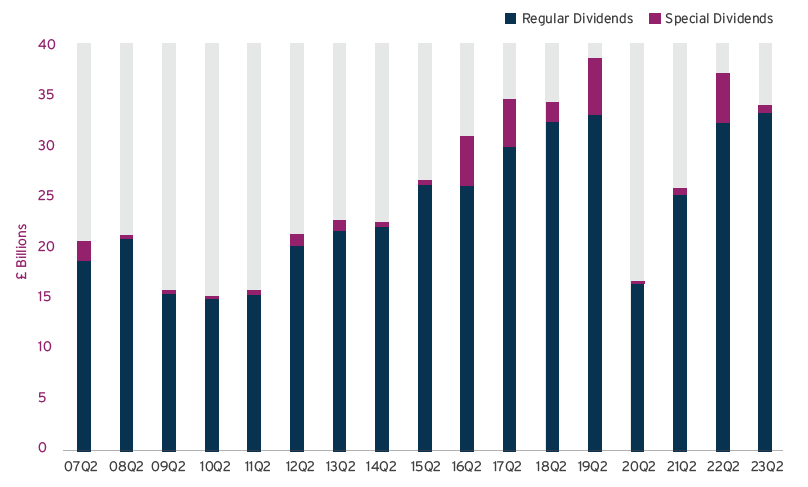

UK dividends 2023

Source: Computershare Dividend Monitor

Mark Cleland, chief executive of issuer services for the UK, Channel Islands, Ireland and Africa at Computershare, said: “This modest growth in dividends reflects the earnings picture: cost pressures have eased for many businesses, but the cost of capital has risen sharply, and economic growth is sluggish at best in the UK and in much of the world. This makes it difficult for companies to build earnings momentum, which influences how much boards decide to return to shareholders in the form of buybacks or dividends.”

In the first quarter of this year, oil and pharmaceutical companies were among the highest payers, but the strong pound was a hindrance and, in the case of Shell and BP, offset the per-share dividend increases declared by the companies.

For the full year, oil dividends are likely to be roughly flat to slightly ahead, the report read.

“A more modest 2024 for the oil sector removes a significant engine of dividend growth from the UK market this year, after it made a major contribution during its recovery from the cuts made early in the pandemic. However, surplus capital will likely continue to be returned through share buybacks.”

Sterling strength also brought the value of pharmaceutical dividends down 2.9% in the first quarter as AstraZeneca held its payout flat in dollar terms.

Telecoms were also major contributors, but the largest payers, Vodafone and BT, didn’t increase their dividends.

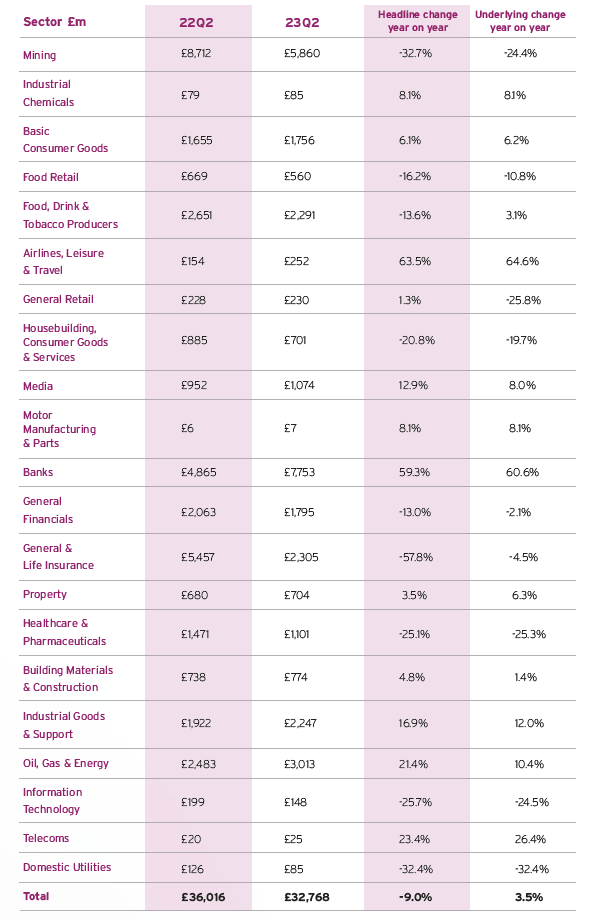

Dividends by sector £m – Q1

Source: Computershare Dividend Monitor

Banks are likely to make the largest contribution to dividend growth in the UK for the third year running, Computershare experts noted.

Virgin Money was the only bank to make a payment during the first quarter, although its payout was reduced due to the impact of rising credit impairments on profits.

Nonetheless, Smith remained positive towards the banking sector. “Having been forced to stop dividend payments during the pandemic, it’s good that banks’ dividends have been restored and grown back to pre-pandemic levels. We expect further dividend growth this year given the rise in profits from higher interest rates have yet to fully flow through to earnings,” he said.

“Despite banking dividends now being better covered by earnings and strong capital positions in the sector, dividends yields are high, offering income investors an attractive opportunity. We believe those dividends should be sustainable, absent a severe recession in the UK.”

Banks have been buying back their own shares extensively, a practice that can have a negative impact on dividend payouts in the short term but should bring long-term benefits, according to James Lowen, senior fund manager of the J O Hambro UK Equity Income fund.

“Over the long term, the anticipated effect is to amplify dividend growth, as there will be fewer shares in issue for a set amount of dividend to be spread across. This is a powerful second derivative effect of buybacks for long-term dividend growth, which we see in numerous stocks.

“Fund dividend forecasts incorporate a shift towards lower dividends and increased buybacks from 2024, signifying a short-term dip but projecting higher returns in the medium term.”