The FTSE 100 hit a milestone on Monday, closing at an all-time high of 8,023.87, and experts expect the UK stock market to continue gathering steam.

Axel Rudolph, a senior market analyst at IG Group, thinks the FTSE could notch up to 8,300 this summer before flying as high as 8,500 by year’s end, while Darius McDermott, managing director of Chelsea Financial Services, believes 9,000 could be possible.

AJ Bell investment director Russ Mould stuck at a more conservative forecast of 8,300, arguing that ample dividend payments and record amounts of share buybacks are signs of corporate confidence.

Rudolph said: “Since the FTSE 100 is on track for its third consecutive month of gains, helped by foreign investors buying undervalued UK shares and companies, a technical analysis upside target called the 161.8% Fibonacci extension around the 8,300 mark may be hit over the next few months.”

A 161.8% Fibonacci extension is used by technical analysts to forecast price targets when financial markets hit all-time highs and is a 1.618 times price projection of a previous move.

“The depreciating pound sterling, making foreign purchases of UK shares cheaper to buy, is expected to underpin the UK blue-chip index as well,” Rudolph continued.

“By year-end the 8,500 mark may be reached, especially if the UK economy starts to grow again amid future interest rate cuts by the Bank of England, the first of which is expected to be seen in August.”

McDermott agreed and was even more bullish. “We like the UK and could easily see the FTSE 100 moving towards 9,000 by year-end if commodity prices continue their upward trajectory. There is also a renewed political realisation that the UK market is falling behind and the government has finally recognised it needs to do more to support its domestic stock market,” he said.

Taking a step back, the Covid-19 pandemic gave companies the chance to press the reset button on their dividend policies and adjust them to more sustainable levels.

“Now, with healthier cash flows, these businesses are using those resources to repurchase their own shares at historically cheap valuations, further boosting stock prices,” McDermott said.

“Increased geopolitical tension is also increasing commodity prices, benefiting the FTSE’s energy and mining stocks.”

Jason Hollands, managing director at Bestinvest, agreed. “The UK equity market is home to a significant aerospace and defence sector where stock prices have soared, reflecting ongoing global crises and increased defence spending. The standout performer here has been Rolls-Royce, whose shares are up 167% over the past 12 months, matching the aggregate returns from the Bloomberg Magnificent Seven Index of US mega-caps.”

Monetary policy divergence and US dollar strength have contributed to recent gains as well, he continued. “Global investors now anticipate two rate cuts from the Bank of England this year, as the inflationary environment looks more benign than it does in the US, where a possible reverse-ferret rate hike is back on the cards at the Fed.”

The domestic economy, meanwhile, is improving. “An unexpected rise in the composite Purchasing Managers Index in April suggests the economy grew faster at the start of the second quarter. GDP data earlier this month confirmed that the technical recession that the UK entered at the end of last year is almost certainly over and this signal might have boosted investors’ faith in UK equities,” Hollands explained.

Emma Moriarty, an investment manager at CG Asset Management, sees the next general election as a catalyst that “might resolve some of the more structural political uncertainty that has created an overhang for the UK markets”.

Despite breaking records, UK equities still appear attractively valued compared to other developed markets, Hollands pointed out. “UK shares are trading at a price-to-earnings (P/E) ratio of 11x, a 37% discount to global equities, and well below their long-term median valuations.”

Mould added that even if the FTSE 100 advanced to 8,350, the index would still be on a P/E of 12x and a yield of 3.9%.

For investors who want to bet on the UK equity market’s sustained recovery and take advantage of the current reasonable valuations, McDermott suggested CT UK Equity Income, Jupiter UK Special Situations and Schroder Recovery. “These funds offer well-diversified portfolios, primarily focused on larger UK companies,” he said.

Performance of funds vs benchmark over 10yrs

Source: FE Analytics

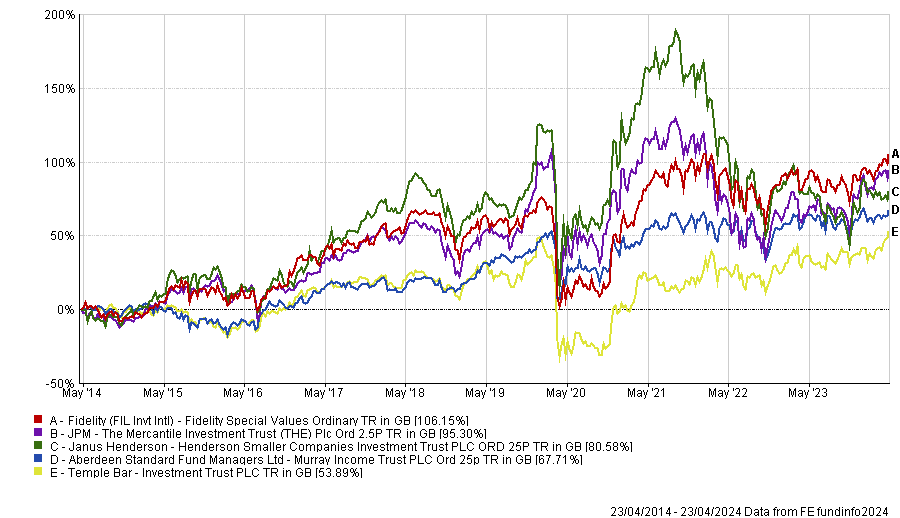

Hollands recommended considering investment trusts trading at discounts. “Strong trusts to consider include Fidelity Special Values (-10.1% discount), Mercantile Investment Trust (-11.2% discount), Murray Income Trust (-9.9% discount), Temple Bar Investment Trust (-7.4%) and Henderson Smaller Companies (-14.3%).”

Performance of trusts over 10 years

Source: FE Analytics