The vast majority of year-end predictions made in 2022 included a recession of sorts, which has yet to come about. Investors should therefore focus on what we do know (for example that 2024 will be a pivotal election year) and invest for the future, according to Andy Merricks, co-manager of the IDAD Future Wealth fund.

This December, as analysts, economists and wealth management companies are publishing their outlooks for the year ahead, Merricks didn’t refrain from making his own prediction, which is that all projections will be forgotten “before the Christmas decorations come down”.

As the industry engages in “the pastime of polishing and gazing into crystal balls”, many prefer to take a step back and don’t engage in the fun. Others, such as Saxo Bank, make their own fun by releasing outrageous predictions for the new year, which, for how baffling they might be, have come true from time to time.

This demand for forecasts is “strange”, according to Merricks, who said: “I’m not sure what it is about the end of the calendar year that makes it any different from any other randomly selected 12 month period”.

But while last year everybody agreed there would be a recession in 2023 and were wrong (in Merricks’ words: “being early is the same as being wrong”), this year there is a big split between analysts and an even bigger elephant in the room.

“The data and indicators that point towards a recession eventually happening are very persuasive indeed (as they were last year, to be fair). But a growing number of forecasters are coming round to thinking that this was indeed the recession that never came,” said the manager.

“It wouldn’t be the first time that logic goes out of the window in the face of some unforeseen, or underestimated, event that proves the exception to the rule. This is where some may be missing the TRUMPeting elephant in the room.”

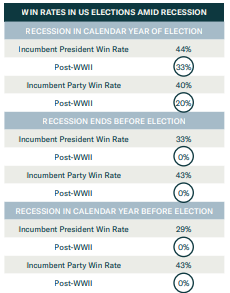

Donald Trump could have a better chance of being re-elected in 2024 than people are thinking, according to Merricks, whose data shows that the record of victory for an incumbent party around a recession is “not good”, as the table below shows.

Chances of incumbent parties surviving a recession

Source: Nber, Dave Leip’s Atlas.

But while Trump might be ahead in the polls, there is “a policy elite in the US who have been striving to ensure that he cannot be re-elected”. And this is where panto season opens, generating “a political circus with cries of ‘Oh no he won’t’, ‘Oh yes he will’ accompanying every court appearance and its outcome of whether the former president is facing time in jail,” said Merricks.

“The entire situation with all its participants from either side gives credence to the oft-mentioned observation that fact is, indeed, stranger than fiction.”

But Americans won’t be the only ones called to cast their votes, with Taiwan elections in January potentially significant as they could “set the tone for Chinese/US relations depending upon whether the newly elected president is China-friendly or otherwise,” said the manager, while in Europe there are scheduled votes in Russia and potentially the UK.

So how should investors navigate this climate?

The path of logic, according to Merricks (who quoted Marko Papic, geopolitical analyst at Clocktower Group), would suggest that the Federal Reserve has now pivoted and is not going back. Even a hint of an early recession would induce a panic, forcing more rate cuts than currently expected. If inflation stays sticky, it will not bring back the hawks.

This should benefit themes such as cybersecurity, healthcare and tech. But markets don’t follow logic and fears of recession and its consequences may lead to “yet another postponement of the most forecast recession in history”, he concluded.