Wealth managers have flooded into global funds at the expense of buying portfolios in different regions, something Temple Bar investment trust manager Ian Lance said was “a big mistake”.

As wealth managers have been merging and getting bigger they have become “very sensitive” about their returns per client being within the same ballpark, he explained. “They don't want one client getting one return and another similar client getting a completely different return.”

This means that investment committees will come up with asset allocation models and everyone ends up following the same blueprint, which has resulted in a big switch to global that can’t be reeled back.

“I can't see a world in which the wealth managers suddenly decide to get back to regional having spent the past five years going global,” he said.

He has known frustration especially well in the past year, when his positive performance hasn’t been enough to retain investors.

“That's frustrating, because we've done a really good job for people and clearly they are still just dumping the shares,” he said. “It’s been a very satisfying year in some ways, and yet it doesn't feel like we're much appreciated.”

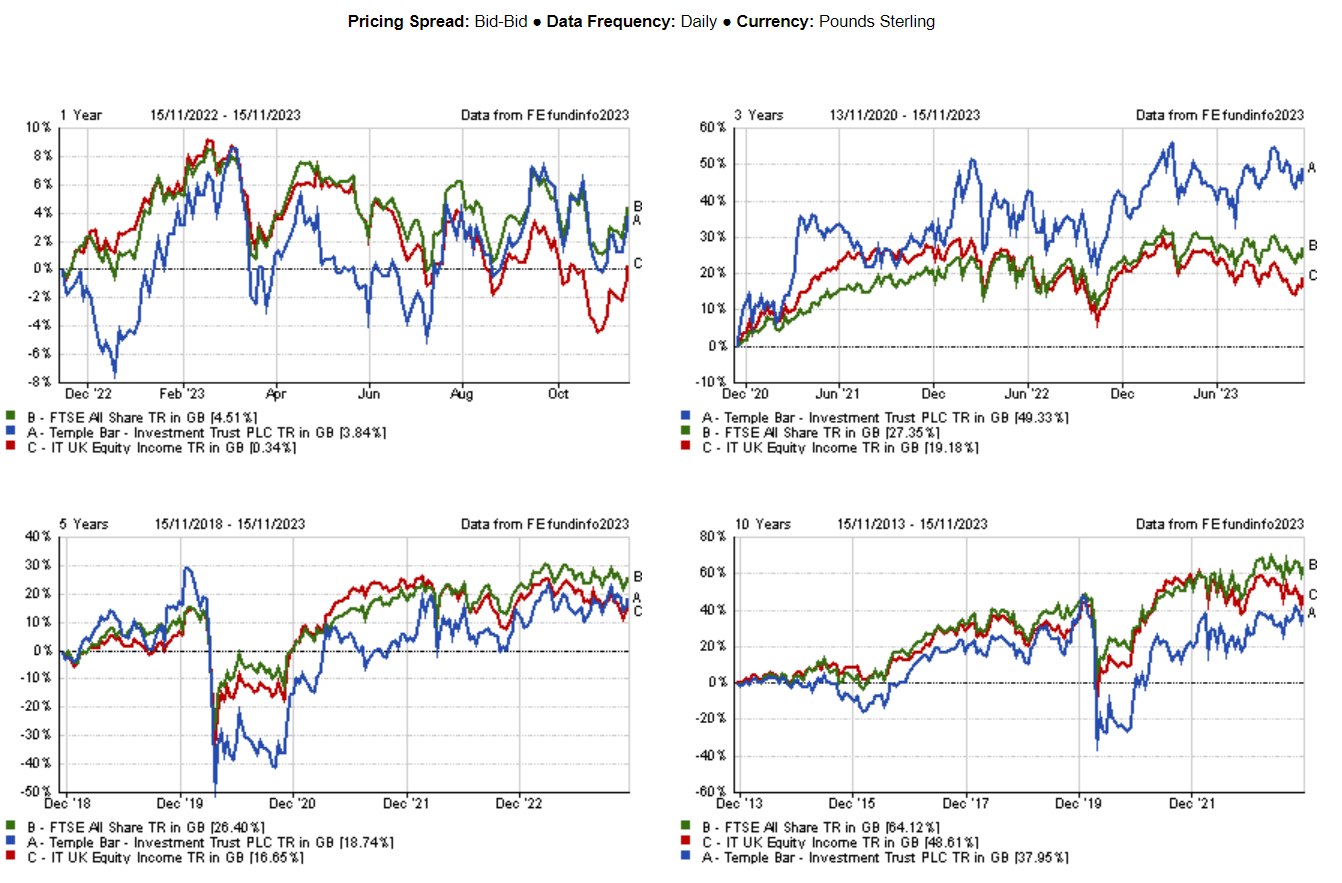

The trust has been in the top quartile of the IT UK Equity Income sector over one and three years, making 3.8% and 49.3% respectively, against 0.6% and 16.7% for the average peer, although has struggled over longer periods.

Performance of fund vs sector and index over 1, 3, 5 and 10 years

Source: FE Analytics

“Performance-wise, undoubtedly it has been a very good year. We've made some good returns. With our open-ended funds, we have one of the best-performing income funds in the entire sector over the past year or so. And yet, it's still an odd environment,” the manager said.

“With Temple Bar, we're at a 6% discount and the reason why it's only 6% is because we are basically sat there buying back shares every day.”

This isn’t just Lance’s chagrin – the whole investment companies industry has been plagued with huge discounts, driving some managers to desperately buy back shares despite little evidence that they work.

But on the open-ended side, the Redwheel UK Equity Income fund has also had “quite a number of redemptions throughout the year”, which the managers said is “really frustrating in an environment where we've put out some really good returns and the funds are really well positioned and very cheap.”

Part of that money, he suggested is going into fixed income, as people are going back to bonds now paying high yields for the first time in more than a decade. The other reason given was the switch from UK and regional funds to global portfolios – something he argued “is a big mistake”.

“Around 70% of global is the US now, and the US stock market has pretty much never been more expensive than it is today. Selling the UK to buy the US is just a bad thing to do at the moment.”

This leads to the question: What is going to drive the returns in the UK market for the next couple of years? While Lance has been unable to answer this in recent months, he finally does have an answer. “Share buybacks”.

Lance said often company CEOs sat in front of him will have their head in their hands and say: ‘My business is going well you know, we're growing, I've got a strong balance sheet. Why on earth am I trading on a price-to-earnings ratio of five and a dividend yield of eight?’

“And I don't know, life's not fair. But rather than get frustrated about it, we tell them to use it to their advantage, which means to buy back their own stock,” he noted.

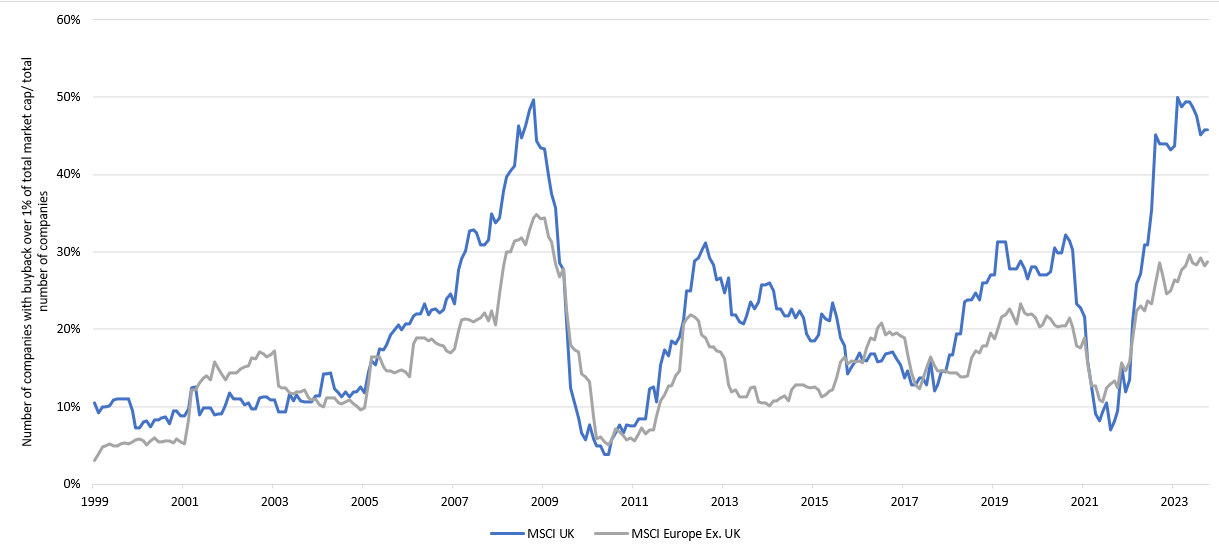

Number of companies with buyback over 1% of total market cap/ total number of companies

Source: Redwheel, AlphaSense, Morgan Stanley.

The chart above shows how many companies have bought back their shares in the past 12 months, and the for the UK, that’s 50%, “way higher than any other market in the world”.

“Finally companies have woken up to the idea that there's not going to be this big wall of money coming back from the US to come here and buy the likes of Marks and Spencer,” said Lance.

“There's about £1bn a week of buybacks going through the UK market at the moment, which is what, ultimately, will drive returns.”