More than half of the UK stocks in the FTSE 350 have failed to get back to their pre-Covid highs, according to data from investment platform AJ Bell.

Some 194 UK names in the large- and mid-cap index are still trading below their level on the eve of the market crash four years ago, using 21 February 2020 as the start date for the research.

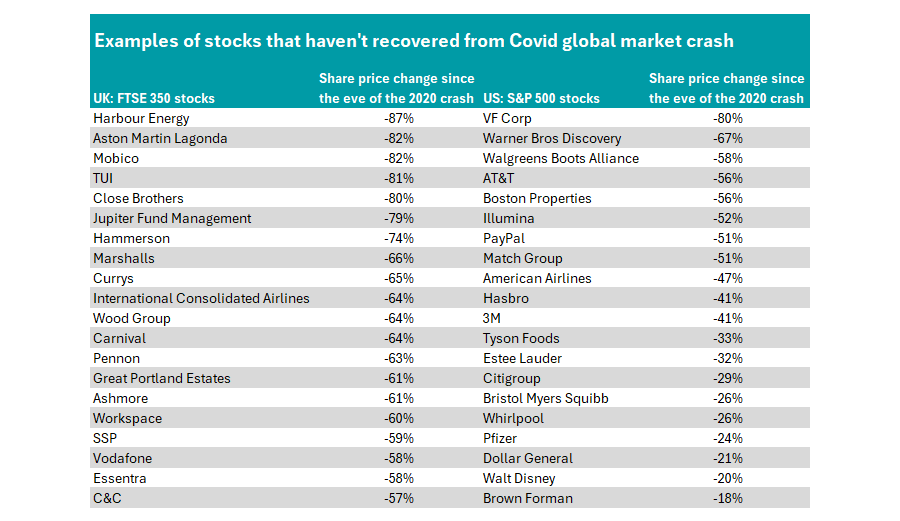

UK stocks have struggled to regain ground, but they are not alone. There are 142 companies in the US S&P 500 in a similar position, the research noted. The below table shows the stocks furthest away from reaching their pre-Covid levels.

Source: AJ Bell

There are myriad reasons why stocks have struggled, according to Dan Coatsworth, investment analyst at AJ Bell, who highlighted some key factors below.

The end of trends

“For certain companies, financial gains made during the pandemic effectively brought forward earnings growth and this demand momentum has now fizzled away, making it harder for these companies to sustain earnings growth,” he said.

This has been the case for companies such as Ocado, which benefited from the rush to online shopping but has failed to keep the momentum as people returned to the supermarkets.

Drug companies also prospered during the pandemic from the need to develop a vaccine, but ran out of steam last year when investors realised the income from Covid-related treatment would be more muted than expected.

Lastly, the work-from-home trend has also slowly faded away, meaning companies in the construction sector have taken a hit from fewer home improvement projects.

Interest rates and inflation

Elsewhere, “supply chain problems during the pandemic fired up inflation and Russia’s invasion of Ukraine exacerbated the situation, leading to a rapid increase in interest rates”, said Coatsworth.

“Companies had to take on extra debt during the pandemic and the subsequent action by central banks to raise interest rates has put pressure on corporate finances. Those having to refinance over the past few years, or those on floating rates, have really felt the pain as the cost of servicing borrowings has shot up.”

One example is airline TUI, he said, which has benefited from stronger demand for travel but is still trying to pay down the large debt taken out during the pandemic.

Higher costs such as labour and shipping due to rising inflation have also squeezed margins despite demand picking up.

Other factors

Issuing too many shares (and therefore watering down investors’ ownership) has been a pitfall for some, such as SSP, the travel food vendor.

“A reduction or complete absence of income meant relying on cash savings and/or debt would weaken their balance sheets and so it became common for companies to issue new shares to raise additional cash,” said Coatsworth.

“SSP was among the companies to issue new stock during the pandemic and it is still trading below its pre-Covid levels. The average share count for the travel hub food and drink seller went from 458 million in the year ending September 2019 to 697 million two years later.”

Choppy markets have also impacted certain sectors, such as asset management, where Jupiter Asset Management and Ashmore Group both remain below their pre-Covid levels.

Macroeconomic uncertainty, combined with investors taking money out of funds and placing it in cash accounts paying high rates for the first time in years, means these firms are “nowhere near” returning to their previous highs.

Markets hide the pain

Yet despite all of these laggards, markets have done well overall. The FTSE 350 index as a whole has recovered all of its losses and is now trading at exactly the same level as it was four years ago, while the FTSE 100 index of large-cap names is a touch better off, up 2%.

Overseas markets have fared much better. The Nasdaq Composite index in the US is up 66% while the S&P 500 is trading 50% higher, according to the report.

“The shape of the UK stock market is a contributing factor to why so many companies in the FTSE 350 have lagged in the post-Covid recovery. The big gains globally over the past few years have been in the technology sector which is grossly under-represented on the London Stock Exchange,” said Coatsworth.

“The UK is more dominated by areas such as telecoms, housebuilding, property, tobacco and life insurance, all of which have disappointed on a sector basis since the onset of Covid.”