Equity income funds fell out of favour with investors in July, analysis by Trustnet suggests, having spent much of 2023 becoming increasingly popular.

High inflation and rising interest rates have pushed investors to find ways to make their money work harder over the past year or so and income funds – which pay out some of their return today rather than in the distant future – were getting researched more by Trustnet readers.

However, when we look at the research trends for July, we found that this dynamic has reversed. In order to discover this, we took at the share of Trustnet’s pageviews that each Investment Association fund gathered in July and compared it with a baseline from the previous 12 months.

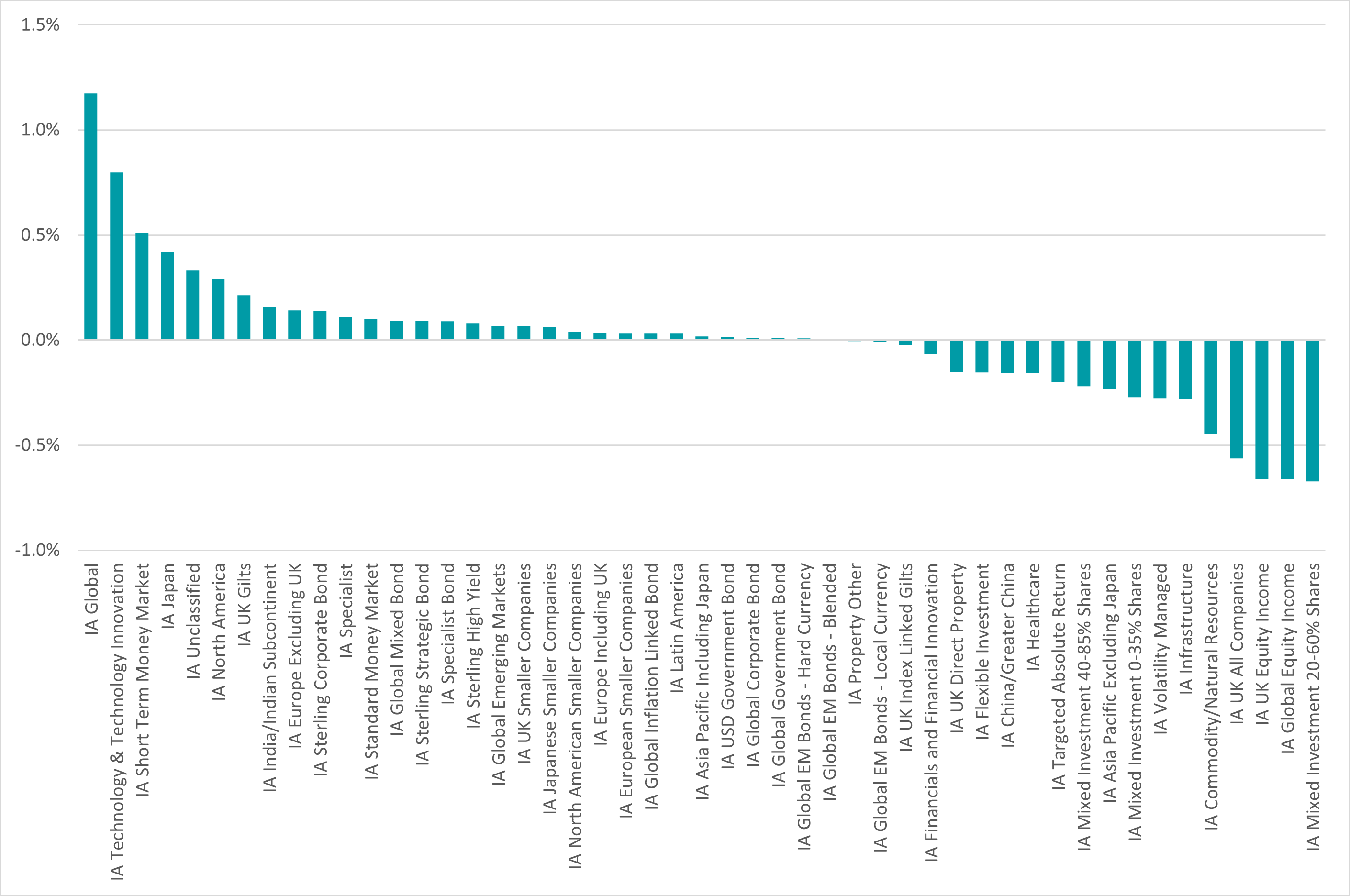

The findings can be seen in the chart below, which shows the change in July’s research shares compared to the baseline, aggregated by Investment Association sector.

Change in research share by Investment Association sector – July 2023

Source: Trustnet, Google Analytics

Both the IA UK Equity Income and IA Global Equity Income sectors were hit by a fall in their research share last month. This is something of an anomaly for 2023, as both sectors had been growing their research month to month.

Among the funds that had the largest decline in research from these peer groups are BNY Mellon Global Income, Vanguard Global Equity Income, JPM Global Equity Income, CT UK Equity Income, Fidelity Global Dividend and Allianz UK Listed Equity Income.

This comes amid signs that the battle against inflation is starting to turn, with the Federal Reserve appearing to be slowing the pace of its interest rate hikes and eyeing a soft landing. The Bank of England has been less successful in its efforts to curb inflation, but the latest UK consumer prices index did fall by more than expected.

Not every equity income fund was being researched less than before, however, with the likes of Aviva Investors Global Equity Income, BNY Mellon UK Income, LF Gresham House UK Multi Cap Income, Royal London Global Equity Income, Schroder Income Maximiser and Man GLG Income being the ones with the biggest increase in interest from Trustnet users.

Other signs that investors are starting to react to slowing inflation comes from the fall in research in the IA Mixed Investment 20-60% Shares sector, which is home to many of the multi-asset funds that focus on income.

In addition, there’s been less interest in the IA Commodity/Natural Resources sector. Its members performed strongly in 2022 when commodities rocketed but has struggled more recently as prices have started to fall back.

There has been a significant jump in research into IA Global funds, however. Some 15.1% of pageviews in the Investment Association universe went to IA Global funds in July, up from 14% over the previous 12 months.

Royal London Global Equity Select, HSBC FTSE All World Index, Vanguard LifeStrategy 100% Equity, Purisima Global Total Return PCG, L&G Global 100 Index Trust and Schroder Global Recovery were the funds with the biggest rises in their research share.

Other notable increases include the IA Technology & Technology Innovation sector (reflecting the fact tech stocks are leading the 2023 rally), IA Short Term Money Market (higher yields on offer thanks to higher interest rates) and IA Japan (strong recent performance).

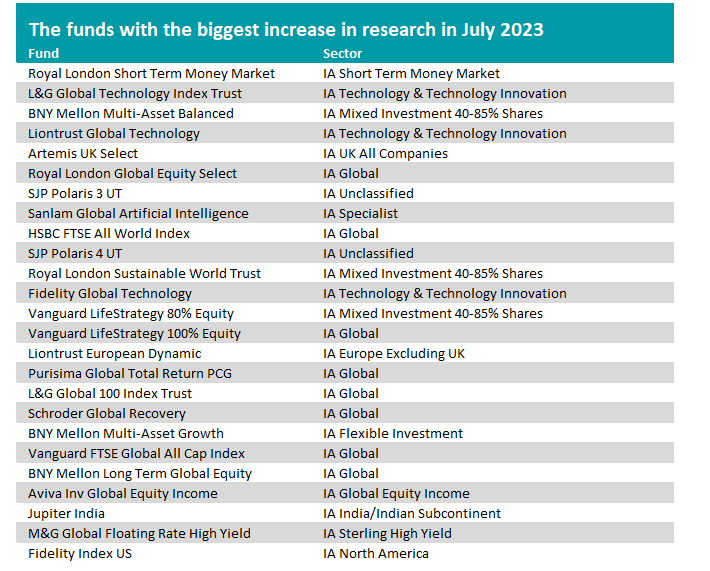

Source: Trustnet, Google Analytics

When it comes to individual funds, Royal London Short Term Money Market has achieved the largest gain in research share among Trustnet readers. Over the previous 12 months, it was the 59th most-viewed Investment Association factsheet but it has climbed to 11th place as investors started to look more at cash.

Many of the other funds in the table above are linked to the themes discussed previously.

Some that aren’t are SJP Polaris 3 UT and SJP Polaris 4 UT. These funds are part of a mixed asset range launched by St James’s Place at the end of 2022 and are its two highest-risk strategies.

Liontrust European Dynamic also continues to attract investors. European equities had been among the funds with the biggest increases in research in recent months, but this eased in July.