The FTSE 100 is set to deliver the third-best cash returns on record in 2023, with pre-tax profits reaching £275bn, the latest Dividend Dashboard Report by AJ Bell has shown.

Although headline pre-tax profit figures are volatile, analysts are anticipating a new all-time high of some £275bn, far ahead of the prior peak of £194bn in 2018.

Inflation does have a role to play here, however, especially given the FTSE 100’s hefty exposure to commodities, and all that glitters is not gold, according to AJ Bell investment director Russ Mould, who highlighted that yield figures are no longer as eye-catching as they once were.

Back in February, the index had reached the all-time high mark of 8,000, but that was short-lived.

“After the brief flirtation with the 8,000 mark, the FTSE 100 is trading no higher than it did in summer 2017,” Mould noted.

“A forecast yield of 4.1% for 2023 (and 4.4% for 2024) offers some compensation, but after a succession of thirteen quick-fire interest rate increases from the Bank of England, returns on cash should be improving, while the benchmark 10-year Gilt yield is 4.4%.”

Investors can even find nominal yields of 5.17% on two-year Gilts, so the days of ‘There Is No Alternative’ (TINA) when it comes to equities and the hunt for yield are over, Mould argued. Indeed, some strategists are pointing out the rival claims of bonds (and cash) as they coin a new acronym, TIARA – There Is A Real Alternative.

“This increase in the number of options available to those looking to build a diversified portfolio of assets, and combat the evils of inflation, is one possible explanation for why the FTSE 100 continues to paddle sideways like a wounded duck,” he said.

“Another may be an understandable degree of scepticism regarding FTSE 100 earnings and dividend forecasts for 2023, given ongoing inflationary and input cost concerns, higher interest bills, tax increases and the murky economic outlook.”

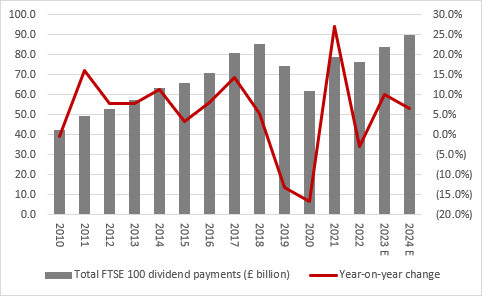

The total dividend pay-out for 2023 was expected to reach £86.7bn a year ago, which would have set a new record, but consensus is now £83.8bn, as analysts have concluded that “a fresh peak may be tantalisingly out of reach in 2023”, said Mould.

“The good news is that 2024’s payments are expected to total £89.4bn, although this estimate has also slipped from £92.5bn in the autumn.”

Consensus forecasts on dividend payments

Source: AJ Bell

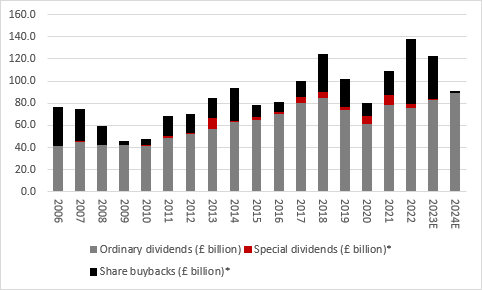

With such healthy levels of cash, thirty-four index constituents have already begun, or have announced, share buyback programmes to return additional cash to shareholders, read the report. In 2022, it was forty-three, but there are more expected to come.

“These bumper cash returns supplement dividends. The FTSE 100’s members are on track to return £122bn to investors via ordinary dividends, special dividends and buybacks in 2023, again with the possibility of more buybacks in the second half,” said the investment director.

That compares to 2022’s all-time peak of £137.6bn and almost matches the prior high, of £124.3bn, reached in 2018.

“It also takes the total cash yield from the FTSE 100 to 6.0%, a figure which nicely exceeds both the two- and 10-year gilt yield, at least at the time of writing.”

Consensus forecasts on dividends

Source: AJ Bell

On the flip side, buybacks can be seen as a contrarian indicator, with FTSE 100 share buybacks hitting a peak in 2006, around a year before the start of the financial crisis.

Additionally, not all constituents are equally contributing to this trend and those that do can raise some red flags under an ethical, social and governance (ESG) lens.

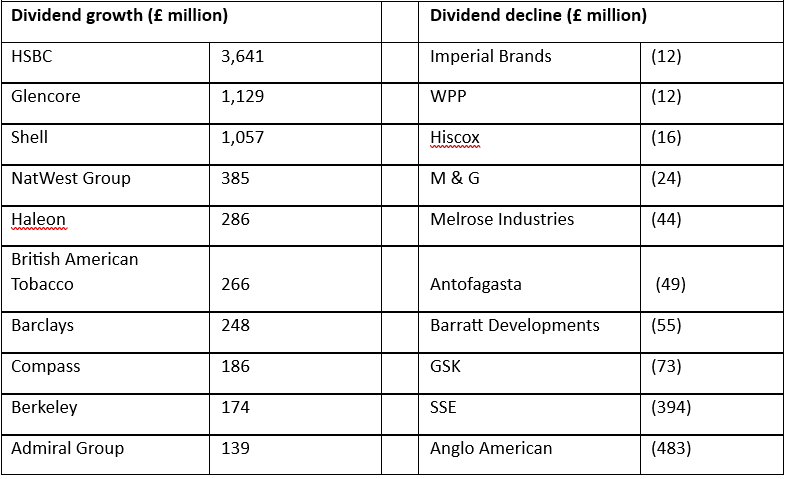

“Dividend increases in the index are particularly heavily concentrated in a limited number of names. The 10 biggest are expected to represent no less than 98% of the total increase for the entire index and the top 20 are forecast to generate all the anticipated £7.7bn increase,” the report read.

Within this list of 10 dividend heavyweights lie two miners, two oil majors, a pair of drug developers plus a bank, a tobacco company, a household goods specialist, and a utility, as highlighted below.

FTSE 100 constituents by estimated dividend growth for 2023

Source: FE Analytics

Investors may wish to be wary of these, however, as buyback programmes can be cut much easier than dividend payouts, Mould warned.