Choosing a sector or a theme will no longer suffice for investors who want to generate outsized returns, said Blackrock Investment Institute’s deputy head Alex Brazier.

Persistent supply constraints are compelling major central banks to hold policy tight, creating a new economic regime with greater macro and market volatility. This was the view he and a panel of experts shared last week at Blackrock’s mid-year outlook conference.

“A new macro regime is playing out, which makes it a difficult environment for the big macro investing cause but brings new opportunities. Different opportunities, but opportunities nonetheless,” Brazier said.

“We find them by getting granular within asset classes and harnessing structural shifts – such as the rise of artificial intelligence (AI) and the rewiring of globalisation – that can drive returns now and in the future.”

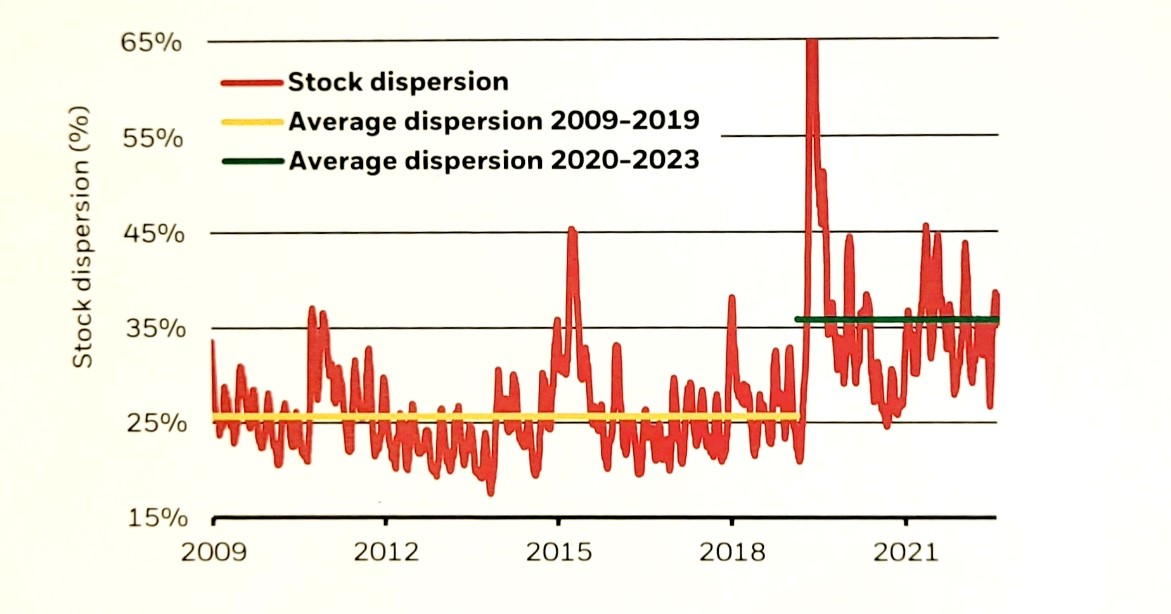

Blackrock’s view is that higher macro and market volatility don’t pair well with broad asset class exposures because of the elevated dispersion (or the extent to which prices deviate from an index) within and across asset classes.

The chart below shows dispersion within the Russell 1000 index has ramped up as the new regime took hold. According to Wei Li, global chief investment strategist at the BlackRock Investment Institute , “this offers more ways to build portfolio breadth via uncorrelated exposures”.

Range of individual stock returns vs. Russel 1000 index

Source: Refinitiv, Blackrock

Where investors find granularity depends on what the market is pricing in.

“Automotive, for example, is already pricing in a version of recession, so although we don't have a great rosy macro assessment, we do see opportunities there,” she said.

“Healthcare is another sector that offers good value and quality characteristics, versus financials and energy, which have seen greater dispersion in performance.”

But these considerations are now mere starting points and investors have to look for a greater level of granularity, according to Blackrock’s head of portfolio management Helen Jewell, who claimed that it's not enough anymore to just say ‘let's go into healthcare’, because there’ll be some part of the sector that look more interesting than others.

“For example in med tech, as a result of Covid, we've still got delays for things like knee replacements, but those should be a beneficiary. On the flip side, supply companies had a huge rally because they were providing technology and equipment to help Covid vaccines be developed, but that's pulled back,” she said.

“So you can't simply say anymore ‘it's Europe versus US’, ‘It is banks versus non-banks’, ‘It is healthcare’. You really need to peel it back to that granularity of ‘What does it mean?’ ‘What is driving earnings in those sectors?’ That's what we are super focused on at the moment.”

For long-term investors, the asset management house is keeping strategic overweights in developed markets equities, inflation-linked developed markets government bonds and private companies with a skew towards income, while keeping an underweight to nominal bonds and growth.

From a tactical perspective (designed for investors with a six-to-12-month time horizon), the overweights are emerging market equities and debt, while keeping underweights to developed markets equities and high-yield bonds.

Finally, global chief investment officer of multi-asset strategies and solutions Simona Paravani-Mellinghoff argued that “the king is back” in relation to cash. It was nowhere to be seen in the post-financial crisis ‘great moderation’ regime, but in the new regime of higher rates “shouldn’t be overlooked” when building a strategic asset allocation, as it can “provide dry power and dynamism” and be useful for jumping in and out of position as opportunities arise.

“Of course, volatility is associated with risk, but it can also help create opportunity. The key point is one has to be ready to work to seize them,” she said.

“This shouldn’t be misinterpreted as being a challenge to the 60/40 portfolio. Far from it – there is nothing wrong with a 60/40 portfolio, it's more a matter that the problem may arise if the allocation is kept static in the face of changing market conditions.”