Growth investing has led the market over the opening weeks of 2023 but strategists at BlackRock have said investors should continue to look at underperforming value stocks.

Although value stocks outperformed in 2022 when central banks were hiking interest rates, in recent weeks they have fallen behind growth stocks as investors start to hope that monetary policy will be eased to tackle economic weakness.

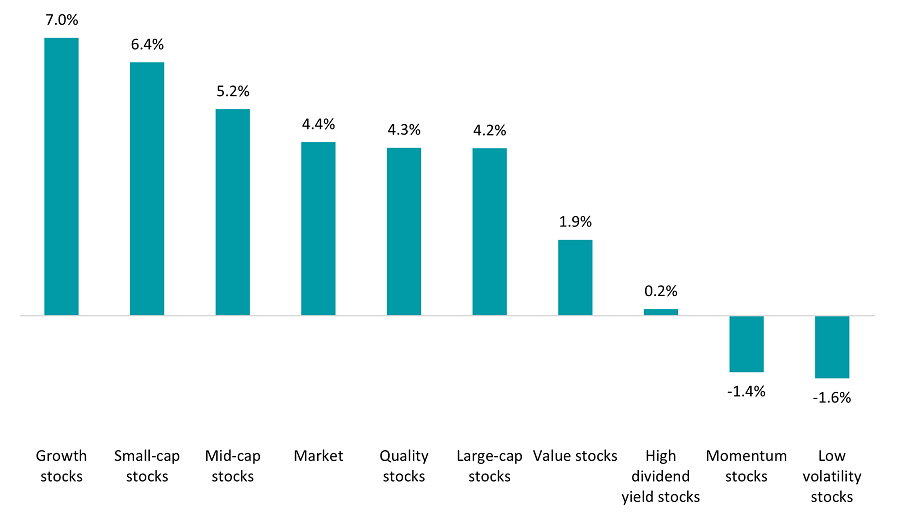

Performance of investment factors in 2023

Source: FinXL

However, BlackRock has been saying for some time that the Federal Reserve and other central banks are not likely to cut interest rates because they are aiming for an economic slowdown to curb stubbornly high core inflation.

It believes that major central banks will have to hike rates further and keep them higher for longer to bring it back down to their 2% targets, contrary to what some investors are expecting to happen.

“We think value can regain the lead. Why? Higher interest rates and inflation, and a steeper yield curve. That all favours value over growth, in our view,” said Wei Li global chief investment strategist at the BlackRock Investment Institute, in its latest note.

Unpacking the reasons for supporting value over growth, she noted that higher interest rates feed into higher discount rates, which makes the future cash flows of growth stocks less attractive.

Secondly, investors are likely to demand more compensation for holding long-term government bonds given persistent inflation. “Value tends to outperform when the yield curve steepens,” Li said.

The risk of recession is the third reason for expecting value to outperform.

“While value historically underperforms heading into recession because capital-intensive companies can’t respond quickly to changing cycles, we think that could be different in this atypical economic cycle. Value is still attractive after being beaten down for so long. Companies in the value bucket have also had time to prepare for a well-telegraphed downturn: many banks have already provisioned for losses in advance of a recession,” Li explained.

Finally, she expects a mild recession, which would mean the impact is likely to be softer on value companies than in past cycles.

In light of this, BlackRock’s current asset allocations have a tilt towards value with quality characteristics. It finds that Europe and emerging markets have a consistent value bias, although it prefers to take a sectoral approach when finding value.

“We see energy as a fusion of value and quality,” Li said. “We find value in the sector after being unloved and undisciplined with capital in the past. We think its stronger balance sheets, better investor payouts and improved return on equity give it more of a quality tilt.”

There is also value in financials, but not the same quality, she argued. The financial sector is currently capitalising on higher rates with improved net interest margins after years of ultra-low or even negative rates.

Healthcare has also become more of value sector of late, while retaining some characteristics of growth. The firm likes healthcare for its growth prospects “at the right price” – its valuations look reasonable compared with other sectors – as well as its defensive characteristics, which help companies to stand up during a recession.

However, Li reminded investors to continue to run diversified portfolios rather than allocating too much to the value or growth styles.

“It’s not about choosing one factor over another: Factors mean different things to different people and the composition of factors also changes over time,” she said. “Case in point: The healthcare sector is now a modest overweight in the MSCI USA Value index compared with an underweight in 2008.”