Inflation will go back to 2% in the developed world, but that’s not necessarily the good news investors might think – in fact quite the opposite, Pictet Asset Management chief strategist Luca Paolini says.

In the asset management house’s five-year outlook, Paolini opposed the view many economists hold that we find ourselves in a ‘new normal’ where interest rates are persistently higher.

“We don't think that the central banks will change their 2% inflation target,” he said.

“From a purely communicational point of view, it would be horrendous to change the official target if you have been unable to achieve it first.”

The journey to reverse inflation has already started and involves “below-trend” global growth for the next five years – caused by a combination of factors, including demographic changes, fading fiscal stimuli and decreasing productivity.

“During the Covid-19 pandemic, we have seen a lot of monetary and fiscal policy stimuli that inevitably will fade,” Paolini said.

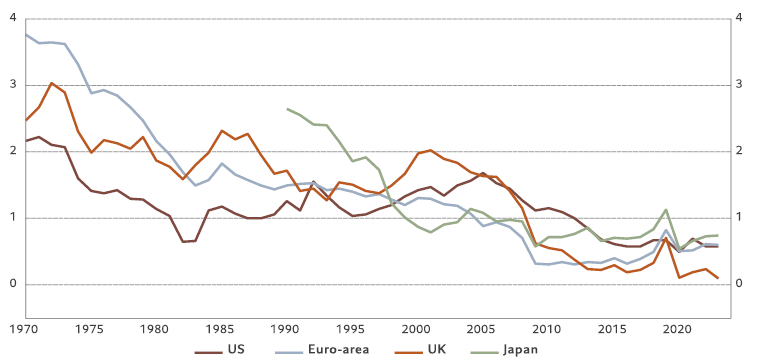

“On top of that, I see dangerous demographic trends developing. An ageing population has fewer ideas and becomes less productive. Productivity is the ultimate engine of growth and it remains in a secular downtrend.”

Total factor productivity in major economies, 10yrs compound annual growth rate in %

Source: Refinitiv Datastream, DG ECFIN Ameco, Pictet Asset Management.

The strategist remained sceptical as to whether new technologies, including artificial intelligence, will be able to offset this trend.

“There have been massive technological innovations, such as the smartphone, that had no impact whatsoever on productivity. You should be able to make money choosing the right technology company or the right sector, but it doesn't necessarily mean that the world will be completely different,” he said.

“This isn’t reason to be extremely pessimistic, but to believe that the golden age of investing of the past 20 years is coming to an end. We have to accept that we are growing less, and there is no evidence that this trend of lower productivity growth is going to change.”

But the message on inflation was more complicated than that. Inflation will go back to normal average levels, but with increased volatility.

“Firstly, central banks have effectively moved to a much more backwards-looking policy, as they're too late to hike and also too late to cut rates,” said Paolini.

“Secondly, due to deglobalisation and shortage of labour, the supply curve is much less flexible than in the past. Any increase in demand will likely have a much bigger impact on inflation than it used to. These things aren’t priced in by the market.”

To further complicate the job of portfolio managers, returns dispersion will be much lower.

“We’ll have lower returns and lower dispersion across different asset classes – across regions and sectors. Asset managers won’t be able to rely on beta anymore, but will have to find the pockets of value that will deliver the return they are looking for,” he said.

“Everybody's getting excited about the US and the recently announced infrastructure projects. We don't think that they will be enough to put the US in a much stronger growth area than Europe and Japan.”

Turning to emerging markets, Paolini thought they’ll continue to do well, particularly China.

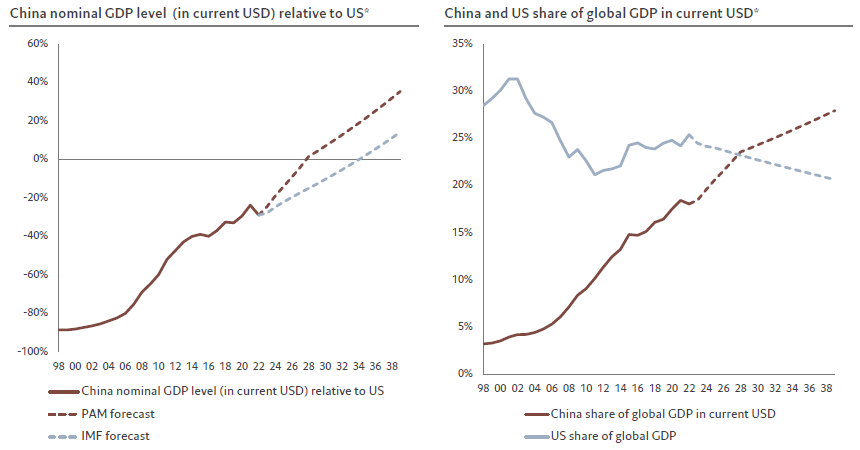

“On our economic forecast, China will be bigger than the US in nominal dollars in 2028. I've done this calculation two, three, four times and yes, you might not believe it, but it's correct. It doesn't mean that it's going to happen, but the point is that the renminbi will appreciate enough to close the gap between China and the US,” he said.

“The decoupling between the US and China will probably get worse and it will probably not resolve to military confrontation, but this toppling will have significant impacts on a lot of things. Probably the most logical one is, in a very simplistic way, that there will be a West bloc dominated by the US and East bloc dominated by China.”

China set to overtake the US as the biggest economy by 2028

Source: Refinitiv, IMF; Pictet Asset Management

Against this backdrop, investors will have to think more tactically and adjust allocations faster, even with a longer investment time horizon, focus on quality stocks and secular growth themes, and diversify away from US equities, argued Paolini.

“The good news is that we are going back to a world where equities will perform in line with GDP growth, corporate markets will be more or less stable and fixed income is finally going to give you something which is at least close to inflation rate, if not above,” he said.