With the mid-year mark approaching, Brown Shipley has unveiled its outlook for the rest of 2023 and readjusted its portfolios for a new economic environment.

However, the group said it’s not time to re-risk yet, as more defensive, low-volatility equities remain “comparatively attractive” for their potential to mitigate downside risk while partially capturing the upside.

Below, Brown Shipley chief economist Daniele Antonucci and head of portfolio strategy Cyrique Bourbon outline their views on global markets, discuss inflation perspectives and the attractiveness of the Asia market, as well as explain why they sold some alternatives to make room for hedge funds.

Peak inflation, a pivot in central banks’ hiking cycles and a pickup in Asian growth were the three focal points that Brown Shipley adopted for its investment philosophy at the beginning of the year, and they remain more or less unchanged except for the second, where now a pause is expected rather than a pivot.

“The US is six months ahead of the rest of the developed world and will be the first country to see inflation come down and its central bank to pause hiking,” said Antonucci.

“From a high of 9.1% in the middle of the past year, US inflation is now below 5% and trending lower, meaning that the Federal Reserve will most likely not hike at their next meeting on 14 June, and perhaps deliver a final hike in July. In the case of the UK, we see a maximum of three more hikes until it takes a break. We do not anticipate outright rate cuts before 2024.”

This means that Western economies will still face “ongoing bouts of financial instability and banking-sector stress”, leading to tighter lending conditions that will limit expansion, while the East – in particular China and Japan – will rebound, said the economist.

Together, these trends will create “a divergence of growth and the emergence of asynchronous market cycles”.

In this scenario, the first area of interest for Bourbon was US high-quality bonds over equities.

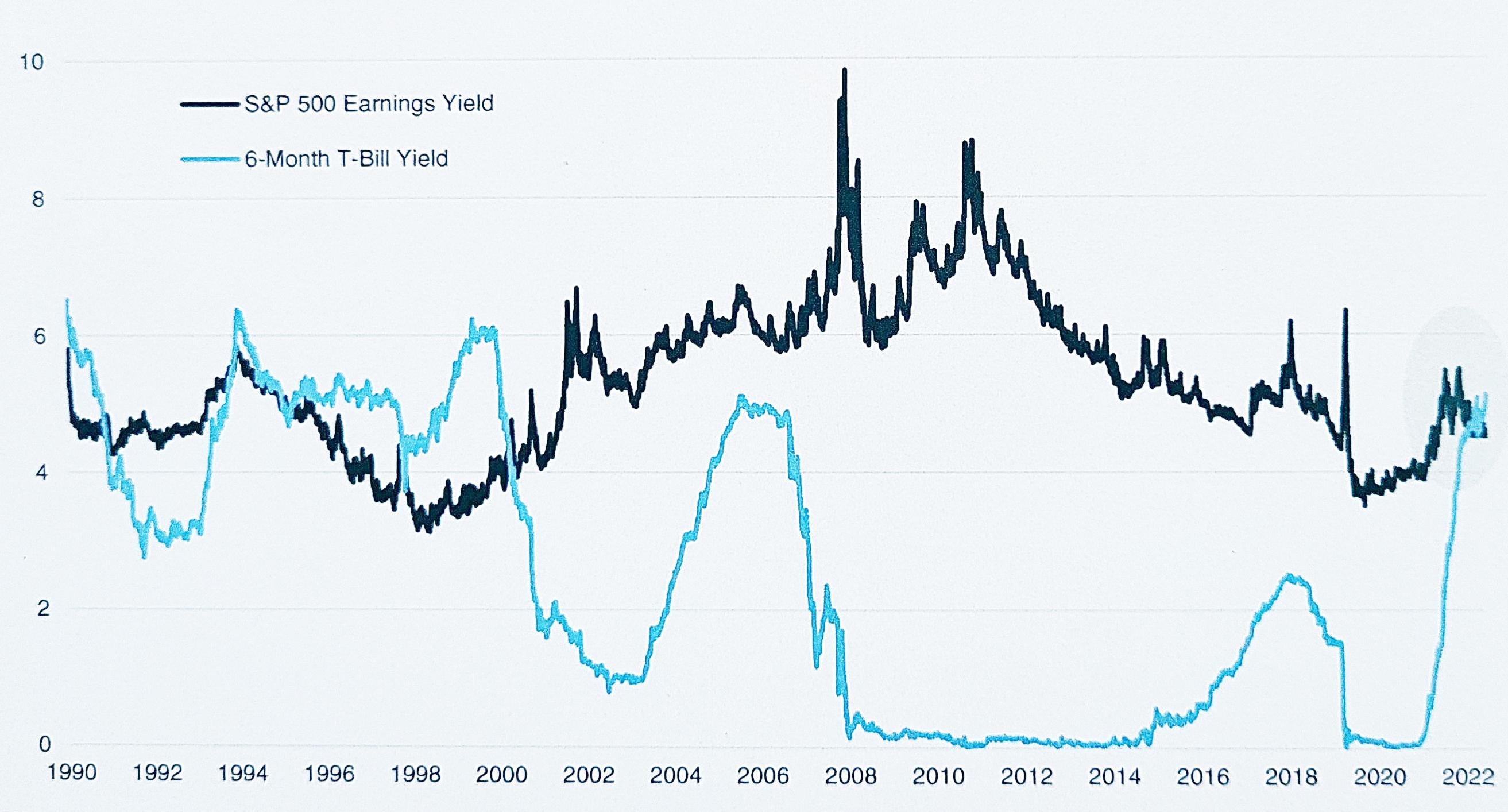

“At a time when 6-month Treasury bills are yielding as much as the S&P 500 [as showed in the chart below], we believe the near-term risk-reward for equities appears unfavourable relative to high-quality bonds,” he said.

S&P 500 earnings and 6-month Treasury bills yields (%)

Source: Brown Shipley, Refinitv

“While US equities are an attractive asset class over the longer term, on the short-term, they’re too expensive and we have reduced our exposure, which is the dominant equity exposure in our portfolios.”

In Europe and the UK the dynamic is different, as investment-grade bonds will remain under pressure for as long as hiking cycles will continue and equities look attractively valued.

“We added an exposure that blends defensive markets, such as Switzerland and the UK, with the eurozone, which is a more cyclical market. We didn’t want to add exposure just to the eurozone, because it rallied so much and we think momentum is probably excessively stretched,” Antonucci said.

“We like these equities, which give a higher weight to defensive sectors such as healthcare and consumer staples, could outperform the market if we see a spike in volatility or a downturn.”

Asia is also interesting at the moment, according to the team. China and Japan in particular are in the same positions the UK was in two years ago and look set to grow after re-emerging from the Covid lockdowns.

In China, it’s taking longer than expected but Antonucci believed the recovery is happening. In Japan, earnings prospects already look better and momentum is already reflected in markets.

“Japanese equities are appealing from a valuation perspective and supported by resilient corporate profitability, improving economic growth, loose monetary policy and, following structural reforms, higher standards of corporate governance,” he said.

“That's an exposure that we have added recently and maintained with this outlook.”

In the alternatives space, the team moved away from gold and added hedge funds instead.

“Gold already reflects a lot of good news for that asset class. It's reached near record highs and detached from real bond yields, to which it typically well correlated. That means that gold is already where it should be even if you project an adjustment in real yields and inflation is getting lower,” said Antonucci.

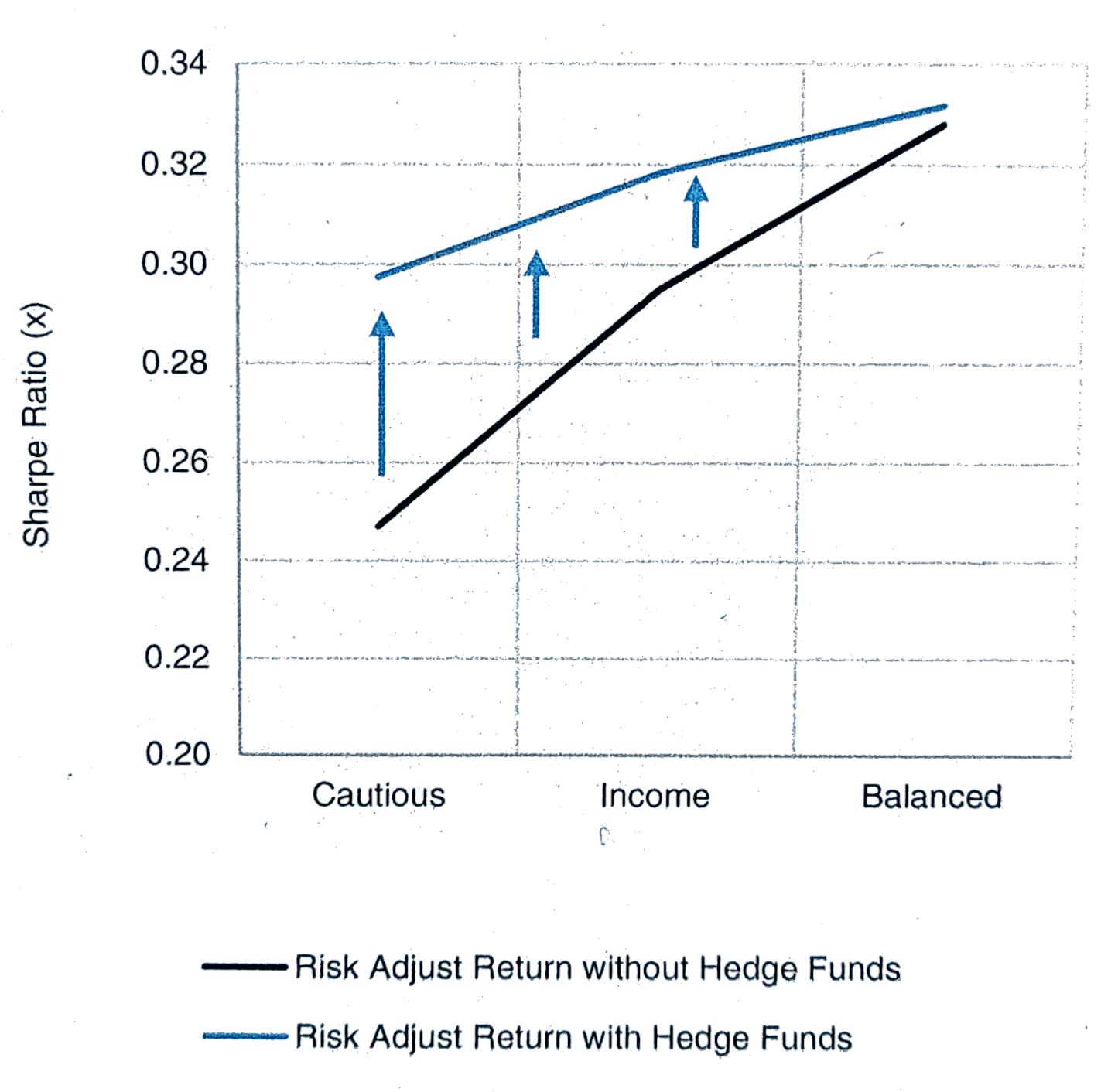

“Essentially, we thought it was the right time to reduce our gold exposure to free up capital and make space for hedge funds. Our research showed that risk-adjusted return increase especially for the more cautious, conservative portfolios, as their performance is lowly correlated with everything else in the portfolio.”

Diversified liquid hedge funds can improve risk-adjusted returns

Source: Brown Shipley, Refinitv

In an area where Brown Shipley’s risk is high, the goal is to have a liquid, well-diversified basket of hedge funds, according to Bourbon.

“Most of the vehicles we added are daily-dealing and operate in different areas, including global macro funds, Commodity Trading Advisor funds [CTAs], relative value, market-neutral as well as event-driven funds,” he said.