Investors have been “surprised significantly” by the resilience of markets in 2023 given the challenging launchpad, according to Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund.

Many were unsure how the year would play out in January against the backdrop of high inflation, rising interest rates and looming recession, but markets “have displayed far more resilience than anticipated”.

Smit highlighted Europe, the US and Japan as equity markets that made “very solid” returns in 2023, but can they continue to thrive in the second half of the year?

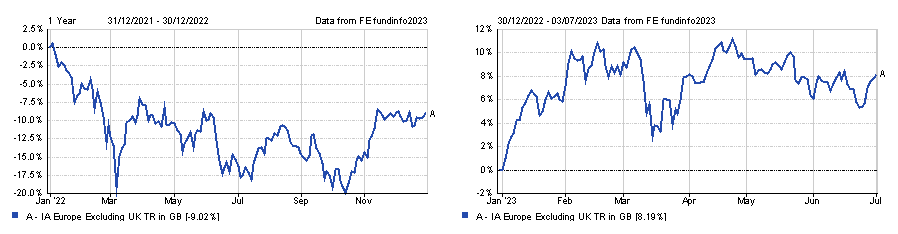

Funds in the IA Europe Excluding UK sector are up 8.2% in 2023 having dropped 9% the year prior after Russia’s invasion of Ukraine shocked markets.

Total return of sector in 2022 and 2023

Source: FE Analytics

Although European funds have come some way in recovering from last year’s fall, Smit said an eventual end to the conflict is likely to benefit the continent.

“Investors cannot plan for geopolitical events, but the end of the Ukraine war, when it comes, can potentially hold huge rewards for European investors,” he added.

“The long process of rebuilding the affected areas will cost vast fortunes. Many European companies can directly benefit from peace in Ukraine.”

This paints a positive outlook for the region, but Smit said investors wanting exposure to Europe’s rebound will need to be selective in where they allocate.

European equities are a “mixed bag” of companies spread across a range of sectors, so investors are better off with an actively managed fund in the area, he said.

“It is probably the main region where active stock selection (rather than regional allocation) is most critical to portfolio management success,” the Stonehage Fleming Global Best Ideas Equity fund manager noted.

Equities in the region also have the added appeal of being cheap compared to markets such as the US, but Smit said he would “caution against such comparisons”.

Investors should remember that US equities are more expensive because they have a higher growth profile and currently less risk than those in Europe.

Smit explained: “The Federal Reserve has been ahead of some of its European peers in fiscal tightening, leaving Europe with more uncertainty about future interest rates and potential shocks. This increases the risk premium for many investors.”

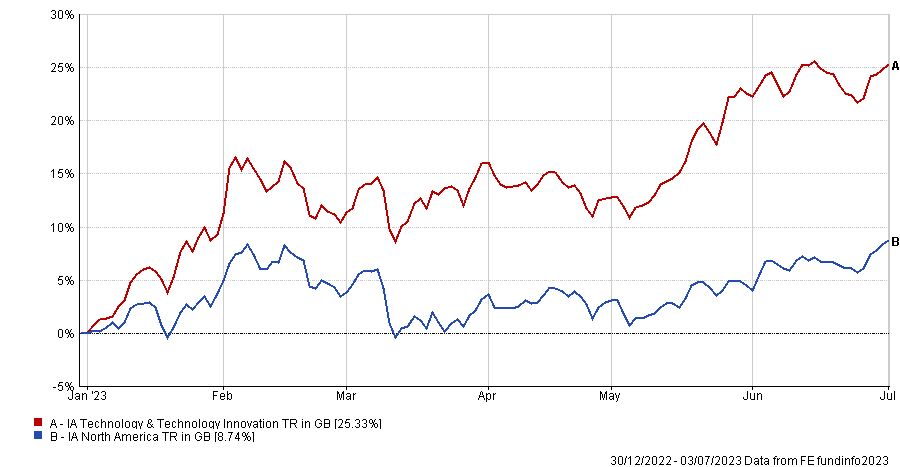

Indeed, the IA North America sector was the third best performing group in the Investment Association universe in the first half of the year, climbing 8.7% year-to-date.

Contrary to perceptions, Smit said “most US shares have done little this year” because the charge was led by a small handful of technology companies.

This is shown by the IA Technology and Technology Innovation sector beating all other fund groups this year with a total return of 25.3%.

Total return of sectors in 2023

Source: FE Analytics

The concern now is that US equities are in for another derating in the second half of 2023, but Smit said this is unlikely given share prices are already much lower than they were a year ago.

“This should not be the case,” Smit said. “Whilst a recession may be imminent, it could be a short and mild one.

“Importantly, we have had a bear stock market before the recession, with prices and valuations already much lower. Inflation continues on its downward trajectory and interest rates have settled at much lower levels than previously thought.”

Technology companies may have been some of the first to bounce back, but Smit said other US sectors could begin their own recoveries soon, particularly healthcare.

“The sector has lagged, mainly because of a high Covid-19 base and lack of nursing support for procedures, but these have predominantly been solved, laying the groundwork for a good earnings recovery,” he said.

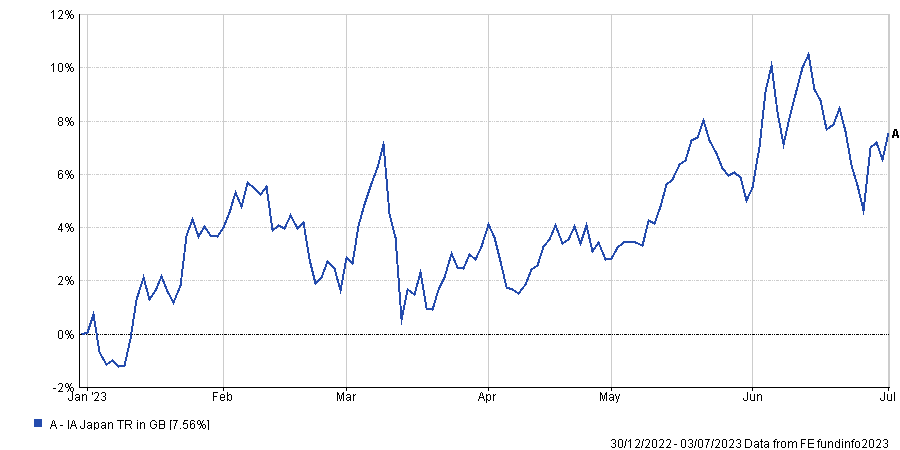

Elsewhere, Smit was thrilled by the strong performance of Japanese equities in the first half of the year. Funds in the IA Japan sector soared 7.6% in 2023, putting the market back on investors’ radars.

Smit recently bought his first Japanese holding – sensor manufacture Keyence – since the Stonehage Fleming Global Best Ideas Equity fund launched in 2013.

He said Japan’s inflation expectations have reached attractive levels and its loose monetary policy “further stimulates its stagnant economy”.

Total return of sector in 2023

Source: FE Analytics

The nation has knuckled down on improving the corporate governance standards of Japanese companies, improving the long-term outlook for investing there.

He said: “These are designed to improve capital allocation and return on equity, which, if successful, can orientate business management towards more efficient balance sheets and shareholder friendly actions. We expect increasing dividend growth and an extended phase of strong share buybacks.”

Japan has also benefited from a wave of spending from China following its re-opening earlier this year. Smit said he “prefers taking this indirect approach to investing in China,” as issues still remain when investing directly in the country.

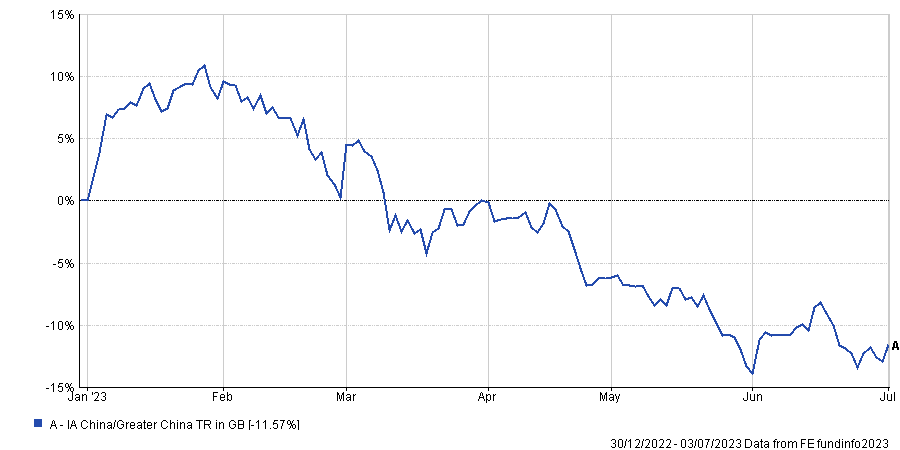

Investors were in high hopes that the wind-down of China’s strict lockdown measures would result in strong growth at the start of the year, but performance has been “rather disappointing” as returns slipped 11.6% in 2023.

Total return of sector in 2023

Source: FE Analytics

On top of that, souring relations between the US and China have added an extra layer of volatility that have further dampened investor appetite.

“Despite the reopening of its economy, investor interest and valuations remain depressed,” Smit said. “Tense geopolitical and regulatory issues, along with some economic sanctions, keep investors on the sidelines.”

Shares in China and across all emerging markets are attractively valued, but Smit said the region needs “a catalyst to attract new investors”.

Like Europe, he said an actively managed portfolio is the best option for investors seeking exposure to any potential rebound in China.