Many investors may feel more comfortable with a large fund that other people have already committed their money to, but there are plenty of small portfolios with admirable traits.

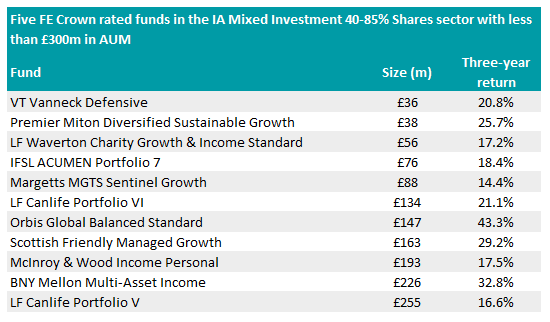

Trustnet found 11 funds in the IA Mixed Investment 40-85% Shares sector that have less than £300m in assets under management (AUM), but have acquired a five-Crown rating from FE fundinfo.

Only the top 10% of the thousands of funds monitored by FE fundinfo achieve this rank, awarded for consistently generating alpha while suppressing volatility.

Source: FE Analytics

The smallest fund to make it on the list is the £34m Premier Miton Diversified Sustainable Growth strategy, which is diversified across a mix of stocks, bonds, alternatives and property. It is up 27.8% over the past three years.

It failed to beat the FTSE 100 over this period, with this year’s rally helping the index jump 36.6%, but it made 13.1 percentage points more than the average fund in the sector.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

This is one of five funds managed by Neil Birrell in his Diversified range, with Premier Miton Diversified Cautious Growth a standout portfolio in Trustnet’s previous story on cautious funds.

Another four funds below £100 have a five-Crown rating but only two of them – IFSL ACUMEN Portfolio and Margetts MGTS Sentinel Growth – are available to retail investors.

The £75.6m IFSL ACUMEN Portfolio, managed by John Leiper, is up 16.7% over the past three years, while Alex Illingworth and Simon Edelsten’s £88.6m Margetts MGTS Sentinel Growth fund climbed 15.8%.

Total return of funds vs sector

Source: FE Analytics

Other small funds to boast a five-Crown rating include VT Vanneck Defensive (£36m) and LF Waverton Charity Growth & Income (£56m), but these are not available on most investment platforms.

The best performer on the list over the past three years is Orbis Global Balanced, which more than doubled the returns of its peer group, soaring 42.6%.

This £147m portfolio, managed by FE fundinfo Alpha manager Alec Cutler, has a 32% allocation to the US. While this is its largest regional weighting, it is significantly lower than the MSCI World index’s 68.9% exposure to the nation.

Its assets in emerging markets and the UK (which jointly account for 30% of the portfolio) are the biggest overweights compared with the benchmark.

Total return of fund vs sector over the past three years

Source: FE Analytics

Cutler is rated as an Alpha Manager, meaning he has a proven track record of long-term outperformance.

Scottish Friendly Managed Growth came in at second over the past three years, climbing 28.4% over the period. However, this £163m portfolio, managed by Colin McLean since 2004, is not available to retail investors.

The third best performer over the period is BNY Mellon Multi-Asset Income. Its total return of 28.2% landed short of the MSCI ACWI benchmark, but it still beat the peer group by 15.9 percentage points.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

This is one of four multi-asset funds managed by Paul Flood, with each portfolio in the range offering exposure to global themes for investors with varying risk thresholds, according to analysts at RSMR.

They said: “Thematic analysis looks to identify the longer-term ‘big picture’ drivers of economies, markets, sectors and companies and helps to direct analysts towards the more interesting investment areas.

“There is a progression of risk through the range and a mixture of growth and income, all without any specific risk targets, so there are solutions for most investors.”